UniWeb Review: Is UniWebCorp a Legit Opportunity or High-Risk Scam?

UniWeb reviews often raise questions about its true nature. Many people search for clear facts on this platform. This article combines data from multiple sources to provide a comprehensive picture. Scams Radar looks at ownership, compensation plans, returns, and risks. Our goal is to help readers make smart choices.

Table of Contents

Part 1: Ownership and Transparency Issues

UniWebCorp shows no clear owners. No names or profiles appear on the site. No team details exist. The domain started on May 10, 2025. It uses privacy services to hide registrant info. WHOIS checks show no public data. Some reports link it to Chinese groups. Communications use the Chinese language. This points to overseas operations.

No regulatory filings show up. No SEC or FCA approval. No business address listed. Legit firms share this info. Coinbase lists leaders and licenses. UniWebCorp does not. This lack raises doubts. Hidden identity often signals problems.

Part 2: Compensation Plan Breakdown

UniWebCorp mixes investment and referrals. Users deposit USDT for returns. Plans start at $20. Daily rates range from 1.5% to 3.5%. Higher tiers need more money and recruits.

Investment Tiers

Plan Name | Minimum Deposit (USDT) | Daily Return (%) | Monthly Return (%) | Annual Return (%) |

Starter | 20-80 | 1.5 | 45 | 540 |

Growth | 100-250 | 2.0 | 60 | 720 |

Premium | 300-500 | 2.15 | 64.5 | 774 |

Star 1 | 1,000 | 2.3 | 69 | 828 |

Star 2 | 2,500 | 2.5 | 75 | 900 |

Star 3 | 5,000 | 2.6 | 78 | 936 |

Star 4 | 10,000 | 2.75 | 82.5 | 990 |

Star 5 | 17,000 | 3.0 | 90 | 1,080 |

Star 6 | 25,000 | 3.25 | 97.5 | 1,170 |

UniWeb Star | 35,000 | 3.5 | 105 | 1,260 |

Referral Structure

Referrals drive growth. Up to 8% bonus on direct invites. Commissions go five to seven levels deep.

- Level 1: 13%-22%

- Level 2: 5%-12%

- Level 3: 2%-7%

- Levels 4-7: 1% each

Bonuses reward recruitment. Recruit two for $20. Build large downlines for more. This setup focuses on bringing in people. It resembles pyramid models.

Withdrawals charge 5% fee. Funds are used in a centralized wallet. No blockchain links.

2.1 Why Returns Are Unsustainable: Math Proof

Promised rates seem high. Let’s calculate.

Use formula: FV = P × (1 + r)^n

P = principal, r = daily rate, n = days.

For $100 at 1.5% daily:

- Month: $100 × (1.015)^30 ≈ $156 (56% gain)

- Year: $100 × (1.015)^365 ≈ $15,476 (15,376% gain)

At 3.5% daily for $35,000:

- Year: $35,000 × (1.035)^365 ≈ $1.68 billion

No market supports this. S&P 500 averages 10% yearly. Warren Buffett hits 20%.

To pay, new funds must enter. When recruitment stops, it fails. This is Ponzi math.

2.2 Comparison to Real Investments

Investment Type | Annual Return (%) | Risk Level | Source Example |

UniWebCorp | 540-1,260 | Extreme | Platform Claims |

Bank Savings | 4-5 | Low | FDIC Average |

Real Estate | 7-10 | Medium | U.S. Rental Yield |

Crypto Staking (ETH) | 3-7 | High | Ethereum Network |

S&P 500 | 10 | Medium | Historical Avg |

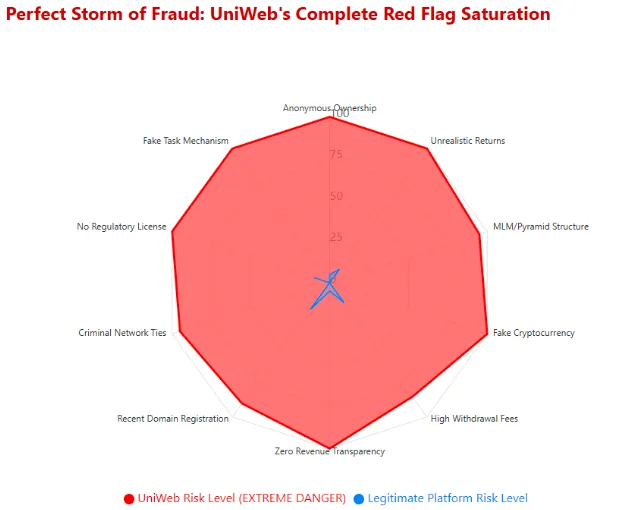

Part 3: Key Red Flags

- nonymous owners: No profiles or addresses.

- High returns: Impossible without new money.

- MLM focus: Earnings from recruits, not value.

- Fake token: UNIWEB unlisted.

- Recent domain: Less than a year old.

- Centralized control: No blockchain proof.

- High fees: 5% on withdrawals.

- Traffic: Mostly India, referral-based.

- No audits: No smart contracts shown.

These match past scams like HAHM.

3.1 Traffic Trends and Perception

Traffic comes from India. Low global rank. Spikes from referrals. Public views are bad. Scamadviser gives low trust. BehindMLM calls it Ponzi. No Trustpilot reviews. Reddit warns against it.

3.2 Security and Performance

Basic SSL only. No 2FA or audits. App loads slowly. Dashboard shows zero activity. Content copies legit sites. Support via Telegram. Responses slow.

Payments use USDT only. No fiat.

3.3 Social Media and Promoters

Profiles on Instagram (@uniwebcorp), TikTok. Low engagement. Promoters push referrals. They linked to past flops like GTM. Facebook groups share links.

DYOR Tool Reports

- Scamadviser: Low trust, hidden WHOIS.

- GridinSoft: Suspicious, low score.

- ICANN: Recent, private.

- VirusTotal: Check for malware.

- SimilarWeb: India traffic.

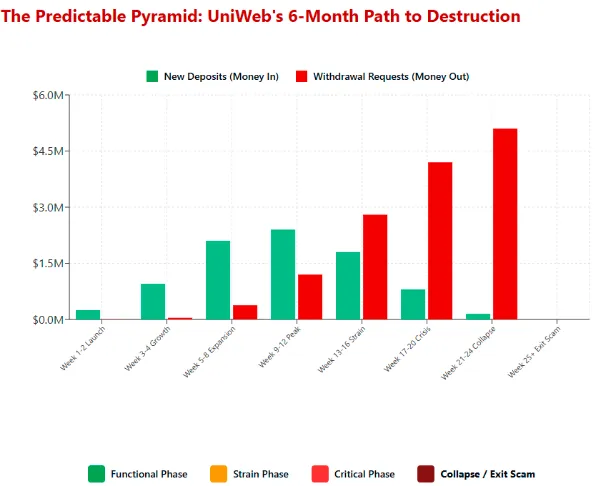

Future Outlook

Similar schemes collapse in 6-18 months. UniWeb may peak soon. Watch for withdrawal issues.

Recommendations

Avoid deposits. If in, withdraw now. Use legit options like ETH staking or banks. Verify tokens on CoinGecko. Report to authorities. Now Visit Vizzion Bot Pro Review.

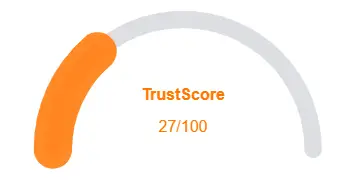

UniWeb Review Trust Score

A website’s trust score is an important indicator of its reliability. UniWeb currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with UniWeb or similar platforms.

Positive Highlights

- Website content is fully accessible

- Site content contains no spelling or grammar errors

- Domain is ranked within the top 1M on the Tranco list

Negative Highlights

- Low AI review rate

- Newly registered domain

- Hidden WHOIS data

Frequently Asked Questions About UniWeb Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. It hides ownership, has no license, and shows Ponzi traits.

It claims 1.5%-3.5% daily, equaling 540%-1,260% yearly impossible ROI.

It pays up to 22% commissions for recruitment, not real products.

Anonymous owners, fake tokens, extreme ROI, no regulation, and high fees.

Both rely on unrealistic ROI, MLM-style recruiting, and hidden operators.

Other Infromation:

Website: UNIWEBCORP.COM

Reviews:

There are no reviews yet. Be the first one to write one.