Titan Token, promoted through TitansToken.io, promises high returns in the volatile world of cryptocurrency. This Titan Token review investigates the legitimacy, focusing on ownership, compensation plan, traffic trends, public perception, security, payment methods, customer support, technical performance, and ROI claims. By analyzing these factors, Scams Radar aim to provide a clear, data-driven assessment for potential investors. Our goal is to help you make informed decisions about Titan Token and avoid potential risks.

Titan Token markets itself as a platform offering significant returns through a cryptocurrency token, likely on the Binance Smart Chain. It may involve staking or trading mechanisms, similar to platforms like Titano Finance. However, the lack of clear information raises concerns about its legitimacy. This review combines insights from multiple sources to evaluate Titan Token’s credibility and risks.

The ownership of titantoken.io is unclear. No verifiable information about the founders, team, or company registration is available on TitansToken.io. Legitimate platforms, such as Token.io, disclose team credentials and regulatory compliance (e.g., UK’s FCA or Germany’s BaFin). A WHOIS lookup (via ICANN) may reveal the domain’s age or registrar, but privacy protection (e.g., WhoisGuard) hides ownership details, a common tactic in scams. Anonymous teams increase the risk of exit scams, as seen in past cases like Bitconnect.

Red Flags:

Investors should verify ownership through platforms like LinkedIn or SEC’s EDGAR database. Lack of transparency is a major concern for Titan Token’s credibility.

The compensation plan of TitanToken is not explicitly detailed, but similar platforms promise high returns through auto-staking or referral systems. For example, Titano Finance claims a 102,483.58% APY (1.917% daily). If Titan Token offers a similar 1.89% daily ROI, let’s calculate its sustainability:

Formula: ( A = P \times (1 + r)^n )

A $1,000 investment would theoretically grow to ~$999,830 in a year, a 99,983% return. Such returns are unsustainable without exponential token value growth or constant new investments, resembling a Ponzi scheme.

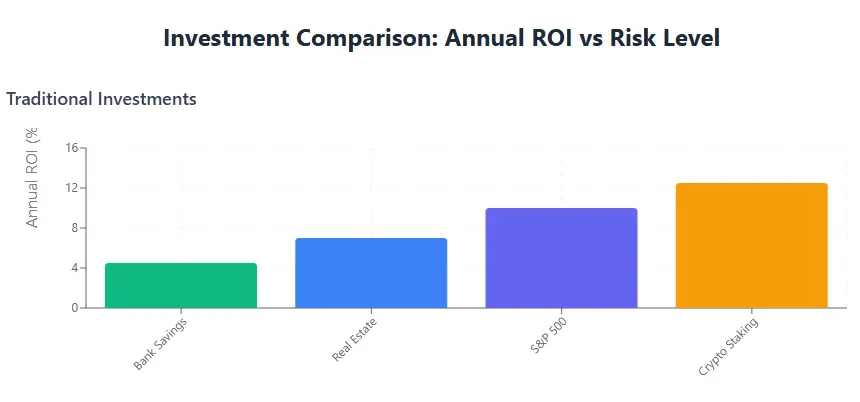

Investment Type | Annual ROI | Risk Level |

Bank Savings | 4-5% | Very Low |

Real Estate | 6-8% | Moderate |

S&P 500 | 8-12% | Moderate |

Crypto Staking | 5-20% | High |

Titan Token | 100,000%? | Extremely High |

Red Flag: Promises of triple-digit monthly returns (e.g., 10% daily) are mathematically impossible without a Ponzi-like structure.

No traffic data is available for TitansToken (e.g., via SimilarWeb). Low traffic (<10,000 visits/month) or high bounce rates (>70%) suggest poor engagement. A related “Titan Token” from 2021 suffered a rug pull, with its price crashing due to manipulative mechanics (Reddit, TronWeekly). Titan Token has no significant Reddit or X buzz, unlike legitimate projects with active communities.

Red Flags:

Investors should check CoinMarketCap or DEXTools for Titan Token’s market cap and trading activity. Low liquidity indicates potential insider dumps.

TitansToken.io’s security measures are unknown. Legitimate platforms use HTTPS, 2FA, and audited smart contracts (e.g., Certik). No SSL certificate or audit reports are disclosed, increasing risks of hacks or token dilution. Technical performance, like website uptime or transaction speed, cannot be verified without access.

Red Flags:

Use tools like SSL Labs or VirusTotal to check security. Unverified contracts may allow unlimited minting, a common scam tactic.

Payment methods are unclear, but similar platforms require crypto-only payments (e.g., BNB via PancakeSwap). This lack of fiat options or KYC/AML processes raises concerns. Customer support details are absent, unlike legitimate platforms offering 24/7 channels (e.g., Token.io’s live chat).

Red Flags:

A single X handle, @itshellotitan (joined Feb 2025), promotes Titans Token without disclosing other projects or credentials. No Telegram or Reddit activity was found. Promoters linked to past scams (e.g., Forsage) are a red flag.

Investigation Tip: Use HypeAuditor to verify promoter authenticity.

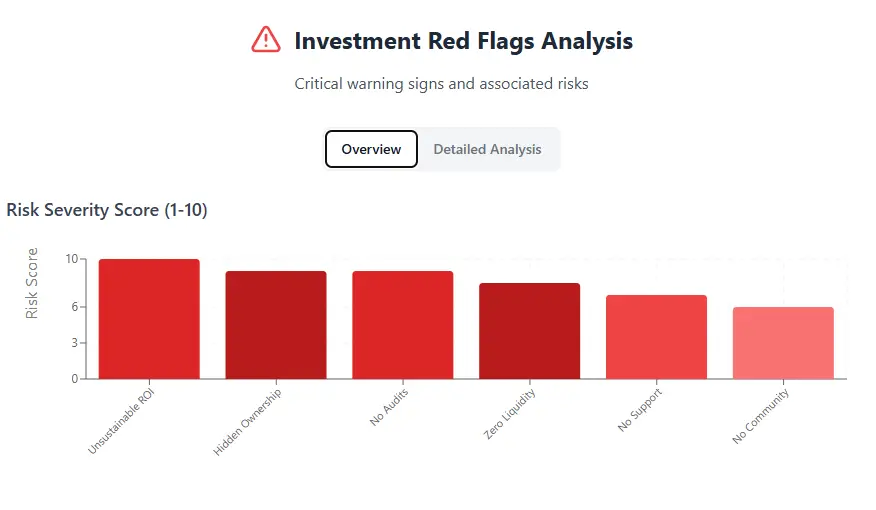

Issue | Risk Description |

Hidden Ownership | No accountability, scam risk |

Unsustainable ROI | Ponzi-like structure |

Zero Liquidity | Insider dumps possible |

No Audits | Financial manipulation risk |

No Support | Poor dispute resolution |

No Community | Lack of trust and adoption |

With increasing regulatory scrutiny in 2025, unverified platforms like Titan Token face high exit risks. Legitimate projects require transparency and audits to survive. Investors should prioritize established assets like Bitcoin or Ethereum.

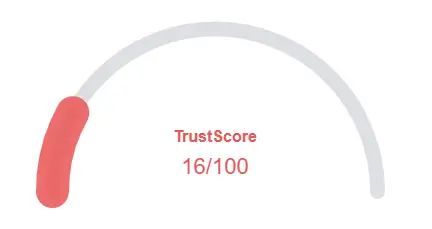

Titan Token, promoted via TitansToken.io, exhibits significant risks due to hidden ownership, unsustainable ROI claims, and lack of transparency. Its low market cap and absence of community engagement suggest a high likelihood of fraud. Investors should steer clear and explore safer alternatives like regulated crypto exchanges or traditional investments. Always verify claims independently using trusted tools.

DYOR Disclaimer: This review is for informational purposes only and not financial advice. Cryptocurrency investments carry high risks. Conduct thorough research and consult professionals before investing.

These commonly asked questions address the issue of how to confirm the accuracy of the Titan Token crypto Network’s findings. We have provided the following questions and answers to help allay any worries you might have:

Titan Token refers to different tokens such as TTT (Titan Finance) and TNT (Titan Token on BNB Chain), each serving as utility tokens within their respective decentralized finance (DeFi) ecosystems, including trading, staking, and payments.

Titan Tokens can be bought on decentralized exchanges like PancakeSwap for TNT and centralized exchanges like LBank for TITAN token variants.

Titan Token TTT is a BEP20 token on Binance Smart Chain, while TNT is also on BNB Chain. TITAN token aims to digitize gold and operates on a blockchain ecosystem supporting staking and lending.

Titan Token (TNT) price is approximately $0.00343 with a market cap around $343,000 as of June 2025, showing recent price increases and active trading volume on PancakeSwap.

You can add Titan Token by importing its contract address (e.g., TNT contract: 0x6338daf47ea4cf4f0901d16853eaa8e64b499c30) into MetaMask manually or via CoinGecko’s one-click add feature

Title: Titan Token

There are no reviews yet. Be the first one to write one.