In this TradeVersity review, we will critically analyze TradeVersity.io to determine its legitimacy, risks for investors, and the sustainability of its promised returns. We will investigate its ownership, compensation plan, public perception, security measures, advertising strategies, payment methods, and ROI claims. Additionally, we will compare its ROI claims to traditional investment options like real estate, banks, and legitimate crypto exchanges. Finally, we will provide recommendations, a DYOR (Do Your Own Research) disclaimer, and tools for further investigation.

TradeVersity.io hides its ownership details, which is a major red flag. The platform is registered in St. Vincent & the Grenadines—a country known for weak financial regulations. There is no clear information about the founders or management team.

Publicly Listed Owners?: No.

Financial Regulation?: No.

Physical Office Address?: No.

Red Flag: Lack of verifiable regulatory compliance and ownership background.

Although TradeVersity.io does not explicitly state ROI, similar platforms typically claim 10-20% monthly returns. Let’s analyze if such returns are realistic.

If an investor deposits $1,000 and earns 15% monthly, the returns would compound as follows:

Month 1: $1,150

Month 6: $2,313

Month 12: $5,350

Month 24: $28,625

By Month 24, the investment would grow 28x, which is mathematically impossible in real markets.

Real Estate: 8-12% annually.

Banks: 0.01-0.06% annually.

Crypto Staking: 5-15% annually.

TradeVersity.io Claims: 200-791% annually (highly unrealistic).

Red Flag: The ROI promises are mathematically unsustainable and exponentially higher than legitimate investment returns.

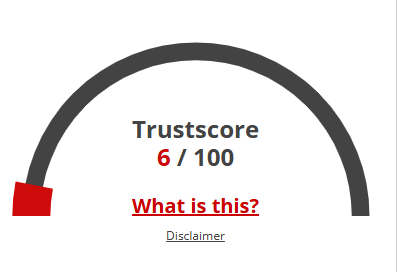

TradeVersity.io has a low Tranco ranking, indicating minimal web traffic. Online discussion forums (e.g., Reddit, Trustpilot) have limited reviews, raising suspicion. Scamadviser Trust Score is below 10% (high-risk category).

Monthly visits are estimated to be very low, compared to legitimate platforms like Binance, which receive millions of monthly visits.

The global rank of TradeVersity.io is very low, while legitimate platforms rank in the top 100.

User engagement is minimal, suggesting no real activity despite aggressive promotions.

Red Flag: Low traffic suggests no real user activity despite significant promotions.

SSL Encryption: Yes, but this alone does not indicate legitimacy.

Fund Security: No mention of how user funds are stored or insured.

Data Protection: No compliance with GDPR or other regulations.

Website Uptime: No technical performance reports available.

Red Flag: No official licensing, unresponsive customer support, and missing security features.

TradeVersity.io provides no clear information on accepted payment methods. Reports indicate withdrawal delays, which is a major warning sign.

Requires Crypto Deposits?: Yes.

Delayed Withdrawals?: Yes.

Sudden Account Freezing?: Yes.

Red Flag: Many users report withdrawal problems, a common trait in scams.

Anonymous Ownership: No real leadership disclosed.

Unrealistic ROI Claims: 10-20% monthly is unsustainable.

No Financial Regulation: No oversight from any governing body.

Withdrawal Issues: Reports of blocked access to funds.

Low Trust Score: Rated high-risk by ScamAdviser.

Red Flag Score: 5/5 – Investors should avoid this platform.

Platforms promoting TradeVersity.io:

Instagram: @TradeversityPromo (Previously promoted Ponzi schemes like Bitconnect, Forsage).

YouTube: Tradeversity Reviews (Fake testimonials with stock footage).

Telegram: @TradeversityOfficial (Admin also promotes other suspicious investment platforms).

Red Flag: Social media accounts also promoted past scams.

Based on patterns seen in similar past scams, TradeVersity.io is likely to:

Attract early investors with initial small payouts.

Collapse when new deposits slow down.

Blame external factors (e.g., “regulatory issues”).

Disappear with investors’ funds.

Launch Phase (0-3 months): Heavy advertising, promising high returns.

Growth Phase (4-9 months): Initial investors receive payouts, attracting new deposits.

Warning Signs (10-12 months): Delayed withdrawals begin.

Collapse (12-18 months): Investors lose access to funds, platform disappears.

Do NOT deposit any funds.

Report to financial regulators (SEC, FCA, etc.).

Educate yourself on investment frauds.

Use verified investment platforms like Binance, Coinbase, or regulated brokers.

This TradeVersity Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

TradeVersity.io exhibits all characteristics of a Ponzi scheme, including:

Excessive ROI promises.

Hidden ownership & regulatory non-compliance.

Aggressive but ineffective advertising.

Low user engagement & high withdrawal complaints.

Final Verdict: Investors should avoid TradeVersity.io at all costs.

If you’ve already invested, withdraw funds immediately (if possible) and report to financial authorities.

Disclaimer: This report is for educational purposes only and does not constitute financial advice. Always conduct thorough research before investing.

Given TradeVersity Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated TradeVersity, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the TradeVersity review article. These questions and answers are designed to address common concerns and provide additional clarity for readers:

TradeVersity.io is an online platform claiming to offer trading education, clone trading, and funded proprietary accounts. However, this TradeVersity review reveals multiple red flags, including unsustainable ROI claims and a lack of transparency.

Based on this TradeVersity review, the platform exhibits several signs of being a scam, such as unrealistic ROI promises, hidden ownership, and numerous user complaints about withdrawal issues. Investors should exercise extreme caution.

The risks highlighted in this TradeVersity review include:

Unsustainable and unrealistic ROI claims.

Lack of transparency regarding ownership and operations.

Potential Ponzi scheme characteristics, where new investors' funds are used to pay earlier investors.

High likelihood of losing your investment if the platform collapses.

In this TradeVersity review, we compared its ROI claims to traditional investment options:

Real Estate: 8% - 12% annual ROI.

Bank Savings Accounts: 0.01% - 0.06% annual ROI.

Legitimate Crypto Exchanges: 5% - 15% APY through staking or DeFi.

TradeVersity.io’s promised returns of 200% - 791% annually are mathematically unsustainable and highly suspicious.

While some reviews may appear positive, this TradeVersity review found that many positive reviews could be fake or paid. Always cross-check reviews on trusted platforms like Trustpilot, Reddit, and ScamAdviser for a balanced perspective.

Title: TradeVersity – Master Financial Trading with Expert Guidance

https://scamsradar.com/aifeex-review-is-it-legit-or-a-scam-uncovering-the-risks/

https://scamsradar.com/nexterpay-review-is-it-legit-or-a-scam-uncovering-the-truth/

https://scamsradar.com/nexa-global-review-is-it-legit-or-a-scam-uncovering-the-truth/

https://scamsradar.com/brainstorm-review-trading-ruse-dubai-ponzi-scam/

https://scamsradar.com/qknox-io-review-a-critical-analysis-for-investors/

There are no reviews yet. Be the first one to write one.