XUEX Review: Is This Crypto Exchange Safe or a Potential Scam?

This XUEX review examines the legitimacy of the XUEX cryptocurrency exchange, focusing on its ownership, compensation plan, user experience, and safety. With concerns about withdrawal issues, unrealistic returns, and transparency, we analyze whether the XUEX platform is a trustworthy trading option or a risky venture. Read on for a clear, data-driven assessment tailored for beginner traders. For in-depth scam analysis, visit Scams Radar for a detailed review of xuex.com.

Table of Contents

What Is the XUEX Trading Platform?

The XUEX crypto exchange claims to offer advanced trading features, supporting over 1,700 cryptocurrencies and promising high returns. However, reports of withdrawal delays, unverifiable ownership, and scam allegations raise red flags. This detailed XUEX trading platform review for 2025 explores its legitimacy, fees, security, and user complaints to help you decide if it’s safe.

Ownership and Transparency Concerns

The XUEX platform lacks clear ownership details. Registered on May 21, 2024, via GoDaddy, the domain uses privacy protection to hide WHOIS data, hosted on Cloudflare’s U.S. servers. Claims of being a U.S.-based, Money Services Business (MSB)-certified platform (registration number 31000269479679) lack verifiable evidence from regulatory bodies like the SEC or FinCEN. No executive team, physical address, or corporate structure is disclosed, unlike trusted exchanges like Binance or Coinbase. One source suggests a link to an Iranian company, Chekad Iranian Communication, but this remains unconfirmed. This anonymity is a major concern for XUEX account security and legitimacy.

Key Ownership Red Flags

- Hidden WHOIS data and recent domain registration.

- No verifiable regulatory licenses or business filings.

- Unclear leadership or operational details.

Compensation Plan and ROI Claims

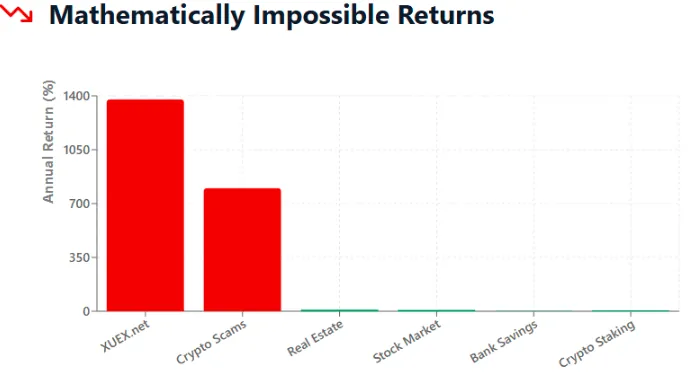

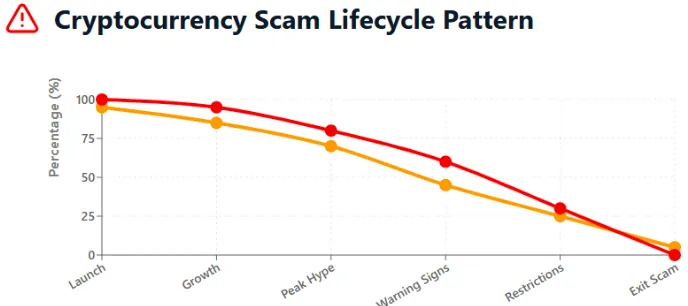

The XUEX trading platform promotes high returns, with some reports citing upto 2–5% daily profits or up to 300% in weeks. User reviews suggest a referral-based structure, resembling multi-level marketing (MLM) or Ponzi schemes, where payouts rely on new investor deposits. Such claims are unsustainable, as shown below.

Mathematical Proof of Unsustainable Returns

Suppose XUEX promises upto 3% daily return on a $1,000 investment, compounded daily:

[ A = P \left(1 + \frac{r}{n}\right)^{nt} ]

- ( P ) = $1,000 (principal)

- ( r ) = 0.03 (daily rate)

- ( n ) = 1 (daily compounding)

- ( t ) = 30 (days)

[ A = 1,000 \times 1.03^{30} \approx 2,427 ]

In 30 days, $1,000 grows to $2,427 (142% return). Annualized:

[ \text{Annualized Return} = (1 + 0.03)^{365} – 1 \approx 47,129% ]

This is impossible in legitimate markets due to:

- Market Volatility: Crypto prices fluctuate significantly, making consistent daily gains unrealistic.

- Liquidity Limits: No exchange can sustain exponential payouts without new funds.

- Ponzi Indicators: High returns often rely on new deposits, as seen in scams like Bitconnect.

ROI Comparison Table

Investment Type | Annual ROI | Monthly ROI | Time to Triple Investment |

Real Estate | 8–12% | ~1% | ~36 months |

Bank Savings | 0.5–5% | ~0.4% | ~50+ months |

Binance Staking | 4–10% | ~0.8% | ~40 months |

XUEX Claims | 47,129% | ~142% | ~1 month |

Traffic Trends and Technical Performance

No reliable traffic data is available from tools like SimilarWeb, but XUEX has a low global rank (~5,293,103), with ~1,500 monthly visits, primarily from Portugal and Bulgaria. A high bounce rate (30.4%) and frequent downtime (43% monthly) suggest technical instability. Users report crashes and inaccessibility, raising doubts about XUEX’s live trading features and infrastructure reliability.

Public Perception and XUEX User Experience

Trustpilot shows a 4.2/5 rating from 14–32 reviews, but positive feedback often lacks detail, appearing generic or incentivized. Negative XUEX Trustpilot reviews highlight:

- Frozen accounts and blocked withdrawals.

- Demands for extra fees (15–30%) to release funds.

- Unresponsive customer support, with delays exceeding 72 hours.

Reddit’s r/CryptoScams and X posts (e.g., @x_owner24, @TOXICLONER1972) label XUEX a Ponzi scheme, citing fake profits and aggressive marketing via Telegram and WhatsApp. Scam detection sites like Scam Detector (30.2/100 trust score) and AlertoPedia flag withdrawal issues and similarities to scams like PCEX and LWEX.

XUEX Security and Account Verification

XUEX claims multi-layer encryption but lacks two-factor authentication (2FA) or cold storage details, standard for secure transactions. Its SSL certificate is basic (Domain Validated), offering minimal protection. Reports of frozen accounts and unverifiable fund storage question XUEX safety and account security measures.

Payment Methods and Withdrawal Issues

XUEX accepts crypto deposits (Bitcoin, Ethereum, USDT) but lacks fiat options. Users report small initial withdrawals succeeding, followed by blocked larger withdrawals unless “security fees” are paid. This mirrors tactics of known scams like Cryptexar. Legitimate platforms ensure transparent XUEX deposit and withdrawal times.

XUEX Customer Support Response Time

Support is inconsistent, with no live chat or phone options. Users report unanswered emails and demands for fees to process withdrawals, undermining claims of 24/7 support. Trusted exchanges offer responsive, multi-channel support.

DYOR Tool Reports

- Scamadviser: Notes SSL and over one-year domain age but warns of high-risk crypto services.

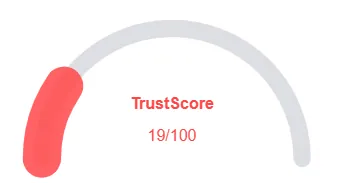

- Scam Detector: Low trust score (30.2/100) due to phishing risks and unverifiable claims.

- AlertoPedia: Flags scam allegations and withdrawal issues, linking XUEX to PCEX and LWEX.

- ScamMinder: Cites exaggerated claims and no regulatory compliance.

- RefundBack.net: Reports credibility concerns and user losses.

Social Media Promotion

X accounts like @x_owner24 and @TOXICLONER1972 warn of XUEX’s fraudulent tactics, with no other promoted platforms mentioned. Aggressive marketing via Telegram, WhatsApp, and TikTok, often using deepfake celebrity videos, further erodes credibility.

Recommendations for XUEX Users

- Avoid Investing: XUEX’s withdrawal issues, unrealistic returns, and anonymity make it high-risk.

- Choose Regulated Exchanges: Use Binance, Kraken, or Coinbase for transparent, secure trading.

- Test Small Deposits: Verify withdrawals before committing large sums.

- Report Issues: Contact the FTC or CNC Intelligence if funds are lost.

- Verify KYC: Ensure platforms have clear XUEX KYC verification processes.

XUEX Review Conclusion

This XUEX review reveals a platform with significant risks. Its unrealistic 47,129% annualized returns, hidden ownership, and withdrawal complaints align with Ponzi scheme tactics. Compared to real estate (8–12% ROI), banks (0.5–5%), or Binance staking (4–10%), XUEX’s claims are unsustainable. Scam detection tools and user reports confirm its questionable legitimacy. Similar concerns have been identified in our Aztek Company Review, highlighting a pattern of fraudulent behavior across platforms. For safe trading, choose regulated exchanges and conduct thorough research. Always verify claims independently to protect your funds.

DYOR Disclaimer: This analysis is for informational purposes only. Cryptocurrency trading carries risks. Verify all claims, consult financial advisors, and only invest what you can afford to lose.

XUEX Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and XUEX a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with XUEX or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- No grammar or spelling errors

- Whois info available

Negative Highlights

- Low AI review count

- Recently registered domain

Frequently Asked Questions About XUEX Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, XUEX raises concerns about its legitimacy due to withdrawal issues, unrealistic returns, and lack of transparency. These are typical signs of a risky platform.

Using XUEX involves significant risks, including potential withdrawal problems, lack of regulatory oversight, and promises of returns that are too good to be true.

XUEX claims to generate returns through cryptocurrency trading, but there is no verifiable proof of its trading activities. The promised returns seem unrealistic.

No, XUEX is not regulated by any known financial authority. The lack of regulation is a major red flag for potential investors and traders.

It is advisable to avoid trading on XUEX due to its lack of transparency, suspicious returns, and withdrawal issues. Always conduct thorough research before engaging with such platforms.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.