TradeXMastery Review: Is This Prop Trading Firm Safe or a Scam?

This TradeXMastery review on Scams Radar explores the legitimacy of a proprietary trading firm promising funded accounts, high profit splits, and rapid scaling. We analyze ownership, compensation plans, and risks using clear data and math. Our goal is to help traders make informed decisions about TradeXMastery (tradexmastery.com).

Table of Contents

What Is TradeXMastery?

TradeXMastery offers funded trading accounts from $10,000 to $200,000 through a two-step challenge. Traders pay fees ($99–$975) to hit profit targets (10% in phase 1, 5% in phase 2) with strict rules like 5% daily loss limits. Successful traders keep 80–90% of profits, paid in Bitcoin (BTC). The firm claims to support forex, crypto, indices, and commodities via TradeLocker.

Ownership: Hidden and Unregulated

A trustworthy trading firm shares its leadership and registration details. TradeXMastery does not. Its Terms of Service mention Creative Brands, LLC, a Delaware company, but no verifiable link exists. The domain, registered on December 15, 2023, via NameCheap, uses WhoisGuard to hide owner details. No CEO, founders, or team bios are listed, unlike reputable firms like FTMO. Reports tie promoter Matthew Thayer to an SEC fraud investigation, raising concerns. No regulatory oversight from the SEC, FCA, or other bodies is disclosed.

- Red Flag: Anonymous ownership and no regulation suggest high risk.

Compensation Plan: High Stakes, Strict Rules

TradeXMastery’s model revolves around a two-step challenge and affiliate commissions:

- Challenge Structure:

- Phase 1: 10% profit, 5% daily loss limit, 10% maximum drawdown.

- Phase 2: 5% profit, same risk rules.

- Funded Account: 80% profit split (90% with add-on), BTC-only payouts.

- Fees: $99 for $10,000 account; $975 for $200,000. Non-refundable for instant accounts.

- Scaling: Accounts grow 50% after three 10% profit months, up to $5 million.

- Phase 1: 10% profit, 5% daily loss limit, 10% maximum drawdown.

- Affiliate Program: 15% commission on challenge purchases, including repeats, incentivizing recruitment over trading success.

Payout Terms: First payout after 8 days (standard) or 30 days (instant accounts), processed within 21 days in BTC. No fiat options.

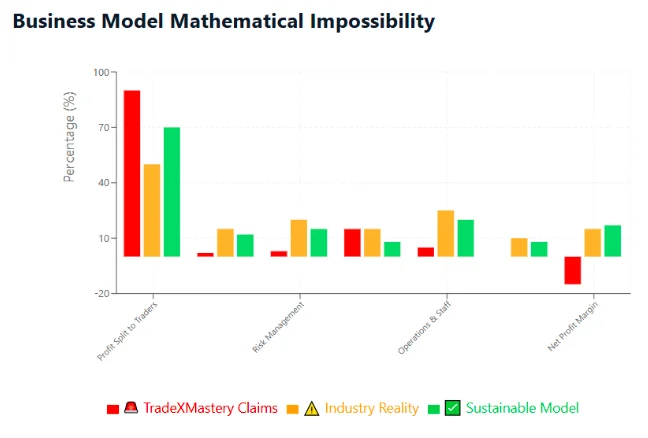

The MLM-style affiliate program, promoted by figures like Thayer, mirrors Ponzi tactics, prioritizing recruitment. Strict rules (e.g., no news trading, no EAs) and tight drawdowns make success challenging.

Red Flag: High fees and MLM structure favor the firm, not traders.

ROI Claims: Ambitious but Unrealistic

TradeXMastery avoids fixed ROI promises, but marketing implies high returns. Assume a $599 fee for a $100,000 account, earning 5% monthly:

- Monthly Profit: $100,000 × 5% = $5,000.

- Trader’s Share (90%): $4,500.

- Annual ROI: ($4,500 × 12) ÷ $599 ≈ 9,017%.

This assumes perfect trading, which is rare. Compare to:

- S&P 500: 7–10% annually (medium risk).

- Real Estate: 6–12% annually (medium risk).

- Crypto Staking: 4–20% APY (high risk, e.g., Kraken).

- Bank Savings: 4–5% APY (low risk, FDIC-insured).

Investment Type | Annual ROI | Risk Level |

TradeXMastery (Claimed) | 9,000%+ | Extremely High |

S&P 500 | 7–10% | Medium |

Real Estate | 6–12% | Medium |

Crypto Staking | 4–20% | High |

Bank Savings | 4–5% | Low |

Traffic and Public Perception

SimilarWeb shows under 50,000 monthly visits, mainly from the US, Malta, and Pakistan, with a 2024 spike. Trustpilot’s 139 reviews are mixed, with generic praise and complaints about manipulation or payout delays. Scamdoc rates it 60%, citing anonymity. Forex Peace Army has zero reviews, a red flag for prop firms. Reddit flags Thayer’s shady promotions.

- Red Flag: Low traffic and suspect reviews suggest limited trust.

Security and Payments

The site uses basic SSL and Cloudflare but lacks 2FA or audits. BTC-only payouts are irreversible, increasing risk. Challenge fees accept cards or crypto, but non-refunded instant accounts raise concerns.

Content and Technical Performance

Marketing touts “real capital” but Terms confirm simulated trading, a major inconsistency. No educational content or performance data exists. TradeLocker is functional but restricts EAs, and users report stop-loss issues.

Metric | Status |

Scamdoc Trust | 60% (Average) |

Domain Age | Dec 2023 |

Review Authenticity | Suspect (Low Volume) |

Regulation | None |

Social Media Promotion

Accounts like @tradexmastery (X, Instagram, TikTok) and Telegram’s t.me/tradexmastery push challenges. Promoters, including Thayer, also hype Akashx.com, Trident Markets, and TradeLocker, indicating a risky network.

DYOR Tool Reports

- Scamdoc: 60% trust, flags anonymity.

- Trustpilot: 139 mixed reviews.

- WHOIS: Hidden registrant, Dec 2023.

- Forex Peace Army: No reviews.

- VirusTotal: No malware, phishing risks noted.

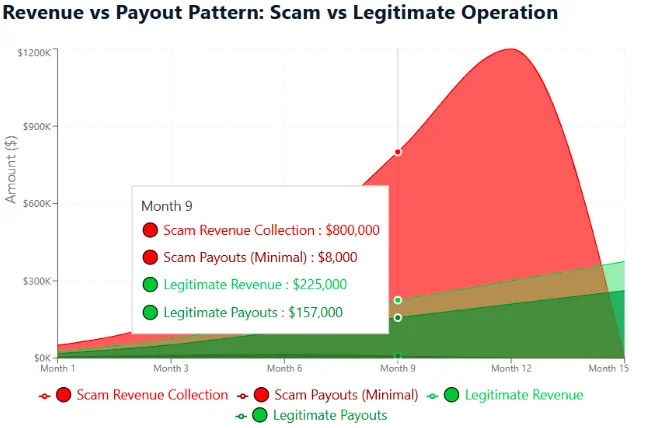

Future Outlook

TradeXMastery may attract early adopters with payouts, but strict rules and crypto delays could frustrate users. Regulatory scrutiny or low sign-ups may lead to a shutdown within 12–18 months.

Recommendations

- Avoid non-refunded instant accounts.

- Choose regulated firms like FTMO or Topstep.

- Diversify with stocks, real estate, or staking.

- Report issues to the SEC or local authorities.

TradeXMastery Review Conclusion

This TradeXMastery review uncovers a risky platform with hidden ownership, MLM promotions, and unrealistic profit expectations. Its low trust score and BTC-only payouts scream caution. Stick to transparent, regulated firms for safer trading.

For a detailed analysis, you can also check out our Maxim Gain Review for more insights on high-risk platforms.

DYOR Disclaimer

Based on public data as of August 26, 2025, this analysis is for education only. Trading carries risks. Research thoroughly and consult advisors before investing. If it seems too good to be true, it likely is.

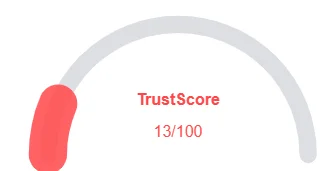

TradeXMastery Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 TradeXMastery currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with TradeXMastery similar platforms.

Positive Highlights

- Website content is accessible.

- No suspicious patterns found.

Negative Highlights

- Low AI review rating.

- New domain.

- New archive.

- Whois data hidden.

Frequently Asked Questions About TradeXMastery Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

TradeXMastery is a proprietary trading firm that claims to offer funded accounts, high profit splits, and rapid scaling. But is it as good as it sounds?

While TradeXMastery promises lucrative returns, our review uncovers potential risks and hidden truths about its ownership and compensation structure.

TradeXMastery offers profit splits and scaling opportunities, but the structure may rely heavily on recruitment, raising concerns about sustainability.

Risks include unverified promises of rapid scaling, lack of transparency, and potential red flags resembling high-risk, unregulated platforms.

Investors should approach TradeXMastery with caution. Our review urges thorough research and consideration of safer, regulated alternatives.

Other Infromation:

Website: tradexmastery.com

Reviews:

There are no reviews yet. Be the first one to write one.