VIM Review: Is WeAreVim.com Worth Your Time and Money?

If you are searching for a VIM review, you likely want straight facts on wearevim.com. This platform claims to offer personal growth tools and income opportunities. But does it deliver? In this detailed Scams Radar’s VIM review, we break down its structure, risks, and real value based on public records and expert analyses. Our goal is to help you decide with clear insights.

Table of Contents

Part 1: Understanding VIM: Core Offerings and Promises

VIM positions itself as a community for self-improvement. It focuses on mindset shifts, goal setting, and building networks. The main site highlights courses like “Elevate” and “Beyond Freedom.” These aim to help users break limits and find passion.

Access starts simple. You begin with the Essential membership at $47 per month. This gives basic tools and referral options. From there, upgrades include the Effect package at $497 one-time. The top tier, Elite, costs $1,997 once. There’s also an All-In bundle at $2,541.

The site stresses transformation. It talks about clarity in confusion and thriving in community. Yet, it includes an earnings disclaimer right up front. This notes that results vary by effort. No income is guaranteed. Examples of success are just illustrations.

Public pages show a Scottsdale, Arizona address: 8924 E Pinnacle Peak Rd, Suite G-5 404. Contact comes via email at support@wearevim.com. The setup funnels users to a members area at members.vimnow.com for deeper engagement.

1.1 Founders' Profiles: Brent Payne and Linda Baer's Track Record

A solid VIM review must cover leadership. Co-founders Brent Payne and Linda Baer lead the charge. Payne brings years in personal development. He started Liberty League International in 2000. That program ran until 2009. It faced scrutiny in Australia, where regulators called it a pyramid scheme.

After that, Payne launched Avant Global in 2010. It focused on similar growth tools but closed amid slowing recruitment. He followed with Real Estate Worldwide in 2012, which also ended. His latest tie was to RenovoVita until October 2024. Now, VIM launched in 2013 as a fresh start. It echoes Liberty League’s no-retail-sales model.

Linda Baer partners with Payne. Her background is less public. She appears in founder videos and social posts. Instagram profiles for both push “passive income” ideas. Payne’s bio links to VIM and mentoring calls. Baer’s content ties to program pitches but lacks deep corporate details.

The founders page on the site repeats disclaimers. It lists the Arizona address but skips full bios or credentials. This opacity raises questions in our VIM review. Past collapses suggest patterns. Experts like BehindMLM note VIM as a reboot of risky models.

Part 2: Breaking Down the VIM Compensation Plan

The heart of any VIM review is the pay structure. VIM uses a two-tier referral system. You must hold the $47 monthly Essential to qualify for commissions. No volume minimums apply. Payouts come from selling memberships.

Here’s the plan in a simple table:

Tier Name | Price | Level 1 Commission | Level 2 Commission |

Essential | $47/month | N/A | N/A |

Effect | $497 one-time | $250 | $50 |

Elite | $1,997 one-time | $1,000 | $200 |

All-In Bundle | $2,541 one-time | Varies by components | Varies by components |

Marketing hints at quick wins. Phrases like “earn within days” or “thousands in the first month” appear. But the disclaimer tempers this. Commissions flow only on paid referrals. No retail sales exist outside promoters buying in.

To stay eligible, you pay the monthly fee ongoing. This creates a pay-to-play dynamic. Watchdogs flag it as recruitment-focused. FTC rules stress retail sales for legitimacy. VIM lacks that separation.

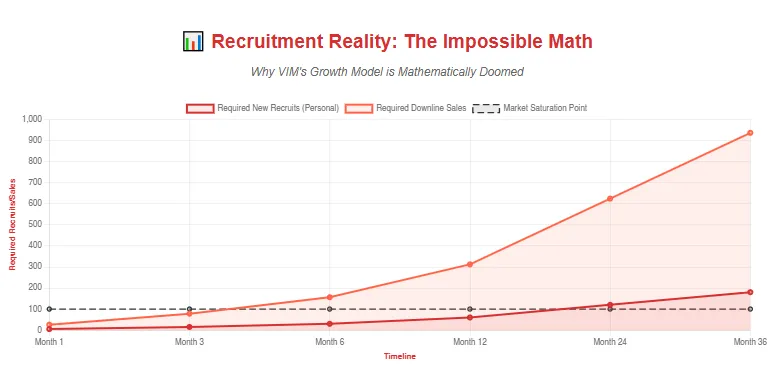

2.1 Why VIM's ROI Claims Don't Add Up: A Math Breakdown

Promised returns sound appealing in a VIM review. Sell one Elite package, pocket $1,000. But sustainability? Let’s crunch numbers.

Assume you aim for $5,000 net monthly. After the $47 fee, you need $5,047 in commissions. For Elite sales, that’s about 5 direct referrals per month. Over a year, that’s 60 high-ticket closes.

Now, factor in the two-tier. If downline affiliates each close one Elite, your Level 2 adds $200 each. To hit $5,000 without personal sales, you need 26 such closes monthly. That means managing 26 active sellers, each recruiting steadily.

We ran a basic simulation. Start with one recruiter. Each brings in two more. After 10 levels, you need 2,047 affiliates. Global population limits this to about 33 levels max. But VIM caps at two tiers. Still, growth stalls without endless new joins.

Scenario | Monthly Recruits Needed | Annual Total | Sustainability Issue |

Solo (Direct Only) | 5 Elites | 60 | High churn; no team leverage |

Team (Level 2 Only) | 26 downline sales | 312 | Requires constant training/recruitment |

Full Pyramid Growth | 2 per person | 2,047 in 10 levels | Market saturation in 2-3 years |

This shows reliance on inflows, not value creation. It’s classic pyramid math. Early birds win; most lose.

Part 3: Key Red Flags in Our VIM Review

Spotting issues early matters. We combined insights to list top concerns:

- Recruitment drives all income; no true retail base.

- High entry costs ($1,997) for best payouts.

- Monthly fee required to earn.

- Short 3-day refund window.

- Arbitration in Arizona waives class actions.

- Founders’ history of failed programs.

- Split domains hide full terms.

- Outdated privacy policy (2014 date).

- Vague science claims without sources.

- Address variations across pages.

- “Passive income” social pitches.

- Recent watchdog pyramid label.

- Opaque traffic data.

- Email-only support.

- No phone or chat options.

- Inconsistent legal updates.

These 16 flags signal caution.

3.1 Public View, Traffic, and Security Check

Perception leans negative. BehindMLM’s September 23, 2025, piece calls VIM a pyramid risk. YouTube videos echo scam warnings. Trustpilot and Sitejabber show zero reviews. ScamMinder scores it high on age alone.

Traffic stays low. SimilarWeb data is sparse, under 10,000 visits monthly. Spikes tie to affiliate pushes, not organic searches.

Security uses HTTPS. But no advanced headers stand out. Checkout on members.vimnow.com lacks clear processor info. Privacy allows broad data sharing. Run your own scans via SecurityHeaders.com.

Support is email-based. No user stories on quick fixes.

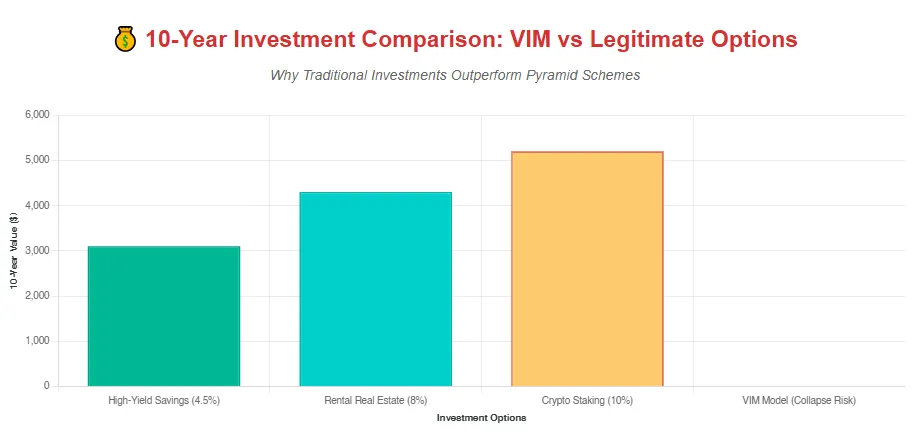

3.2 How VIM Stacks Up Against Safer Options

VIM implies fast gains. Reality differs. Compare over 10 years on a $1,997 start:

Option | Annual Return | 10-Year Value | Risk |

High-Yield Savings | 4.5% | $3,100 | Low (FDIC-backed) |

Rental Real Estate | 8% | $4,300 | Medium (market shifts) |

Crypto Staking | 10% | $5,200 | High (volatility) |

VIM (Implied) | 50%+ short-term | Collapse likely | Extreme |

Banks offer a steady 3.9-5% APY. REITs hit 6-10% long-term. Crypto promos reach 10-13% briefly. VIM’s model can’t match without recruitment bubbles.

4.1 DYOR Tools for Your VIM Review

Verify yourself:

- WHOIS via ICANN Lookup.

- Archives on Wayback Machine.

- Tech stack with BuiltWith.

- Security via SSL Shopper.

- Reputation on VirusTotal.

- Traffic on SimilarWeb.

- Complaints at BBB or FTC.

BehindMLM provides the deepest dive.

Final Thoughts: Proceed with Eyes Wide Open

This VIM review reveals a program heavy on hype and light on safeguards. Founders’ past and recruitment focus create real risks. Math proves returns rely on unsustainable growth. For steady wins, stick to banks or real estate. Check our detailed Nivex and Luma review to uncover similar red flags.

If growth appeals, test with minimal spend. Document all. Seek advice from pros. Remember, true value builds slowly.

DYOR Disclaimer: This draws from public data as of September 27, 2025. It’s not advice. Consult experts. Verify everything yourself.

VIM Review Trust Score

A website’s trust score is a key factor in judging its reliability. VIM Company currently shows a concerningly low rating, raising doubts about its legitimacy. Users are strongly advised to proceed with caution.

Warning signs include low web traffic, negative user feedback, potential phishing risks, hidden ownership details, unclear hosting information, and weak SSL protection.

Given its poor trust score, the risks of fraud, data leaks, or other security issues are significantly higher. It is essential to review these red flags carefully before engaging with VIM Company or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- The archive is recently created.

- Whois details are concealed.

- According to Tranco this site has a low rank

Frequently Asked Questions About VIM Company Review

This section addresses important questions about VIM Company, offering clarity, building trust, and tackling concerns related to the platform’s legitimacy.

VIM positions itself as a self-improvement and income opportunity platform. It offers personal growth courses like Elevate and Beyond Freedom while promoting referral-based income through memberships.

VIM was co-founded by Brent Payne and Linda Baer. Payne has a long history with personal development ventures such as Liberty League International, Avant Global, and Real Estate Worldwide — many of which ended amid scrutiny or decline.

VIM uses a two-tier referral system. To qualify for commissions, members must pay $47 per month for the Essential package. Commissions are earned only when selling memberships, not retail products.

Essential: $47/month

Effect: $497 one-time

Elite: $1,997 one-time

All-In Bundle: $2,541 one-time

Not really. While VIM suggests you can earn thousands quickly, sustainability is questionable. Mathematical breakdowns show income depends heavily on constant recruitment, a sign of a pyramid-style model.

Other Infromation:

Website: wearevim.com

Reviews:

There are no reviews yet. Be the first one to write one.