Gerbi Review: A Deep Dive into Legitimacy and Risks

This Gerbi review examines the legitimacy of an investment platform promising high returns through automated trading. For an in-depth scam analysis, visit Scams Radar for a detailed review. Launched recently, the platform raises concerns due to its bold claims, lack of transparency, and user complaints. We analyze ownership, compensation plans, security, customer service, and ROI sustainability to determine if gerbi.com is trustworthy, comparing it to legitimate investments. Our goal is to provide clear, trustworthy insights for potential investors.

Table of Contents

What Is Gerbi?

Gerbi is an online platform claiming to offer automated trading on the Solana blockchain, with daily returns of 3% to 10%. It promotes a referral program and accepts cryptocurrency payments. However, its recent launch and negative Gerbi online reviews raise questions about its reliability and legitimacy.

Ownership and Transparency Concerns

The platform’s ownership is unclear. A WHOIS lookup shows the domain was registered on July 31, 2025, with privacy protection via Cloudflare, hiding registrant details. No company registration, executive team, or physical address is disclosed. Legitimate platforms typically share leadership profiles and regulatory filings, such as with the SEC or FCA. This lack of transparency fuels Gerbi scam allegations and is a major red flag.

Key Ownership Issues

- Anonymous Founders: No named individuals or verifiable team members.

- Recent Domain: Registered in July 2025, suggesting a short operational history.

- No Regulatory Filings: Absent from SEC, FCA, or ASIC databases.

Compensation Plan Breakdown

Gerbi offers investment plans with daily returns based on deposit tiers:

- 3% daily for 3 days (9% total).

- 5% daily for 5 days (25% total).

- 7% daily for 7 days (49% total).

- 10% daily for 10 days (100% total, doubling your investment).

- 6% referral commission for inviting new users, even without investing.

These plans promise capital return after the term. For example, a $1,000 investment at 10% daily yields $2,000 in 10 days. However, the platform lacks details on how these returns are generated, citing vague “trading bots” and “decentralized asset management.”

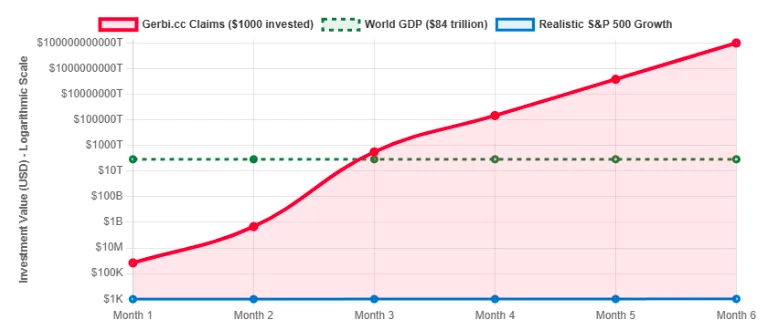

Mathematical Sustainability Analysis

To test Gerbi’s reliability, consider a $1,000 investment at 10% daily, compounded:

- Formula: ( A = P \times (1 + r)^n )

- After 10 days: ( A = 1000 \times 1.10^{10} \approx 2,593.74 )

- Annualized (365 days): ( A = 1000 \times 1.10^{365} \approx 5.6 \text{ trillion} )

Such returns are impossible without constant new deposits, a hallmark of Ponzi schemes. The graph below illustrates this unsustainable growth compared to legitimate investments.

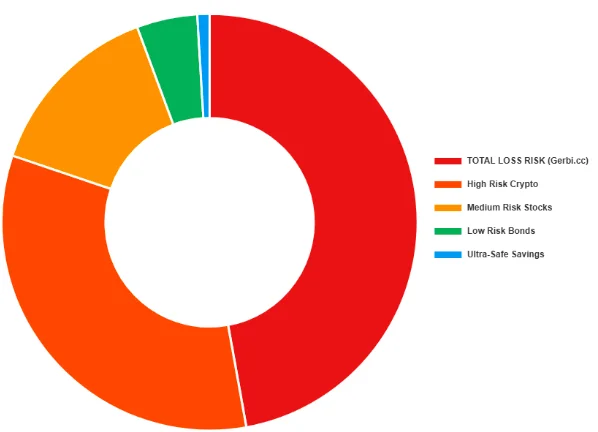

Comparing Gerbi to Legitimate Investments

Investment Type | Annual ROI | Risk Level |

Real Estate | 8–12% | Medium |

Bank Savings | 3–5% | Low |

Crypto Staking | 5–15% | High |

Gerbi (Claimed) | 4,600%+ | Extreme |

- Real Estate: A $100,000 property yields $8,000–$12,000 annually.

- Bank Savings: A $1,000 CD at 4% APY yields $40 yearly.

- Crypto Staking: Staking $1,000 on Binance at 10% APY yields $100 yearly. Gerbi’s claims dwarf these, signaling a high-risk, unsustainable model.

Public Perception and Gerbi Complaints

Gerbi’s reputation on Trustpilot is poor, with a 2.1/5 rating from 14 reviews, 79% being one-star. Users report:

- Shane (US): 31,000 USDT withdrawal unprocessed after five days.

- Stefan (RO): Called it a “fraudulent platform” after deposits were not returned.

- Anna (NL): Noted withdrawal cancellations and deleted Telegram messages.

These Gerbi complaints highlight issues with reliability and customer service, suggesting a pattern of non-payment.

Security and Technical Performance

Gerbi utilizes a Google Trust Services SSL certificate and Cloudflare hosting, but lacks details on advanced security measures such as two-factor authentication (2FA) or cold wallet storage. User reports of wallet vulnerabilities raise concerns. The site uses H-Script, a common HYIP template, and blocks content crawlers, preventing external audits. This undermines claims of “advanced trading bots.”

Payment Methods and Gerbi Customer Service

Deposits are crypto-only (USDT, BTC, ETH, LTC, TRX, ePayCore), with a $10 minimum. Instant withdrawals are promised but contradicted by user reports of delays. Gerbi’s customer service is limited to a single email address (support@gerbi.io), with no live chat or phone support available. Users report unresponsive or blocked communication, a critical issue for Gerbi’s reliability.

Social Media and Promotions

Gerbi lacks a verified social media presence. Promotions appear on:

- Telegram: Russian-language investor groups.

- YouTube/TikTok: Videos hyping “guaranteed profits.”

- Forums: Vietnamese HYIP threads.

Promoters also pushed Casx. Bet and Cryptocasino run, flagged as scams, indicating a pattern of marketing high-risk schemes.

Red Flags Summary

Red Flag | Description |

Unrealistic Returns | 3%–10% daily ROI is unsustainable. |

Anonymous Ownership | No team or registration details. |

Poor Reviews | 79% one-star ratings on Trustpilot. |

Crypto-Only Payments | Irreversible transactions, no KYC. |

Short History | Launched August 2025, new domain. |

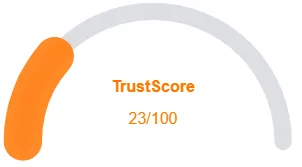

DYOR Tools for Gerbi Review

Verify Gerbi’s legitimacy with:

- ScamAdviser: Low trust score due to new domain and reviews.

- Trustpilot: Check user feedback for Gerbi complaints.

- WHOIS Lookup: Confirm domain age and privacy status.

- ScamMinder: Analyze related domains like Gerbi.io.

Conclusion: Should You Trust Gerbi?

This Gerbi review concludes that the platform is high-risk. Its unrealistic ROI, anonymous ownership, poor Gerbi customer service, and scam-like traits mirror failed schemes like BitConnect. Investors face a high chance of total loss. Instead, consider regulated options like Coinbase staking (5–15% APY) or bank savings (3–5% APY).

For a deeper comparison, check out the Margin Space Review, where we examine the risks and warning signs of similar high-risk platforms.

DYOR Disclaimer: This Gerbi review is for informational purposes only. Always conduct your research and consult licensed financial advisors before investing. Cryptocurrency investments carry high risks, and you should never invest more than you can afford to lose.

Gerbi ReviewTrust Score

A website’s trust score plays a vital role in evaluating its credibility, and Gerbi a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Gerbi or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- Online fraud prevention tool

- No spelling/grammar errors

- High AI review score

Negative Highlights

- New domain

- Hidden Whois data

Frequently Asked Questions About Gerbi Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Gerbi raises concerns due to its lack of transparency, bold ROI claims, and user complaints about its operations.

It claims to provide high returns through automated trading systems, but there is no verifiable evidence to support these performance claims.

No. Gerbi is not licensed or registered with any recognized financial regulator, making it a high-risk choice for investors.

Risks include potential loss of funds, lack of regulatory protection, unrealistic ROI promises, and questionable customer support.

It’s not recommended. The platform’s red flags, absence of clear ownership, and unverified claims make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.