We Chain Review: Uncovering Legitimacy and Key Risks

In this We Chain review, Scams Radar looks closely at the platform’s setup and promises. We Chain positions itself as a blockchain solution with AI compliance and Zero-Knowledge Proofs for decentralized compliance. Yet, questions arise about its ownership, rewards, and long-term viability. This guide breaks it down for everyday readers.

Table of Contents

Part 1: Ownership Profiles and Backgrounds

We Chain operates through AppAtlas Technologies LLC, registered in St. Vincent and the Grenadines with number 3644 LLC 2024. The address is Euro House, Richmond Hill Road, Kingstown. Another entity, InfiniCore Tech LLC, handles the WFI token from Saint Kitts and Nevis, number L 23312, at Suite 1, Main Street, Charlestown.

These spots offer little oversight. No public records show who owns or runs them.

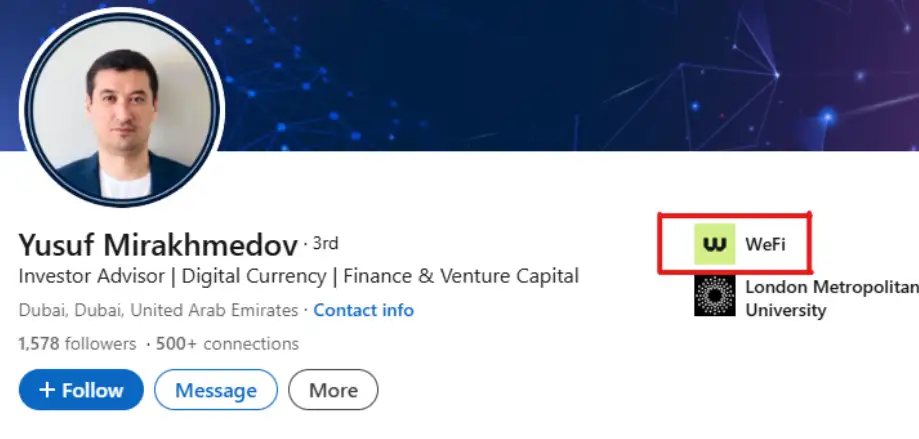

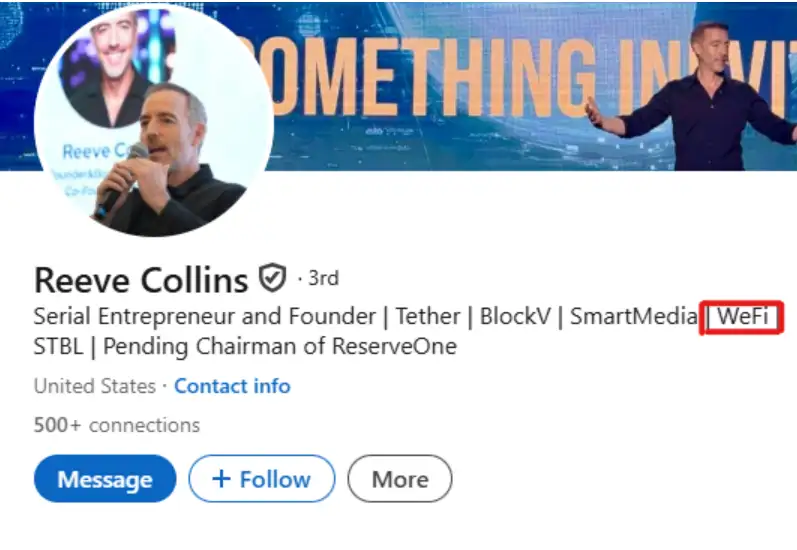

Other names surface from probes. Reeve Collins, once with Tether, chairs. Yusuf Mirakhmedov faces old claims of fund misuse in Uzbekistan. John Sachtouras is tied to past schemes like FutureNet. Many have Dubai links, a hub for risky crypto ops. This lack of clear profiles raises doubts.

Part 2: We Chain Compensation Plan Explained

The plan centers on ITO nodes. Users buy them with USDT to mint WFI tokens. Tiers start at $1,000 and reach $300,000. Nodes promise rewards over the years.

Staking adds 15% for 180 days, 20% for 365 days, or 25% for 730 days. Stablecoin yields hit 18% in some setups.

It includes MLM elements. Referrals earn commissions in WFI, auto-staked. Levels unlock with buys: 3% at level 1 ($250), 5% at level 2 ($500), 8% at level 3 ($1,000). This pushes recruitment.

No split shows funds to ops versus payouts. Rewards come from new buys, not fees.

2.1 ROI Claims and Why They Fall Short

Marketing touts 350% annual ROI on a $1,000 node. Staking boosts it further.

But math shows issues. For $1,000 at 350%, year one yields $3,500. For 1,000 users, that’s $3.5 million needed. WFI supply is 1 billion total, 74 million circulating. Minting floods supply without demand.

Equation: Price = (Locked Value + Demand) / Supply. If nodes sell $10 million, rewards need $35 million more. Low volume, $1.2 million daily, can’t handle it.

Growth requires 20% monthly recruits. It stops when new funds dry up, like in OneCoin.

Investment Type | Average Annual ROI (%) |

Bank Savings | 4-5 |

Real Estate | 7-10 |

Crypto Staking | 5-20 |

We Chain Claim | 350+ |

Part 3: Traffic Trends and Public Views

Traffic is low and scattered. Sources include Vietnam (24%), Ecuador (21%), and France (15%). Sister sites show Canada (54%), Brazil (29%). No strong organic growth.

The views are poor. Forums call it node fraud. BehindMLM labels it Ponzi. Reddit flags suspicions. No positive mainstream talk.

3.1 Security Measures and Content Check

We Chain claims Zero-Knowledge Proofs for privacy, AI for compliance, Cosmos SDK for scalability and interoperability. But no audits from Certik exist. Content feels generic, with unverified partners.

Payments use crypto like USDT. Support lacks details, no phone, just email. Tech claims lack benchmarks.

3.2 Payment Methods and Support

Users pay in USDT for nodes. Rewards in WFI, tradable on BitMart. Support seems basic, unresponsive in crises.

Red Flags in We Chain Review

- Hidden owners in offshore spots.

- MLM ties with a recruitment focus.

- No revenue to back ROIs.

- Scam alerts from tools.

- Low liquidity for WFI.

- Disclaimers deny financial role.

DYOR Tool Reports

ScamAdviser: 61/100 trust, hidden owner, bad reviews. BehindMLM: Fraud via shells. Trustpilot: No page, similar flagged. CoinGecko tracks WFI, but no endorsement.

Social Media and Past Promotions

@wefi_official on X pushes nodes and staking. LinkedIn posts launches. Promoters link to past risks like Bytnex. Grassroots style, no big names. But many small promoters look like paid promoters

Future Outlook

Short term: Hype may lift WFI. Medium: Inflows slow, price drops. Long: Likely crash 80%+, delists, legal issues.

Conclusion: Weigh the Facts

This We Chain review shows high risks outweigh claims. Offshore setup, unclear owners, and math issues point to caution. For secure options, stick to regulated paths. Research fully.

DYOR Disclaimer: Info from public sources as of November 25, 2025. Not advice. Consult experts. Invest wisely.

We Chain Review Trust Score

A website’s trust score is an important indicator of its reliability. We Chain currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the We Chain or similar platforms.

Positive Highlights

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About We Chain Review

This section answers key questions about We Chain, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Its hidden owners, offshore setup, and unrealistic returns make it a high-risk option.

Rewards mainly come from new node purchases, not real revenue, which is unsustainable.

MLM recruitment, unclear leadership, no audits, low liquidity, and exaggerated ROI claims.

No independent audit confirms these features, so the claims remain unproven.

Both highlight hidden ownership and impossible profit promises, signaling serious risk.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.