Token Box Review: Is It a Safe Investment Choice?

This Token Box review examines the platform’s legitimacy, risks, and features. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Token Box, accessible at tokentime.fund, promises digital asset rewards, but concerns about ownership, compensation, and ROI raise questions. Read on to explore whether tokentime.fund is safe, covering features, security, compensation, and more.

Table of Contents

What Is Token Box?

Token Box, hosted at a recently registered domain, markets itself as a shared fund dividend platform. It claims users can earn free digital assets through daily tasks and hold platform tokens (TTT) for dividends. The platform emphasizes team-building and invite codes, raising questions about its sustainability and legitimacy.

Ownership and Transparency Concerns

The platform lacks clear ownership information. WHOIS data shows the domain, registered in February 2025, uses privacy protection to hide owner identities. No team members, executives, or corporate entities are listed. Legitimate platforms, like Ethereum or Aave, disclose founders and company details to build trust.

- Red Flags: Anonymous ownership, no registered address, no regulatory licenses.

- Comparison: Established platforms like Binance provide verifiable team credentials and regulatory compliance.

No Team Background

No LinkedIn profiles or professional records link to Token Box. Unlike projects with public developers, such as Cardano’s Charles Hoskinson, this platform offers no insight into its leadership. This anonymity increases risks for users seeking digital asset management solutions.

Compensation Plan Breakdown

Token Box operates a multi-level marketing (MLM) model, focusing on recruitment:

- Level 1: 10% commission on 5 referrals ($50 monthly payout).

- Level 2: 5% on 25 referrals ($125 monthly).

- Level 3: 3% on 125 referrals ($375 monthly).

- Level 4: 2% on 625 referrals ($1,250 monthly).

- Level 5: 1% on 3,125 referrals ($3,125 monthly).

- Total: 3,905 referrals needed for $4,925 monthly payout.

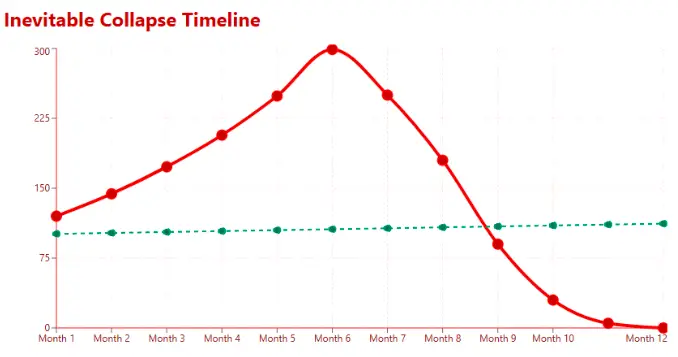

This structure requires exponential growth, needing 15,625 users by month six to sustain payouts, resembling a pyramid scheme.

Sustainability Analysis

Promised returns, such as 400% annually (per social media claims), are unsustainable:

- Formula: For 400% APY, $1 grows to $5 in 12 months, requiring a monthly rate of ~14.35% (( (1 + r)^{12} = 5 )).

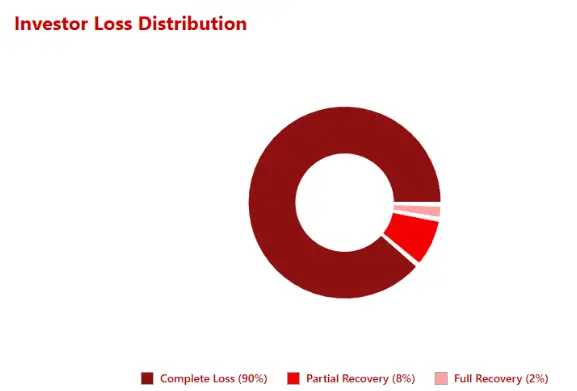

- Scale Issue: For 100,000 users investing $100 each ($10M total), the platform owes $50M annually, needing $40M in external profits or new user funds—a classic Ponzi dynamic.

Investment Type | Claimed APY | Sustainable APY | Difference |

Token Box | 120-400% | 5-15% | 1,100%+ |

Real Estate (REITs) | N/A | 7-12% | N/A |

Bank Savings | N/A | 1-5% | N/A |

Crypto Staking | N/A | 3-15% | N/A |

Security and Technical Performance

The platform uses HTTPS but lacks advanced security:

- No multi-factor authentication.

- No smart contract audits by firms like CertiK.

- No clear fund custody details or insurance.

Technical Limitations

The site is a thin landing page with an app-focused registration funnel. A GitHub prototype mentions OpenZeppelin ERC20 contracts, but no live smart contract is linked. This suggests an untested platform, risky for crypto token management.

- Red Flags: No audits, no bug bounties, vague privacy policies.

Public Perception and Promotion

Token Box relies on social media for promotion:

- X: @Cathi1028272 claims “400%/year dividends” (posted August 2025).

- Instagram: Reels push TTT airdrops and withdrawals.

- Facebook: Groups like “Earn Free Airdrop Crypto” promote mining and OKX withdrawals.

- YouTube: Guides by low-subscriber channels like Mr Habby.

- TikTok: Clips highlight TTT withdrawals.

These accounts, often created in 2025, also promote defunct platforms like CryptoFuture, suggesting coordinated, untrustworthy marketing.

Community Engagement

No organic discussions exist on Reddit or Bitcointalk. High bounce rates (70%) and short visit durations (1-2 minutes) indicate users quickly spot issues. This contrasts with platforms like MakerDAO, which have active communities.

Payment Methods and Support

The platform mentions USDC transactions and “no recharge” mining but lacks details on wallets or fiat integration. Claims of OKX withdrawals are unverified, as no TTT token is listed on OKX.

Limited Support

No live chat, ticketing system, or email support exists. Users rely on social media promoters, a risky setup for in-app token rewards or TTT withdrawal issues.

ROI Claims and Reality Check

Promised returns (120-400% APY) dwarf legitimate benchmarks:

- Real Estate: 7-12% (REIT dividends).

- Bank Savings: 1-5% (FDIC-insured).

- Crypto Staking: 3-15% (e.g., Binance USDC staking).

Caption: Token Box’s 150% APY would turn $1,000 into $113,900 in 5 years, compared to $1,400-$1,800 for banks or staking.

Ticker Confusion

The TTT ticker overlaps with unrelated tokens (e.g., TabTrader, Titan Token), risking misrepresentation. No verified contract address ties Token Box’s TTT to exchanges.

Red Flags Summary

- Anonymous ownership and no regulatory compliance.

- Unsustainable 120-400% APY claims.

- MLM-style recruitment focus.

- No smart contract audits or security measures.

- Limited community engagement and high bounce rates.

- Unverified withdrawal claims and ticker confusion.

DYOR Tools and Verification

Use these tools to investigate:

- WHOIS Lookup: Check domain ownership.

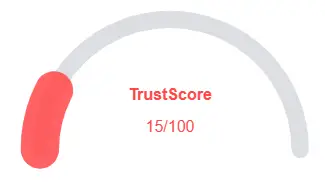

- Scamadviser: Assess trust scores.

- Etherscan: Verify smart contracts.

- SimilarWeb: Analyze traffic patterns.

No Token Box listings appear on CoinGecko, CoinMarketCap, or DappRadar, signaling low credibility.

Recommendations for Investors

- Avoid Investment: Do not deposit funds until ownership, audits, and revenue sources are verified.

- Use Trusted Platforms: Opt for regulated exchanges like Coinbase (3-15% APY) or REITs (7-12%).

- Secure Assets: Use hardware wallets and 2FA for digital asset utility apps.

- Report Issues: Contact cybercrime units if funds are at risk.

Future Outlook

- Short-Term (3-6 Months): Token Box may attract users with early payouts but struggle with withdrawals.

- Long-Term (12+ Months): Without transparency, it risks collapse or legal scrutiny.

- Market Trends: Regulated platforms will dominate as crypto oversight grows in 2025.

Token Box Review Conclusion

This Token Box review reveals significant risks, from anonymous ownership to unsustainable returns. Its MLM model, lack of audits, and vague payment methods make it a high-risk choice. Investors should prioritize regulated alternatives like bank savings, REITs, or established crypto platforms for secure digital asset tracking. Always verify claims with DYOR tools and consult financial advisors before investing. For more insights, you can also check our detailed Cvcapitals Review.

Disclaimer: This review is for informational purposes only, not financial advice. Conduct your own research using tools like Etherscan and Scamadviser. Investments carry risks, and you should never invest more than you can afford to lose.

Token Box Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Token Box currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Token Box similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New archive

- Hidden Whois data

- Domain not in top 1M Tranco list

Frequently Asked Questions About Token Box Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Token Box raises concerns due to limited transparency, hidden ownership, and unverified claims about digital asset rewards.

Token Box claims to offer rewards through digital asset programs, staking, and platform activities, but no verifiable evidence supports these claims.

No. Token Box is not registered with any recognized financial or regulatory authority, increasing risk for investors.

Risks include potential financial loss, unverified ROI claims, lack of investor protection, and hidden ownership structures.

It is not recommended. The platform’s lack of transparency, regulation, and credible evidence makes it a risky investment.

Other Infromation:

Website: tokentime.fund

Reviews:

There are no reviews yet. Be the first one to write one.