Welbit Review: Legit Fintech or 2026 Scam?

In this Welbit review, Scams Radar examines the platform’s claims as a fintech company in digital assets and crypto trading. Launched late 2025, it promises high returns via algorithmic trading. But deep checks reveal major concerns. We cover owners, compensation, risks, and more to help you decide.

Table of Contents

Part 1: Welbit Ownership and Background

Welbit operates through Welbit Limited, registered in Northern Ireland on December 22, 2025. The company number is NI736476. The address is a shared virtual office in Belfast. This setup shows little real presence.

Oliver Hogan serves as director. Born in 1975, he lives in England. No past fintech roles appear in searches. No LinkedIn or conference records exist. Quotes from him sound generic. Michael Grant handles media. His name is too common to trace. No clear ties to finance.

The platform links to Visionary Financial promoters. This group copies a real Texas advisor run by Shelly Dodge. Past promotions include AlphaPepe, a rug pull, and DogeStaking, a Ponzi. They warn about other scams to build trust, then push Welbit.

The name mimics Welbilt Inc., a kitchen equipment maker. This confuses searches. Welbilt has real history since 1929. Welbit uses this for false credibility. Domain registered in 2011, updated October 2025. It hides behind Cloudflare. Claims Irish EU registration, but it’s UK-based without FCA approval.

Part 2: Welbit Compensation Plan Explained

Welbit uses a hybrid plan. It mixes binary and unilevel structures. This drives recruitment.

In binary, you build two teams. Pay comes from the weaker side. For example, 10% on matched volume. Spillover helps new users. Uplines place recruits below.

Unilevel adds depth. Earn from levels down. Direct referrals get 10%. Next levels drop to 5%, then 3%. Matches on trading profits.

Leadership ranks go to 12 levels. Rewards range from 4% to 40%. Immediate payouts leak 10-15% of deposits. Level 1: 7%. Level 2: 3%. Level 3: 1%.

This creates quick outflows. A $1,000 deposit pays $110 out right away. Platform keeps $890 but owes returns on full amount. Must earn 12.3% fast to cover. Impossible without new money.

2.1 Welbit ROI Claims and Proof

Welbit offers up to 3% daily via AI arbitrage. But math shows it’s unsustainable.

Take 1.5% daily on $1,000. After 365 days: $1,000 × (1.015)^365 ≈ $229,000. That’s 22,800% yearly.

Arbitrage has limits. Small price gaps vanish fast. High-frequency firms take them. Welbit takes endless deposits. But chances are tiny.

From promoters’ past: 43.8% monthly = 7,800% APY. No real market yields this

2.2 Comparisons to Real Options

Option | Avg ROI | Risk | Key Feature |

Real Estate | 7-10% | Medium | Rental income |

Bank CDs | 0.4-4.8% | Low | Insured |

ETH Staking | 5-10% | High | On-chain |

Part 3: Public Views and DYOR Tools

Trustpilot: One low review. Reddit calls it Ponzi. Scamadviser flags risks. TraderKnows says scam. Justice Trace warns the clone.

Promoters on X: @visionaryfinanc pushes similar frauds like BloFin.

Key Red Flags in Welbit

- Fake EU claims; no license.

- Site often down since its launch.

- Bonus traps demand extra fees.

- No audits or reserves proof.

- Custodial funds risk theft.

- Traffic is low; paid hype only.

- Perception is poor on forums.

Recommendations

Check regulators first. Use blockchain tools. Test small if unsure.

Conclusion

This Welbit review shows major risks in crypto trading and asset management. Avoid due to fake owners and impossible returns. Choose regulated paths for safety. Stay informed to protect funds.

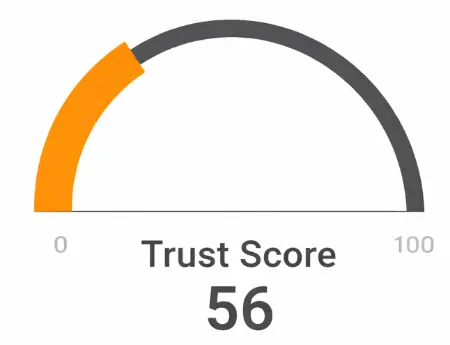

Welbit Review Trust Score

A website’s trust score is an important indicator of its reliability. Welbit currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Welbit or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Welbit Review

This section answers key questions about Welbit, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No clear history. Seems fabricated.

Common in such schemes. Fees block access.

No. UK shell, no FCA.

Yes, links to past frauds.

Registered in Northern Ireland, but only a virtual office. No real presence.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.