Tether DeFAI Review: Legitimate Opportunity or High-Risk Trap?

In this Tether DeFAI review, Scams Radar examines tetherdefai.io as of December 15, 2025. Many seek stable returns in crypto. Yet questions arise about the risks posed by the Tether DeFAI scam. This platform promises daily profits through USDT deposits. We cover ownership, compensation plan, ROI claims, and more. Our goal is to help you make an informed decision.

Table of Contents

Part 1: Ownership and Team Background in Tether DeFAI Review

Ownership lacks clarity. The site shows no founder names or bios. The leadership section stays blank. No company registration or address appears. Only a Telegram contact, @KithDefa, I linked to “Kith Lee,” exists. This handle offers support but no verified background.

Public searches find no criminal ties to “Kith Lee.” Yet, anonymity raises concerns. Legitimate DeFi projects share team details for trust. Here, hidden operators suggest pyramid signs. Tether DeFAI anonymous operators fit common fraud tactics.

Promoters use WhatsApp numbers like +91 7609937827 and +91 7363851754. These links to videos pushing Tether DeFAI MLM commissions recruitment model. Same numbers promoted Loom-X and AKAS DAO. This recycling hints at serial schemes.

Part 2: Detailed Compensation Plan Breakdown

Tether DeFAI uses a unilevel MLM structure. It focuses on recruitment for rewards. Deposits start at 1 USDT on Binance Smart Chain.

Core features include:

- Daily Profits: Over 25 days. Base 4% capital daily. ROI adds 1% to 2% by tier.

Deposit Range (USDT) | Total Daily Return | 25-Day Total Return |

Under 500 | 5% | 125% |

500-999 | 5.25% | 131.25% |

1,000-2,499 | 5.5% | 137.5% |

2,500-4,999 | 5.75% | 143.75% |

5,000+ | 6% | 150% |

- Referral System: 20 levels. Up to 14.5% commissions. Level 1: 1.5%. Drops to 0.25% at level 20. Unlock needs qualified recruits with 100 USDT active.

- Bonuses: Onboarding gives 5-10 USDT to sponsors. Leadership up to 5% based on ranks like Crown Star. Needs team size up to 2,500 members.

Smart contract codes these rules. It takes 5% admin fee upfront. Tether DeFAI referral rewards push network growth. But this MLM focus often signals unsustainable models.

2.1 ROI Claims and Why They Fail Mathematically

Tether DeFAI 6% ROI draws investors. Site claims “guaranteed” yields from strategies. Yet, the contract shows no trading or farming logic. It just distributes funds.

Consider a 100 USDT deposit at 5% daily:

- Admin fee: 5 USDT out.

- Referrals: Up to 14.5 USDT to uplines.

- Left in pool: About 80.5 USDT.

- Owed over 25 days: 125 USDT.

Shortfall: 44.5 USDT per deposit. For Tether DeFAI 6% daily returns, the gap widens to 69.5 USDT.

Without new money, the system collapses. This matches the Tether DeFAI Ponzi blueprint. Liabilities grow faster than the pool.

2.3 Comparisons to Real Investments

Investment Type | Annual Yield | Risk Level | Guarantee |

Bank Savings | 1-5% | Low | Yes |

Real Estate | 5-10% | Medium | No |

Crypto Staking | 4-20% | High | No |

Tether DeFAI | 1,825-2,190% | Extreme | Claimed |

Part 3: Public Perception and Promoter Insights

Searches show niche hype. YouTube videos push it with WhatsApp contacts. No broad trust. ScamAdviser flags high caution. No Reddit or Trustpilot reviews.

Promoters recycle audiences. Risks Tether DeFAI onboarding rewards fraud tactics grow evident.

3.1 Security Measures and Technical Performance

Site loads fast. Integrates wallets. But no audit proof. Contract recently with 37 transactions. Low volume hints beta phase.

Red Flags and Risks in Tether DeFAI DeFi Setup

Several warnings stand out:

- No revenue proof. The contract lacks profit tools.

- Audit claims unverified. BSCScan shows none.

- Low traffic. The site draws few visitors.

- Tether DeFAI wallet connect deposit trap warnings from patterns.

- Public view: Sparse. YouTube promos tied to dubious networks.

- Security: Basic SSL. No multi-sig or timelocks.

- Payments: USDT only. No fiat exit.

- Support: Telegram alone. No formal help.

Tether DeFAI fake smart contracts with no reserves fit this. User complaints: Tether DeFAI payout blocks may rise soon.

Future Predictions and Recommendations

Patterns suggest a short life. Early payouts from new funds. Then delays, collapse.

Avoid Tether DeFAI USDT deposits. Choose regulated options. Recovering USDT from tetherdefai.io scam may prove hard.

In conclusion, this Tether DeFAI review highlights major risks. Math and structure point to failure. Do thorough checks before any move.

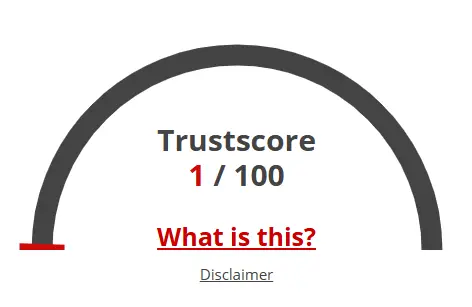

Tether DeFAI Review Trust Score

A website’s trust score is an important indicator of its reliability. Tether DeFAI currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Tether DeFAI or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Tether DeFAI Review

This section answers key questions about Tether DeFAI, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Tether DeFAI claims to offer daily USDT returns via AI DeFi strategies but provides no verifiable revenue source.

Available data shows high-risk Ponzi indicators due to anonymity, MLM payouts, and unrealistic ROI.

Returns appear funded by new user deposits rather than real trading or DeFi activity.

No. Daily returns of 4–6% are mathematically unsustainable in legitimate DeFi markets.

Unlike an Everstead Review, this Tether DeFAI Review highlights anonymous operators and unsustainable returns.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.