UGP Review: Examining Union Green Power's Claims and Risks

Union Green Power draws attention in the green energy space. This UGP review looks at its structure and promises. We cover ownership, compensation, and returns. Data comes from public records and analysis. Read on for clear facts. Scams Radar.

Table of Contents

Part 1: Corporate Structure: Who Runs Union Green Power?

Union Green Power Ltd holds the registration. It sits in Northern Ireland with the number NI734343. The setup started on October 13, 2025. Ryan Hale serves as the only director. He comes from Canada and lives there. His birth date is October 1984.

Hale lacks clear ties to renewables. No past roles show up in energy firms. Searches find no LinkedIn or talks at events. This points to a nominee role. True owners stay hidden. Union Green Power anonymous owners fit scam patterns.

The address is 3 Bedford Square, Belfast. It acts as a virtual office. Services include mail forwarding. No real staff work there. Legit firms have full teams and sites.

Michael Warner appears as COO in some claims. But checks show this as fake. No proof links him to UGP. UGP Michael Warner, COO, raises doubts. The setup hides real control.

Union Green Power uses a shell. It claims big projects in solar and wind. But time does not match. Building takes years. A new firm cannot manage global assets.

Part 2: Compensation Plan: How UGP Pays Out

UGP runs an affiliate program. It uses a unilevel model. This means no width limit. Recruits go on level one. Pay flows down 17 levels.

Commissions take up to 60% of funds. This leaves little for projects. Ranks need high turnover. Rank 1 asks for $10,000. It unlocks 3 levels. Rank 5 needs $1.5 million for 7 levels. Global Rank wants $20 million for all 17.

UGP MLM ranks downline earnings, pushing sales. No products exist. Just packages tied to energy claims. UGP affiliate recruitment commissions drive growth.

Rank | Required Turnover | Levels Unlocked | Notes |

1 | $10,000 | 3 | Start level |

5 | $1,500,000 | 7 | Mid tier |

12 | $20,000,000 | 17 | Top rank |

2.1 ROI Claims: Why They Do Not Add Up

UGP offers daily returns. It ties to clean energy. Promises start from day one. UGP daily ROI pyramid scheme sounds good. But math fails.

Take $1,000 input. It buys 1 kW of solar. Output is 5 kWh per day. Price is $0.05 per kWh. Revenue hits $0.25. But UGP gives $10 daily at 1%.

Deficit is $9.75. Funds come from others. UGP daily returns need constant deposits.

Union Green Power USDT investment plans start at 50 USDT. UGP crypto deposit minimum of 50 USDT fits the crypto focus. Withdrawal of USDT from UGP often hits users.

UGP lockup periods 2500 days tie funds long. This delays exits.

Part 3: Public Perception and Promotions

Views turn negative in forums. BehindMLM calls it Ponzi. Reddit threads agree.

Promoters use Telegram. They share proofs. Past ties to Beurax show patterns.

Join the UGP affiliate but avoid scams. Risks include laws. UGP crypto MLM legit or scam? Data says scam.

Social handles stay hidden. But networks promote.

Red Flags in UGP Operations

Many signs point to issues. UGP green energy Ponzi exposed by lack of proof. No grid ties exist. Claims use stock photos.

Traffic stays low. Under 1,000 visits per month. Bounce rate tops 80%. This fits niche schemes.

Public views are mixed. Trustpilot has a few reviews. Some praise payments. But forums call it a scam. Is uniongreenpower.com safe on Trustpilot? Score looks fake.

UGP Telegram investment warnings grow. Groups push joins. But complaints rise.

Clean energy scam uses Halal tags. It targets groups. UGP’s clean energy revenue proof is lacking.

Fake CEO UGP scam review fits Hale’s role. Passive income draws people. But UGP passive income fraud alerts warn of loss.

Recommendations for Investors

Stay away from UGP. High loss risk. If in, pull out fast.

Report to regulators. Check claims alone.

Opt for real banks or estates. They give steady gains.

DYOR Disclaimer: This info helps. But check facts yourself.

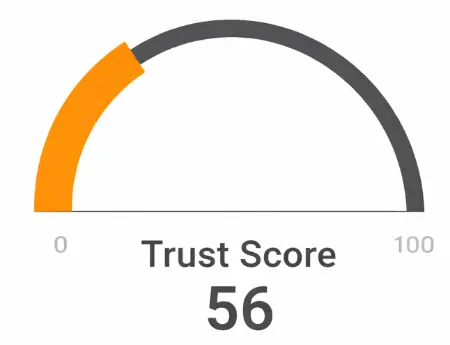

UGP Review Trust Score

A website’s trust score is an important indicator of its reliability. UGP currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the UGP or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions UGP Review

This section answers key questions about UGP, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

UGP shows multiple red flags, including anonymous ownership and unrealistic ROI claims.

UGP claims clean energy revenue, but returns appear dependent on new investor deposits.

It emphasizes recruitment commissions and fixed daily ROI with no real products

USDT investments carry high risk due to long lockups and unclear withdrawal history.

An Everstead Review analyzes its own risks, while this UGP Review focuses on green-energy-based crypto MLM concerns.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.