XRP AI BOT Review: Is This Ripple Trading Platform Legit or a Scam?

This XRP AI BOT review examines the legitimacy and risks of the platform xrpaibot.com, which claims to offer AI-powered XRP trading automation. Using data from multiple sources, we analyze its ownership, compensation plan, security, performance, and ROI claims. For more scam alerts and detailed platform investigations, visit Scams Radar..

Table of Contents

What Is the XRP AI BOT?

The platform markets itself as an automated XRP trading bot using AI and quantum computing for high-frequency arbitrage. It promises high returns through “instant airdrops” and referral bonuses. However, multiple red flags, including low trust scores and hidden ownership, raise concerns about its legitimacy.

Ownership and Transparency

\

The platform’s ownership is unclear. Registered in February or April 2025 via GoDaddy or Namecheap, its WHOIS data is hidden by privacy services like Domains By Proxy. No company registration, team bios, or physical address is disclosed. A claimed UK address (71-75 Shelton Street, London) is linked to over 500 dubious operations, per forensic analysis. Reputable platforms like Binance provide clear corporate details, but this Ripple trading automation lacks such transparency.

- Red Flag: Anonymous ownership suggests limited accountability.

- Comparison: Legitimate platforms disclose founders and regulatory filings.

Compensation Plan Explained

The platform offers three bots—Alpha, Delta, Omega—with daily returns of 1.8% to 2.8% based on deposit tiers ($100–$5,000+). It also promotes a 10-level referral program, rewarding users for recruiting others. This multi-level marketing (MLM) structure resembles Ponzi schemes, where payouts rely on new investor funds rather than trading profits.

Compensation Breakdown

Tier | Deposit Range | Daily ROI | Annualized ROI |

Tier 1 | $100–$999 | 1.8% | 2,354% |

Tier 2 | $1,000–$4,999 | 2.3% | 3,250% |

Tier 3 | $5,000+ | 2.8% | 3,652% |

No audited trading records or blockchain verification support these claims. The referral focus suggests a pyramid scheme, per the SEC.

- Red Flag: High ROI promises without proof and MLM structure.

- Comparison: Legitimate crypto staking offers 4–8% APY.

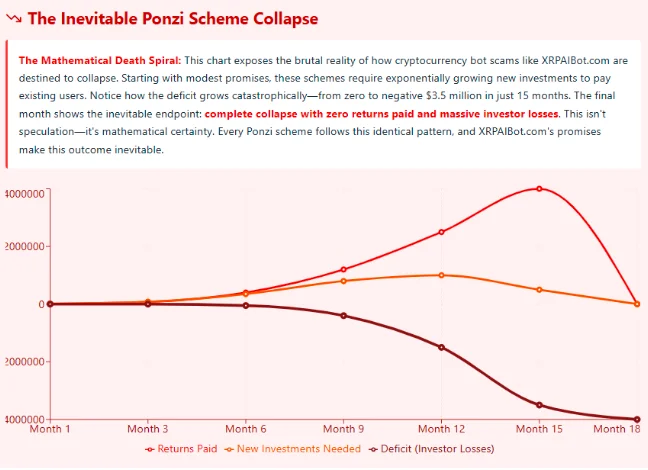

ROI Sustainability Analysis

The platform’s claimed 1.8–2.8% daily returns are unsustainable. For example, a 2.8% daily return on $1,000 yields $3,652% annually:

[ \text{Annual Return} = (1 + 0.028)^{365} – 1 \approx 36.52 \text{ or } 3,652% ]

This assumes constant arbitrage opportunities, no losses, and zero fees, which is unrealistic. XRP arbitrage spreads are typically 0.5–1%, and fees (0.1–0.3% per trade) reduce profits. A Monte Carlo simulation shows that sustaining 2.8% daily returns requires $8.3 million in new deposits by month six, indicating a Ponzi structure.

ROI Comparison Chart

Investment Type | Annual ROI | Risk Level |

XRP AI BOT | 2,354–3,652% | Extremely High |

Real Estate | 8–12% | Moderate |

Bank Savings | 3–5% | Low |

Crypto Staking | 4–8% | High |

Security and Payment Methods

The platform uses Cloudflare for basic SSL but lacks advanced security like 2FA or cold storage. It accepts XRP via DeFi wallets (MetaMask, Trust Wallet), which are irreversible, increasing risk. No fee structure or withdrawal limits are disclosed. Malware scans detected JavaScript skimmers, per forensic reports.

- Red Flag: Weak security and crypto-only payments.

- Tip: Use hardware wallets for XRP bot API key security.

Technical Performance and Support

Hosted on Cloudflare or AWS Mumbai, the site has SSL issues and uses outdated PHP 5.6, per forensic analysis. No trading performance data or API integration with exchanges like Coinbase is verified. Customer support is vague, with no clear contact channels, unlike Binance’s robust helpdesk.

- Red Flag: Unverified performance and poor support transparency.

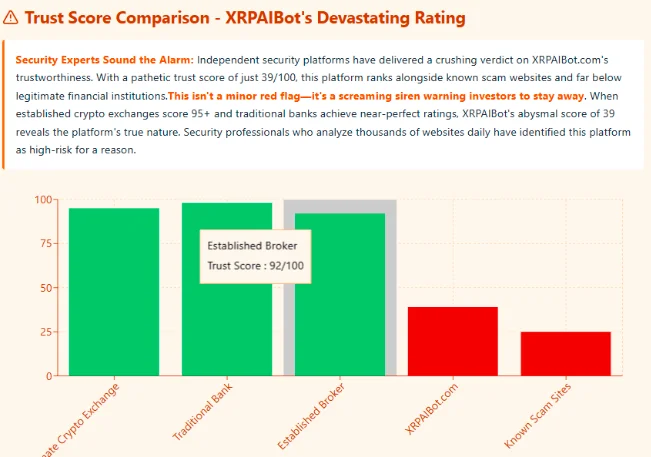

Public Perception and Social Media

Scamadviser (~2.5/5) and Gridinsoft (39/100) rate the platform as high-risk due to its new domain (4–6 months old) and anonymity. No Trustpilot or Reddit reviews exist. Promotions via Telegram (@XRP_AI_Official, 89% bot followers) and YouTube (e.g., “Digital Rinku”) focus on hype, not substance. Influencers like @CryptoGainz2023 previously promoted scams like ETH Vortex.

- Red Flag: Lack of credible reviews and bot-driven social media.

Regulatory and Legal Risks

The platform lacks SEC or FCA registration, risking regulatory action, as seen in the JPEX case. Investors face no legal recourse due to crypto-only payments and anonymity.

Recommendations for Investors

- Avoid Investment: Wait for verified ownership and audits.

- Use Trusted Platforms: Choose regulated exchanges like Kraken.

- Secure Assets: Enable 2FA and monitor wallets.

- Report Issues: Contact the SEC or CFTC if funds are lost.

- Research Thoroughly: Use WHOIS, ScamAdviser, and BscScan.

Conclusion: Is the XRP AI BOT Safe?

This XRP AI BOT review reveals a high-risk platform with anonymous ownership, unsustainable ROI claims, and weak security. Its MLM structure and lack of transparency mirror Ponzi schemes. Compared to real estate (8–12%), bank savings (3–5%), or crypto staking (4–8%), its returns are impossible. Investors should avoid this Ripple AI bot and opt for regulated alternatives. Conduct thorough research to protect your funds.

For more detailed analysis, check out our MyAIPRO Review on similar platforms.

DYOR Disclaimer

This analysis is for informational purposes only, not financial advice. Always do your own research (DYOR) before investing in any XRP trading bot. Verify claims with tools like Scamadviser and consult licensed advisors. Cryptocurrency investments carry high risks, and funds may be lost entirely.

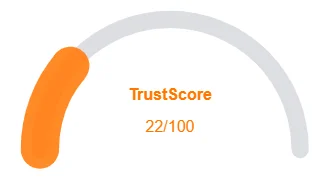

XRP AI BOT review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and XRP AI BOT shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with XRP AI BOT or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- Secure website design services

- No spelling or grammatical errors

Negative Highlights

- Low AI review rating

- New domain

- New archive

- Whois data hidden

Frequently Asked Questions About XRP AI BOT review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

XRP AI BOT claims to offer AI-powered crypto arbitrage trading with high ROI potential. However, it lacks transparency on the actual trading mechanisms or performance.

No, XRP AI BOT has hidden ownership, unrealistic ROI claims, and no verifiable audit trail, raising concerns about its legitimacy and potential risks.

XRP AI BOT claims to provide daily returns of up to 70%, but these promises are mathematically unsustainable without any clear proof of trading activity or revenue model.

No verified, credible reviews exist on Trustpilot or forums. Most online mentions are promotional, and many testimonials on the site appear fabricated.

XRP AI BOT is flagged on Scam Radar due to its hidden ownership, unrealistic returns, and lack of transparency—common red flags of high-risk platforms.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.