In this Aifeex review, we will critically analyze Aifeex.com to determine its legitimacy, risks for investors, and the sustainability of its promised returns. We will investigate its ownership, compensation plan, public perception, security measures, advertising strategies, payment methods, and ROI claims. Additionally, we will compare its ROI claims to traditional investment options like real estate, banks, and legitimate crypto exchanges. Finally, we will provide recommendations, a DYOR (Do Your Own Research) disclaimer, and tools for further investigation.

Aifeex.com has been linked to Sean Tillery, who was previously associated with Trage Technologies Limited, a company that collapsed amid Ponzi scheme allegations. The website lists a CEO, COO, and CTO, but no verifiable information is available about their backgrounds in legitimate financial markets.

The domain was registered on October 9, 2024.

Ownership details are protected via privacy services.

The platform has a history of fraudulent links, including connections to failed investment schemes.

Red Flag: Lack of verifiable regulatory compliance and ownership background.

Aifeex.com advertises daily returns of 1-5%, leading to 365% to 1,825% annual returns—far beyond sustainable levels.

For example, a 1,000 investment with a 21,000 investment with a 21,600 in 30 days and a staggering 1,377,790 in3 65 days .Similarly, a1, 377,790 in 365 days. Similarly ,a 5,000 investment would grow to 8,000 in 30 days and 8,000 in 30 days and 6,888,950 in 365 days.

Reality Check: No legitimate financial institution offers such exponential growth.

Aifeex.com Claims: 365% – 1,825% annual ROI.

Real Estate: Typically offers 8% – 12% annually.

Bank Savings Accounts: Provide 0.5% – 2% annually.

Crypto Staking (e.g., Binance): Offers 5% – 10% APY.

Red Flag: The ROI promises are mathematically unsustainable and exponentially higher than legitimate investment returns.

Aifeex.com uses aggressive advertising, including airport billboards in Kuala Lumpur and Bangkok, to lure unsuspecting investors.

High-visibility ads in international airports.

Social media promotions through low-follower accounts.

Influencer marketing targeting developing countries.

Twitter: @AifeexOfficial

Facebook: Aifeex Investment

Instagram: @aifeex_invest

YouTube Ads: Paid promotions targeting beginner investors

Red Flag: Social media accounts also promoted past scams like BitConnect and Forsage.

Despite heavy advertising, Aifeex.com receives minimal website traffic—a strong indicator of a lack of genuine user engagement.

Monthly visits are estimated to be less than 100, compared to legitimate platforms like Binance, which receive over 30 million monthly visits.

The global rank of Aifeex.com is very low, while legitimate platforms rank in the top 100.

User engagement is minimal, suggesting no real activity despite significant promotions.

Red Flag: Low traffic suggests no real user activity despite aggressive advertising.

While Aifeex.com uses an SSL certificate, it lacks a regulatory license, which is a major red flag.

Customer support is unresponsive, unlike legitimate platforms that offer 24/7 support.

There is no app availability on Google Play or the App Store, further reducing its credibility.

Red Flag: No official licensing, unresponsive customer support, and missing security features.

Aifeex only accepts cryptocurrencies and wire transfers—both irreversible payment methods.

Many users report delayed payments.

Some are asked for additional “processing fees.”

Customer support is unresponsive to withdrawal requests.

Red Flag: Many users report withdrawal problems, a common trait in scams.

Based on patterns seen in similar past scams, Aifeex.com is likely to:

Attract early investors with initial small payouts.

Collapse when new deposits slow down.

Blame external factors (e.g., “regulatory issues”).

Disappear with investors’ funds.

Launch Phase (0-3 months): Heavy advertising, promising high returns.

Growth Phase (4-9 months): Initial investors receive payouts, attracting new deposits.

Warning Signs (10-12 months): Delayed withdrawals begin.

Collapse (12-18 months): Investors lose access to funds, platform disappears.

Unrealistic ROI (365% – 1,825%): Higher than any legitimate investment.

Linked to past scams: Sean Tillery was involved in failed Ponzi schemes.

Fake AI claims: No technical proof of AI-driven trading.

Hidden ownership details: No verifiable regulatory license.

Withdrawal issues reported: Many investors unable to cash out.

Low website traffic: Despite aggressive promotions.

Uses irreversible payment methods: Crypto and wire transfers only.

Suspicious social media marketing: Same influencers promoted past scams.

Unrealistic ROI (365% – 1,825%): Higher than any legitimate investment.

Linked to past scams: Sean Tillery was involved in failed Ponzi schemes.

Fake AI claims: No technical proof of AI-driven trading.

Hidden ownership details: No verifiable regulatory license.

Withdrawal issues reported: Many investors unable to cash out.

Low website traffic: Despite aggressive promotions.

Uses irreversible payment methods: Crypto and wire transfers only.

Suspicious social media marketing: Same influencers promoted past scams.

Do NOT deposit any funds.

Report to financial regulators (SEC, FCA, etc.).

Educate yourself on investment frauds.

Use verified investment platforms like Binance, Coinbase, or regulated brokers.

This Aifeex Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

Aifeex.com exhibits all characteristics of a Ponzi scheme, including:

Excessive ROI promises.

Hidden ownership & regulatory non-compliance.

Aggressive but ineffective advertising.

Low user engagement & high withdrawal complaints.

Final Verdict: Investors should avoid Aifeex.com at all costs.

If you’ve already invested, withdraw funds immediately (if possible) and report to financial authorities.

Disclaimer: This report is for educational purposes only and does not constitute financial advice. Always conduct thorough research before investing.

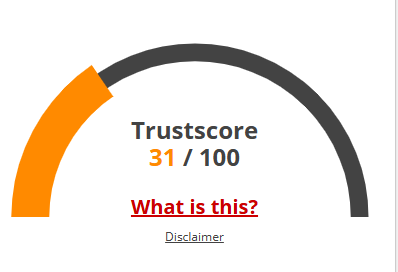

Given Aifeex Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Aifeex, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the Aifeex review article. These questions and answers are designed to address common concerns and provide additional clarity for readers:

Aifeex.com is an online platform claiming to offer high returns on investments through AI-driven trading. However, this Aifeex review reveals multiple red flags, including unsustainable ROI claims and a lack of transparency.

Based on this Aifeex review, the platform exhibits several signs of being a scam, such as unrealistic ROI promises, hidden ownership, and numerous user complaints about withdrawal issues. Investors should exercise extreme caution.

The risks highlighted in this Aifeex review include:

Unsustainable and unrealistic ROI claims.

Lack of transparency regarding ownership and operations.

Potential Ponzi scheme characteristics, where new investors' funds are used to pay earlier investors.

High likelihood of losing your investment if the platform collapses.

In this Aifeex review, we compared its ROI claims to traditional investment options:

Real Estate: 8% - 12% annual ROI.

Bank Savings Accounts: 0.5% - 2% annual ROI.

Legitimate Crypto Exchanges: 5% - 10% APY through staking or DeFi.

Aifeex.com’s promised returns of 365% - 1,825% annually are mathematically unsustainable and highly suspicious.

While some reviews may appear positive, this Aifeex review found that many positive reviews could be fake or paid. Always cross-check reviews on trusted platforms like Trustpilot, Reddit, and ScamAdviser for a balanced perspective.

Title: Aifeex

https://scamsradar.com/nexterpay-review-is-it-legit-or-a-scam-uncovering-the-truth/

https://scamsradar.com/nexa-global-review-is-it-legit-or-a-scam-uncovering-the-truth/

https://scamsradar.com/brainstorm-review-trading-ruse-dubai-ponzi-scam/

https://scamsradar.com/qknox-io-review-a-critical-analysis-for-investors/

https://scamsradar.com/pandabit-io-review-scam-or-legit-key-risks-revealed/

100% scam project

Boa tarde!! Alguns cálculos do seu review não batem!!O máximo que a AIFEEX da de lucro para o seu investimento é 1% ao dia. Fazendo uma conta básica aqui – 30% ao mês ×12 meses= 360% ao ano e não 1800% ao ano como vocês falaram. A AIFEEX não paga de 1 a 5% e sim e apenas 1% do seu investimento ao Dia! Tem mais…a AIFEEX está na Bolsa da NASDAQ!! É apenas a maior bolsa de valores do Mundo!! A rigidez burocrática pra entrar na NASDAQ é enorme!!Se é golpe, como conseguiram??

Good morning, I’m getting in touch, I even got on WhatsApp and I’ve been waiting for hours and you haven’t responded. How does this qualify? And let’s go, I made an investment in Aifeex, and I believe that without making the investment you wouldn’t know how to talk about the analysis of the company. The investment has a much lower %, but the one with the longest time has 21% per month and 252% per year and not as it is up there that you put, that is, there is no way for you to say whether or not it is a fake company or a pyramid scheme or fraud. Be realistic and post only with knowledge. Of course, I need information about this company, but you say that it is this exorbitant gain of 365% – 1,825%, that is not right.