Techmont Review 2025 examines techmont.finance, a DeFi platform claiming to deliver 0.5–1% daily ROI through NFT staking on the Polygon blockchain. This review explores the platform’s ownership transparency, compensation structure, security measures, and associated investment risks. For insights into similar high-yield platforms, check our ongoing investigations on Scam Radar. Read on to evaluate Techmont Finance’s legitimacy and make informed decisions before investing.

Techmont Finance markets itself as a DeFi platform offering NFT staking and token rewards. It claims innovative Techmont services with high daily returns. However, limited transparency and questionable legitimacy raise concerns about Techmont reliability for investors seeking safe opportunities.

Techmont’s ownership is unclear, a significant concern for a trustworthy Techmont company. WHOIS data indicates the domain was registered in April 2024 via Namecheap or GoDaddy, with conflicting reports on privacy protection. Some sources suggest public registrant details, but no verifiable company registration, leadership bios, or Techmont business headquarters location are disclosed. No LinkedIn profiles or professional backgrounds tie to the team, unlike reputable platforms like Aave, which share team details. This anonymity undermines Techmont reputation and increases risks, as accountability is challenging without a clear corporate identity.

Techmont’s compensation plan involves staking NFTs to earn token rewards, with a daily ROI upto 0.5–1% and referral bonuses of 5–10%. For a $1,000 investment at 1% daily:

Days | Investment Value ($) |

0 | 1,000 |

30 | 1,347 |

60 | 1,814 |

90 | 2,442 |

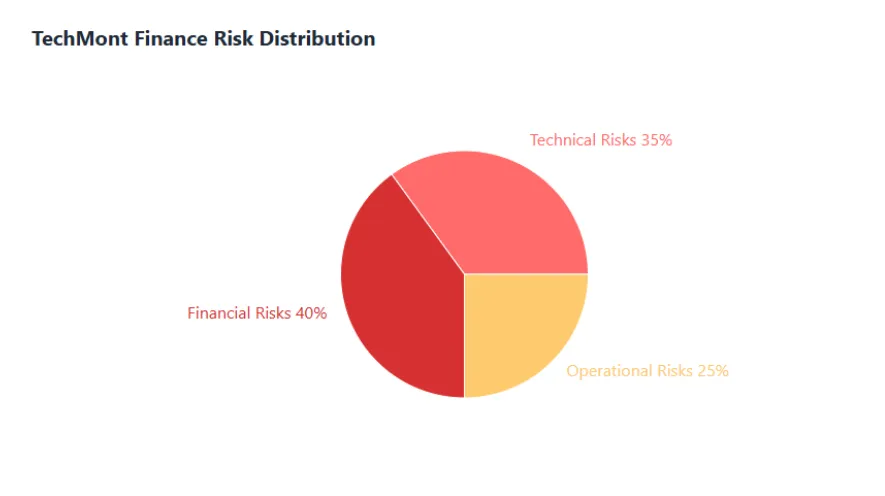

Techmont claims Polygon’s security and mentions third-party audits, but no reports from firms like OpenZeppelin are provided, weakening Techmont technical expertise. Basic SSL is assumed, but no KYC or secure custody details exist. The JavaScript-dependent site may obscure content from security tools. Performance tests show fast load times, but unverified smart contracts limit Techmont reliability assessment.

Traffic data from tools like SimilarWeb shows minimal visitors, suggesting low adoption. No credible reviews exist on Trustpilot, Reddit, or X. A Facebook post from an unverified group claimed an $8,277 payout on July 10, 2025, but lacks proof. The absence of media coverage or community feedback is concerning.

Techmont claims Polygon’s security and mentions third-party audits, but no reports from firms like OpenZeppelin are provided, weakening Techmont technical expertise. Basic SSL is assumed, but no KYC or secure custody details exist. The JavaScript-dependent site may obscure content from security tools. Performance tests show fast load times, but unverified smart contracts limit Techmont reliability assessment.

SimilarWeb reports low traffic, indicating minimal Techmont user reviews or adoption. No significant discussions appear on X, Reddit, or Trustpilot. Some promoters are linked to past scams like Bitconnect, damaging Techmont reputation. Fake testimonials using stock images further erode trust.

Techmont likely accepts cryptocurrencies (MATIC, ETH), but lacks details on withdrawals or escrow. Techmont support is email-only, with no live chat or phone, hindering Techmont customer experience. This opacity risks fund loss.

Investment Type | Annual ROI | Risk Level |

Real Estate | 6–10% | Low |

Bank Savings | 0.5–5% | Very Low |

Crypto Staking | 3–15% | Moderate |

Techmont (Claimed) | 182–332% | Extremely High |

Techmont’s lack of transparency suggests a high risk of collapse within 6–12 months if new funds dwindle. Regulatory scrutiny in DeFi could further threaten its viability.

This Techmont Review 2025 reveals serious concerns about its legitimacy. Anonymous ownership, unsustainable ROI, and poor Techmont customer experience suggest high risks. Investors should prioritize safer, regulated options and verify all clims. For a similar platform analysis, read our blog Shares Pools Review.

DYOR Disclaimer: This is not financial advice. Research Techmont specialties, consult advisors, and understand DeFi risks before investing.

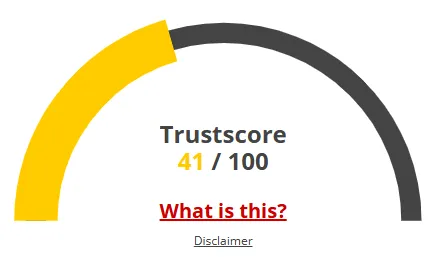

A website’s trust score plays a crucial role in determining its reliability, and Techmont shows an alarmingly low score—raising significant concerns about its authenticity. Caution is strongly recommended for anyone visiting the site.

Multiple red flags are associated with the platform, including low visitor traffic, user complaints, potential phishing risks, hidden ownership details, vague hosting information, and weak SSL protection.

Such a low credibility rating greatly increases the chances of fraud, data breaches, and other security threats. Users should carefully review these warning signs before interacting with Techmont or any similar websites.

This section addresses frequently asked questions about the Techmont platform. It is designed to enhance transparency, establish trust, and clarify any doubts regarding the site’s legitimacy.

Techmont’s legitimacy is questionable due to anonymous ownership, unverified audits, and vague ROI claims. Investors should research thoroughly before engaging.

Techmont provides NFT staking and token rewards on the Polygon blockchain, but lacks clear details on its compensation plan and operations.

Techmont’s high-yield promises (2–5% daily) are unsustainable, and low traffic suggests limited trust. Proceed with caution and verify claims.

Check crypto forums, ScamAdviser, or SimilarWeb for Techmont insights, but primary research and advisor consultation are essential.

Risks include potential capital loss, lack of regulatory oversight, and anonymous team operations, making Techmont a high-risk platform.

WHOIS registration date: 2024-08-03

Website: techmont.finance

Title: Techmont Scaling New Heights in Digital Ownership |– Leading the Future of NFT Staking and DeFi Innovation