The Soluminity review focuses on evaluating the legitimacy of Soluminity.com, a platform claiming to offer high-quality goods, secure payments, and investment opportunities in cryptocurrency, real estate, and other sectors. This comprehensive analysis by Scams Radar examines ownership, compensation plans, traffic trends, public perception, security measures, content authenticity, payment methods, customer support, technical performance, and ROI claims. A DYOR (Do Your Own Research) disclaimer is included to emphasize caution.

Soluminity markets (soluminity.com) itself as an e-commerce and investment platform, promising high-quality goods, secure payments, and opportunities in Solana-based Proof-of-Stake (PoS) mining, crypto trading, gaming, AI, Forex, and crypto exchanges. However, vague details and a lack of transparency raise concerns about its credibility.

Red Flag: Anonymous ownership increases fraud risk, as legitimate platforms disclose team details to build trust.

Using the compound interest formula to assess a hypothetical 10% monthly return:

Formula: A = P(1 + r/n)^(nt)

Calculation: A = 1000 * (1 + 1.2/12)^(12*1) = 1000 * (1.1)^12 ≈ $3,138.43

Result: A $1,000 investment grows to $3,138.43 in one year (213.8% annual return).

For a 2% daily return:

Ponzi Scheme Sustainability Formula:

[ T = \frac{L \times (1 + r)^n}{D} ]

Result: Without new deposits, the scheme collapses in ~12 months.

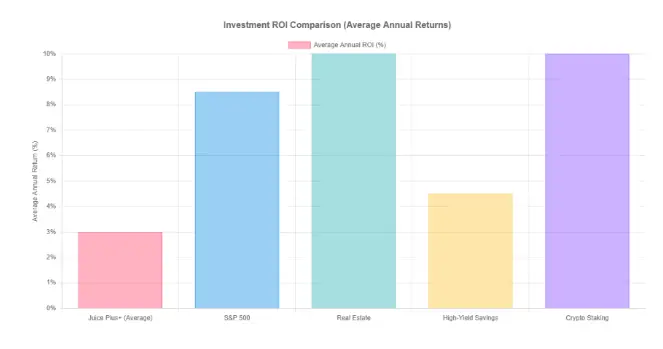

Investment Type | Annual ROI | Transparency |

Soluminity.com | 213.8–137,000% | Low |

Real Estate | 6–10% | High |

Bank Savings | 3–5% | High |

Crypto Staking | 5–20% | Medium |

Red Flag: Unrealistic returns suggest a Ponzi-like structure.

Red Flag: Lack of organic growth and user feedback.

Red Flag: Weak security claims without specifics.

Red Flag: Vague content mirrors scam website tactics.

Red Flag: Lack of payment transparency.

Red Flag: Inaccessible support.

Red Flag: Lack of credible social media presence.

Tool | Findings |

Solsniffer | No data; not Solana-based. |

ScamAdviser | Low trust score, scam risk flagged. |

CryptoScamDB | No entry; too new or obscure. |

CertiK/OpenZeppelin | No audit reports. |

WHOIS Lookup | Hidden via privacy service. |

Red Flag: Absence from reputable DYOR tools.

This Soluminity review reveals significant concerns about its legitimacy. Anonymous ownership, unrealistic ROI claims, low traffic, and lack of transparency align with scam characteristics. Compared to real estate (6–10% ROI), bank savings (3–5% APY), or crypto staking (5–20% APY), Soluminity’s promises are unsustainable. Investors should avoid this platform and prioritize regulated alternatives.

Disclaimer: This Soluminity review is not financial advice. Conduct your own research using tools like ScamAdviser and regulatory websites. Verify ownership, read white papers, and consult financial advisors. Cryptocurrency investments are risky, and you are responsible for any losses.

The answers to frequently asked questions about the validity Solumity report can be found here. To address your concerns, we have provided the following questions and answers:

Soluminity.com raises concerns due to anonymous ownership, vague compensation plans, and unrealistic ROI claims. Lack of transparency and regulatory compliance suggests it’s risky. Always research thoroughly before investing.

Soluminity.com implies high returns, like 2% daily or 10% monthly, which are unsustainable. Such rates (e.g., 137,000% annually) resemble Ponzi schemes, far exceeding legitimate investments like crypto staking (5–20% APY).

The website hides its owners via a privacy service and provides no team or company details. This anonymity is a red flag, as credible platforms disclose verifiable leadership information.

No credible reviews exist on platforms like Trustpilot or SiteJabber. The absence of user feedback and low traffic suggest limited trust or a deliberately low profile, common in questionable platforms.

Unlike regulated platforms like Binance or Coinbase (5–20% APY), Soluminity.com lacks transparency, regulatory oversight, and clear payment methods, making it riskier than established alternatives.

Title: Soluminity

There are no reviews yet. Be the first one to write one.