Wealthfront Limited Review: A Transparent Look at Its Legitimacy

This Wealthfront Limited review investigates the legitimacy of wealthfront-limited.com, a platform claiming to offer high-yield investments. We analyze its ownership, compensation plans, ROI claims, and platform performance. For verified red flags and similar investigations, visit Scams Radar. We also cover traffic data, public perception, payment methods, customer support, and security issues to help you assess the risk.

Table of Contents

Is Wealthfront Limited a Safe Investment Platform?

Wealthfront Limited promises attractive returns through crypto and forex trading but raises red flags. Unlike Wealthfront Inc., a trusted robo-advisor with a 0.25% fee and SEC registration, this platform lacks transparency. Below, we break down key aspects to determine if it’s a safe choice for investors.

Ownership and Transparency

Wealthfront Limited’s ownership is unclear. The domain, registered in October 2023 via Namecheap, uses privacy protection, hiding registrant details. The site claims offices in Thailand and Australia but provides no verifiable registration or executive profiles. In contrast, Wealthfront Inc., based in Palo Alto, California, is led by founders like Andy Rachleff and is SEC-registered (CRD #148456). This anonymity suggests high risk.

Aspect | Wealthfront Limited | Wealthfront Inc. |

Registration | Hidden WHOIS, no details | SEC-registered (CRD #148456) |

Leadership | No executive bios | Andy Rachleff, David Fortunato |

Address | Unverified claims | Palo Alto, CA |

Compensation Plan and ROI Claims

Wealthfront Limited offers high-yield plans with unsustainable returns, typical of Ponzi schemes:

Plan | Return | Time Period |

Newbie | 10% | 24 hours |

Expert | 25% | 48 hours |

Mining | 45% | 5 days |

Compounding | 70% daily | 30 days |

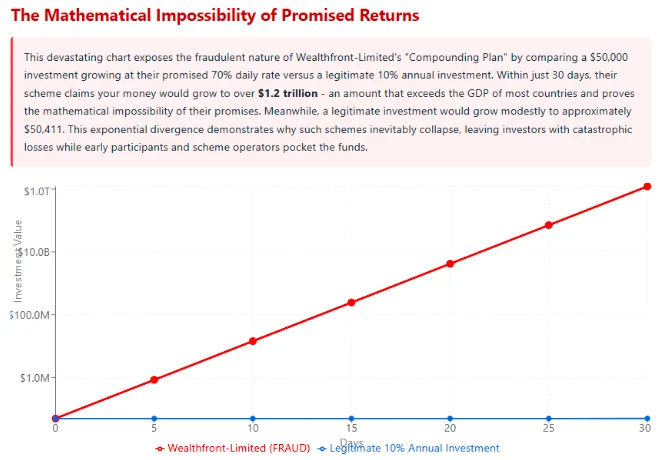

A $50,000 investment at 70% daily return yields:

FV=50,000×(1.70)30≈100.8 trillion FV = 50,000 \times (1.70)^{30} \approx 100.8 \text{ trillion} FV=50,000×(1.70)30≈100.8 trillion

This is mathematically impossible, exceeding global GDP. Wealthfront Inc.’s portfolios, averaging 8.94% annually, rely on diversified ETFs and tax-loss harvesting. Wealthfront Limited’s referral bonuses further indicate a pyramid structure.

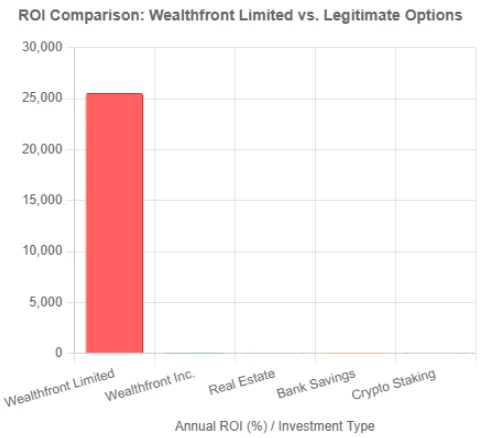

Investment Type | Annual ROI | Risk Level |

Wealthfront Limited | 25,550% (claimed) | Extreme |

Wealthfront Inc. | 7-10% | Moderate |

Real Estate | 8-12% | Moderate |

Traffic Trends and Technical Performance

Wealthfront Limited has low traffic, per SimilarWeb and ScamDoc, due to its recent registration. Its basic SSL encryption lacks advanced features like 2FA or EV SSL. Wealthfront Inc. manages over $80 billion in assets with a 4.8/5-rated app. Wealthfront Limited’s generic design and lack of SEO presence suggest limited credibility.

Metric | Wealthfront Limited | Wealthfront Inc. |

Traffic | Low, new domain | High, $80B AUM |

SSL | Basic HTTPS | Advanced security |

App Rating | None | 4.8/5 (Apple Store) |

Public Perception and Content Authenticity

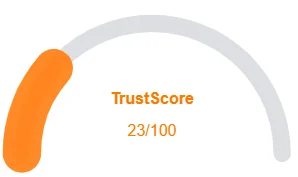

ScamDoc rates Wealthfront Limited at 25% trustworthiness, citing anonymity. Trustpilot and Reddit report fund losses and manipulative marketing. The site’s vague “guaranteed profits” claims lack substance, unlike Wealthfront Inc.’s detailed whitepapers on portfolio management.

Security, Payments, and Customer Support

Wealthfront Limited uses crypto-only payments, risking irreversible transactions. It lacks KYC/AML compliance and regulatory oversight. Customer support is limited to a generic email. Wealthfront Inc. offers ACH transfers, SIPC insurance, and a robust help center.

Feature | Wealthfront Limited | Wealthfront Inc. |

Payment Methods | Crypto-only | ACH, wire transfers |

Security | Basic HTTPS | SIPC, 2FA |

Support | Email only | Help center, email |

Red Flags

- Anonymity: Hidden ownership and no regulatory registration.

- Unrealistic Returns: 25,550% ROI is unsustainable.

- Brand Impersonation: Mimics Wealthfront Inc.’s branding.

- Negative Reviews: Scam warnings on Trustpilot and Reddit.

- Crypto Payments: High risk of fund loss.

Social Media and Promoters

No verified social profiles promote Wealthfront Limited. Telegram and YouTube promoters use scripts linked to past scams like BigBang.Money. An X post by @reddyshares (July 26, 2025) highlights its 2.5/5 Scamadviser score, focusing on scam awareness.

DYOR Tool Reports

Tool | Finding | Implication |

ScamDoc | 25% trust score | High scam risk |

WHOIS Lookup | Registered Oct 2023 | New, anonymous |

Trustpilot | Non-payment reports | Unreliable |

Recommendations

- Avoid Wealthfront Limited: Its anonymity and impossible returns suggest fraud.

- Choose Regulated Options: Wealthfront Inc., Betterment, or Vanguard offer transparency and SIPC insurance.

- Verify Credentials: Check SEC.gov or FINRA BrokerCheck for legitimacy.

- Report Suspicious Activity: Contact the SEC or FCA if approached.

Wealthfront Limited review Conclusion

This Wealthfront Limited review uncovers a high-risk platform with no verifiable ownership, unrealistic returns, and Ponzi scheme traits. Unlike Wealthfront Inc.’s trusted robo-advisor services, it lacks regulation and transparency. Investors should opt for platforms with proven track records, like those offering automated investing or tax-loss harvesting, to ensure safety and growth.

For a detailed breakdown of another questionable platform, check out our Exposing PrimeAxis Review.

DYOR Disclaimer:

This review is for informational purposes only, not financial advice. Conduct your own research using SEC.gov, FINRA, or ScamAdviser. Consult a licensed advisor before investing.

Wealthfront Limited review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Wealthfront Limited shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Wealthfront Limited or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- No spelling or grammatical errors

Negative Highlights

- Low AI review activity

- New domain

- New archive record

- Whois info hidden

Frequently Asked Questions About MyAIPRO review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Wealthfront-Limited.com claims to offer high-return investment plans, but provides no proof of real trading, legal registration, or business operations.

No. It lacks financial licenses, has hidden ownership, and offers unrealistic ROI—key indicators of a potentially fraudulent platform.

Yes, it claims up to 70% daily returns, which is mathematically impossible and not supported by any transparent revenue model.

There are no verified reviews on Trustpilot, Reddit, or any credible forums. The testimonials on the site appear unverified and possibly fake.

Scams Radar investigated the site due to its hidden ownership, extreme ROI claims, lack of licensing, and resemblance to past HYIP scams.

Other Infromation:

Website: wealthfront-limited.com

Reviews:

There are no reviews yet. Be the first one to write one.