Whale Syndicate Review: A Comprehensive Analysis of Legitimacy and Risks

In the ever-expanding world of crypto, bold promises are everywhere—but few are as eye-catching as whalesyndicate.com. With claims of 180%–250% APR staking pools and fast payouts in just 24 hours, the platform markets itself as a shortcut to wealth. But behind the glossy marketing lies a troubling reality, no transparency, anonymous ownership, and profit projections that defy financial logic. Independent investigators such as Scams Radar are already flagging these issues, warning that WhaleSyndicate may be less about innovation and more about exploitation. The question isn’t whether the profits look good, it’s whether they’re even possible.

Table of Contents

What Is Whale Syndicate?

WhaleSyndicate positions itself as a crypto investment platform, emphasizing staking pools on the BNB Smart Chain with advertised annual percentage rates (APRs) of 180%–250%. It promotes “lightning-fast payouts” within 24 hours and also offers affiliate earnings through referrals. While the site is currently live, its lack of transparency, exaggerated profit claims, and aggressive promotional tactics raise serious concerns about its long-term sustainability

Ownership and Transparency

- Anonymous Ownership: No named founders, company registration, or physical address are disclosed. A WHOIS lookup shows privacy protection, obscuring registrant details.

- No Legal Framework: The absence of Terms of Service, Privacy Policy, or regulatory licenses is a major red flag.

- Team Background: No leadership bios or verifiable profiles are available, unlike legitimate platforms that showcase experienced teams.

This lack of transparency is concerning. Legitimate investment platforms provide clear company details and regulatory compliance to build trust. Anonymity often signals high risk, as investors have no recourse if funds are lost.

Compensation Plan

Whale Syndicate’s compensation plan revolves around:

- High-Yield Staking Pools: Promises 180%–250% APR, with some promoters claiming up to 400% annual percentage yield (APY).

- Referral Program: Offers commissions for recruiting new investors, using wallet-tracked referral links (e.g., ref=0x…). This multi-level marketing (MLM) structure rewards early adopters with funds from new deposits.

- Tiered Plans: References to tiers like “Orca,” “Humpback,” and “Blue Whale” suggest a complex system involving NFTs or investment levels, though details are vague.

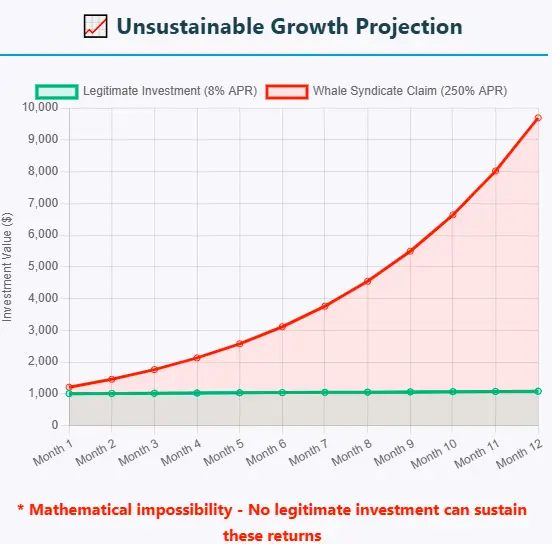

Sustainability Analysis

The promised returns are mathematically unsustainable. Consider a 250% APR:

- Daily Rate: 250% ÷ 365 ≈ 0.6849% per day.

- Annual Payout: A $1,000 investment would yield $2,500 annually, requiring $5 million yearly for $2 million in deposits.

- Compounding at 400% APY: (1 + 0.00442)^365 ≈ 5.0, turning $1,000 into $5,000 in a year.

Investment Type | Annual ROI/APY | Risk Level | Transparency |

Whale Syndicate | 180%–400% | Extremely High | None |

Real Estate | 8%–12% | Moderate | High |

Bank Savings | 4%–6% | Very Low | High |

Crypto Staking | 4%–12% | High | Moderate |

Red Flags

- Unrealistic Returns: 180%–400% APR far exceeds legitimate benchmarks (e.g., 4%–12% for real estate or crypto staking).

- Anonymous Team: No identifiable owners or verifiable credentials.

- MLM Structure: Heavy reliance on referrals indicates Ponzi-like dynamics.

- No Audits: Lack of smart-contract audits or financial disclosures.

- Crypto-Only Payments: Using BNB and wrapped XRP (BEP-20) limits recourse, as crypto transactions are irreversible.

Risk Assessment Matrix

Risk Category | Level | Impact |

Financial Loss | Critical | Total loss likely |

Data Security | High | Risk of data compromise |

Legal Issues | Medium | Potential involvement in illegal schemes |

Recovery Chances | Very Low | Minimal recovery options |

Social Media and Promotion

- YouTube: A “Whale Syndicate Introduction!” video touts 250% APR.

- Instagram/Facebook: Reels and posts from accounts like @whalesyndicatedotcom push referral links and 400% APY claims.

- Past Promotions: Similar accounts have promoted scams like CashFX and Forsage, per online warnings.

The lack of organic discussion on platforms like Reddit or Trustpilot suggests low credibility.

DYOR Tools and Reports

- ScamAdviser/URLVoid: No trust score due to low visibility.

- DappRadar: Lists Whale Syndicate as a “High Risk” dapp on BNB Smart Chain.

- WHOIS Lookup: Shows privacy protection, no registrant details.

- Google Safe Browsing: No blacklist flags, but no endorsement.

- Regulatory Checks: No SEC, FCA, or other regulatory filings found

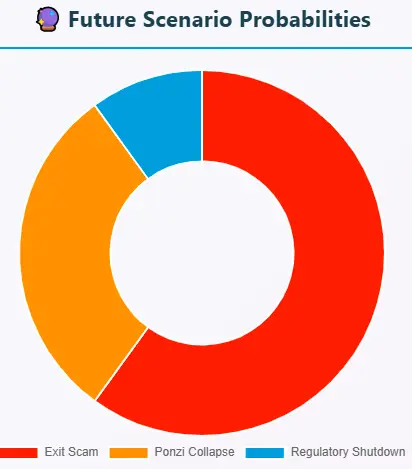

Future Outlook

Without transparency, Whale Syndicate faces three likely scenarios:

- Exit Scam (60%): Disappears with funds within 6–12 months.

- Ponzi Collapse (30%): Fails when new deposits slow.

- Regulatory Action (10%): Shut down by authorities if complaints arise.

Recommendations

- Avoid Investment: The platform’s red flags and unsustainable returns make it a high-risk proposition.

- Safer Alternatives: Consider regulated brokers (e.g., Fidelity), crypto exchanges (e.g., Coinbase), or REITs.

- If Invested: Stop further deposits, document transactions, and report to authorities like the FTC or IC3.

Whale Syndicate Review bConclusion

This Whale Syndicate review reveals a platform with critical flaws: anonymous ownership, unsustainable 180% to 400% APR claims, and an MLM structure resembling a Ponzi scheme. Compared to real estate (8%–12%), bank savings (4%–6%), or crypto staking (4%–12%), its promises are unrealistic. Investors should avoid Whale Syndicate and prioritize transparent, regulated options. For further insights, you can also read our Wormald Farms Review to understand similar risks. Always verify claims with tools like ScamAdviser and consult financial advisors.

DYOR Disclaimer: This analysis is for informational purposes only, not financial advice. Conduct your own research using regulatory sources and trusted tools. Never invest more than you can afford to lose.

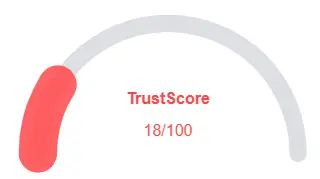

Whale Syndicate Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Whale Syndicate currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Whale Syndicate similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New archive

- Hidden WHOIS data

Frequently Asked Questions About Whale Syndicate Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Whale Syndicate is a crypto platform claiming 180% to 400% APR staking pools and referral commissions, but with no verified transparency.

No, Whale Syndicate shows red flags such as anonymous ownership, no audits, and unsustainable ROI promises, making it high risk.

The platform claims earnings through staking pools, but there is no verifiable proof of real trading or farming activity.

A Whale Syndicate review points to unrealistic returns, Ponzi-like MLM structure, crypto-only payments, and potential total loss of funds.

No, returns of 180% to 400% APR are mathematically impossible compared to real benchmarks in real estate, banks, or regulated crypto staking.

Other Infromation:

Website: whalesyndicate.com

Reviews:

There are no reviews yet. Be the first one to write one.