This Cirrus Networks review examines the legitimacy and risks of CirrusNetworks.io, a platform promising high returns through crypto mining and staking. We analyze ownership, compensation plans, and key concerns like transparency and ROI sustainability. With clear insights, charts, and comparisons, this scams radar guide helps investors make informed decisions using simple, understandable language.

Cirrus Networks (https://cirrusnetworks.io/) markets itself as a decentralized platform offering data ownership and digital rewards through “Gnodi Nodes.” It emphasizes privacy, financial freedom, and community governance. However, its lack of transparency and high-return claims raise concerns about its legitimacy, making this review essential for potential investors.

Understanding who operates a crypto platform is crucial. Unfortunately, CirrusNetworks.io provides no clear details about its founders, executives, or headquarters. A WHOIS lookup shows the domain was registered on July 18, 2024, using a privacy-protected service, hiding ownership details.

This lack of transparency is a major red flag, as noted in the FBI’s 2023 Cryptocurrency Fraud Report, which highlights that scam platforms often conceal ownership to avoid accountability. Legitimate platforms like Coinbase list their leadership team and registration details. The absence of such information makes it hard to trust the platform’s operators.

The platform’s compensation plan centers on purchasing Gnodi Node licenses, promising daily returns of 1%–3% based on investment tiers. For example, a $1,000 investment could yield $10–$30 daily. It also uses a multi-level marketing (MLM) structure, offering bonuses for recruiting others.

This model resembles high-yield investment programs (HYIPs), which the California Department of Financial Protection and Innovation labels as Ponzi-like schemes. The lack of clear details on how returns are generated—beyond vague mentions of mining and staking—raises doubts about sustainability.

Investment Tier | Daily ROI Claim | Annual Return (Compounded) |

$1,000 | 1% | ~365% |

$1,000 | 2% | ~639% |

$1,000 | 3% | ~1,095% |

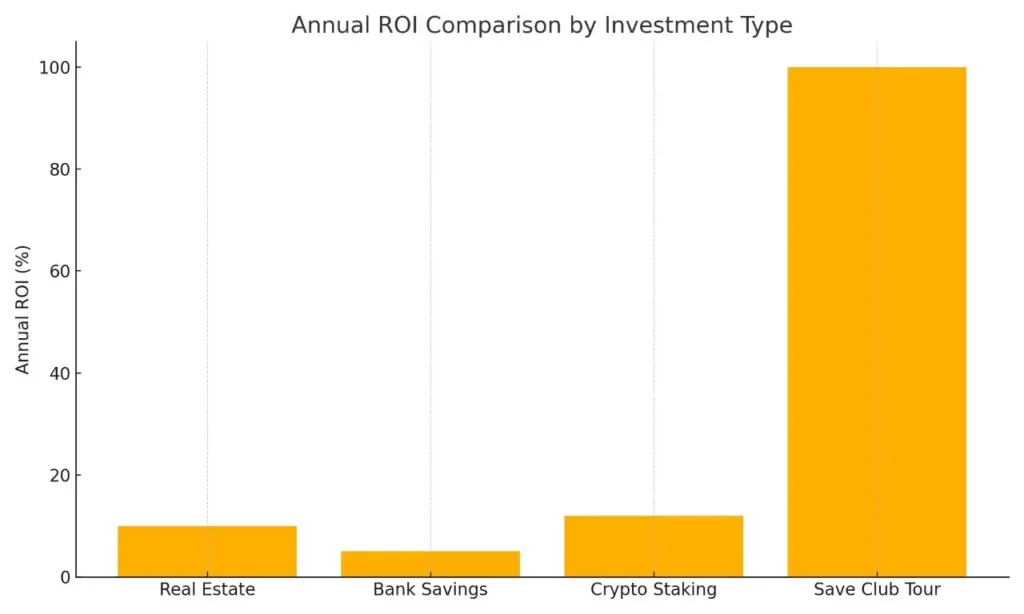

To understand the risks, compare the platform’s claims to other options:

To assess the platform’s ROI claims, consider a $1,000 investment at 2% daily returns, compounded over 365 days:

This yields a 639% annual return, far exceeding legitimate investments like real estate (8–12%), bank savings (4–5%), or crypto staking (4–15% APY on Coinbase). Such returns are unsustainable, as they rely on constant new investments, a hallmark of Ponzi schemes. The SEC warns that high, guaranteed returns, like those in the 2024 Jonathan and Tanner Adam case, often signal fraud.

Public sentiment is negative, with a YouTube review labeling the platform a scam. An X post by @realjessesingh ties it to Juuva’s questionable history, suggesting a rebranding to evade scrutiny. Social media accounts (@cirrusnet_io on X, @cirrusnetworks.io on Instagram, Cirrus Networks on Facebook) promote the platform but lack credible endorsements. No other sites promoted by these accounts were found, indicating limited influence.

The platform claims “advanced encryption” but provides no specifics on security measures like 2FA or KYC compliance. Content is generic, using buzzwords like “blockchain innovation” without proof of reserves or audits, unlike Crypto.com’s transparent reports. Customer support is limited to an email (support@cirrusnetworks.io), with no live chat or phone options, raising concerns about responsiveness.

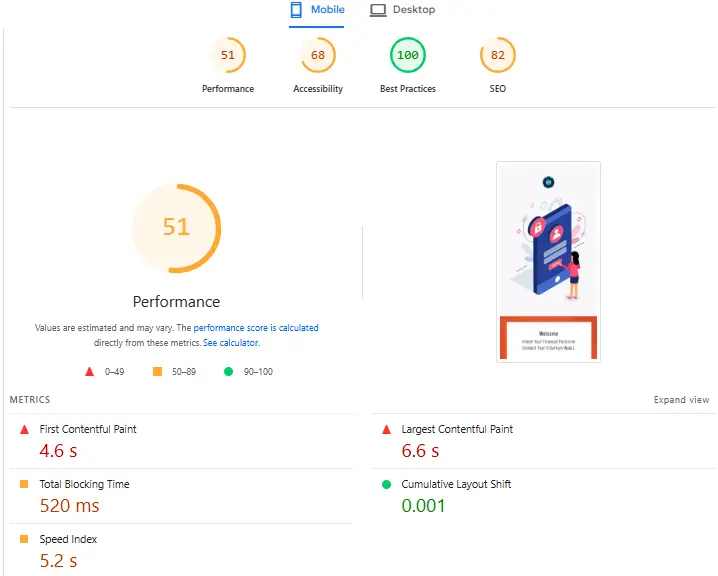

GTmetrix analysis shows average load times and basic functionality, lacking advanced features like APIs or mobile apps. This contrasts with optimized platforms like Binance, suggesting minimal infrastructure investment, common in short-lived scams.

Several issues highlight the platform’s risks:

Limited Support: Only a contact form is available, lacking robust customer service.

Investors should proceed cautiously:

With increasing regulations like the EU’s MiCA, non-compliant platforms may face shutdowns. If CirrusNetworks.io doesn’t address transparency, it risks legal action and reputational damage, potentially leading to financial losses for investors.

This Cirrus Networks review is for informational purposes only and not financial advice Investors must conduct their own research, verify ownership, and consult professionals. Cryptocurrency investments are volatile and carry significant risks, including total capital loss.

The answers to frequently asked questions about the validity Cirrus Networks report can be found here. To address your concerns, we have provided the following questions and answers:

CirrusNetworks.io is a platform claiming to offer high returns through crypto mining and Gnodi Node licenses. Users invest in tiers for daily rewards of 1%–3%. However, its multi-level marketing structure and lack of transparency raise concerns about legitimacy.

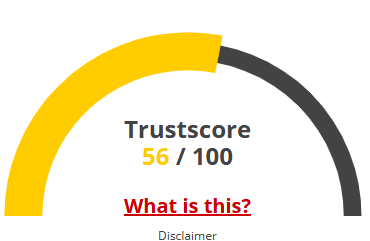

CirrusNetworks.io lacks transparency in ownership and security details, earning low trust scores from ScamAdviser and ScamDoc. Its unrealistic ROI claims suggest potential risks, resembling Ponzi-like schemes.

Risks include hidden ownership, unsustainable 1%–3% daily returns, and crypto-only payments, which are irreversible. The MLM model and negative reviews, like those linking it to Juuva, signal potential fraud.

The Cirrus Networks Review highlights a compensation plan promising 1%–3% daily returns via Gnodi Nodes and MLM bonuses. Mathematical analysis shows these returns (365%–1,095% annually) are unsustainable, indicating a high-risk scheme.

Unlike Coinbase or Binance, which offer 4%–15% APY with clear regulations, CirrusNetworks.io’s high ROI claims lack proof. Its crypto-only model and limited support contrast with trusted platforms’ transparency and security.

Title: Cirrus Networks

There are no reviews yet. Be the first one to write one.