Team Builder BTC Review: Legitimacy, Risks, and Insights

Team Builder BTC presents itself as a Bitcoin investment platform promising high returns through a referral-based system. For an in-depth scam analysis, visit Scams Radar for a detailed review. This Team Builder BTC review analyzes its legitimacy, risks, and sustainability, focusing on ownership, compensation plan, and investor concerns. Designed for clarity, this guide uses simple language, charts, and bullet points to help you decide whether teambuilderbtc.com is safe for your investments.

Table of Contents

What is Team Builder BTC?

Team Builder BTC, also known as Auto BTC Builder, is a cryptocurrency platform claiming to offer earnings through Bitcoin investments and team-building. It promotes a multi-level marketing (MLM) model with ad credits and matrix cycling, targeting users seeking passive income. However, its structure raises concerns about sustainability and legitimacy.

Ownership and Transparency

The platform lacks clear ownership details, a major red flag for any Bitcoin investment platform. Here’s what we found:

- Domain Registration: Registered on June 15, 2025, via Namecheap, with WHOIS data hidden by privacy protection.

- No Legal Entity: No company name, physical address, or regulatory licenses (e.g., SEC, FinCEN) are disclosed.

- Anonymous Team: No founder or team bios are available on LinkedIn or the website, unlike reputable platforms like Coinbase.

This anonymity suggests high risk, as legitimate Bitcoin earning systems typically provide verifiable leadership and registration details to build trust.

Compensation Plan Explained

Team Builder BTC operates a matrix-based compensation plan, emphasizing recruitment over tangible products. The structure includes:

- Direct Referral Bonuses: 10–20% commissions on investments by recruits.

- Team-Building Rewards: Tiered payouts (up to 5% on multiple levels) for building “downlines.”

- Matrix Levels:

- Level 1: $4 per spot + 2 entries in $1 tree cycling.

- Level 2: $7.50 per spot + entries in $1/$2 trees.

- Level 3: $15 per spot + 12 lower tree entries.

- Level 4: $70 per spot + 14 lower tree entries.

- Level 1: $4 per spot + 2 entries in $1 tree cycling.

- Passive Income Claims: Promises 2–5% daily returns (1,353–5,400% annualized) on $100–$10,000 packages.

The plan relies heavily on recruiting new participants, resembling a pyramid scheme. Without a clear revenue source, earnings depend on new investments, which is unsustainable.

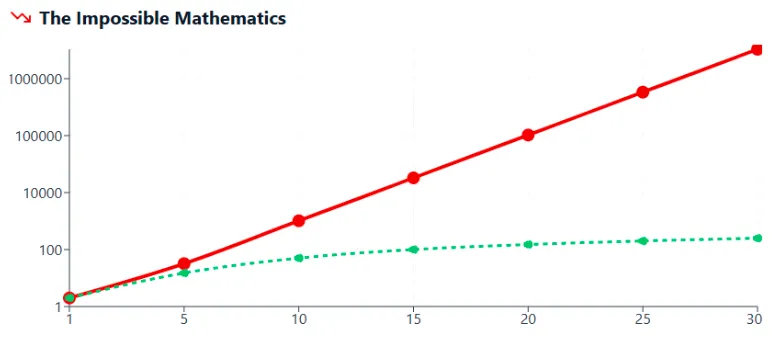

Mathematical Analysis of ROI Claims

The platform’s 2–5% daily return claims translate to 1,353–5,400% annually. Let’s break it down:

- Example Calculation: A $1,000 investment at 3% daily grows to ~$37,783 in one year (((1 + 0.03)^{365} – 1)).

- Matrix Growth: A 2×2 matrix with 8 levels requires 510 new participants per cycle ((2^9 – 2)). By generation 20, over 1 million recruits are needed, which is impossible in a finite market.

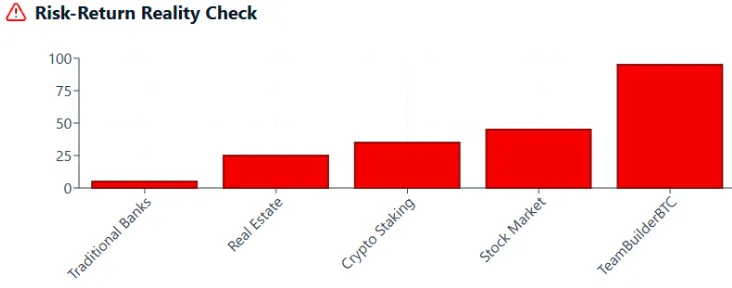

Investment Type | Annual ROI | Risk Level |

Real Estate | 6–12% | Medium |

Bank Savings | 4–5% | Low |

Crypto Staking (e.g., Binance) | 3–15% | High |

Team Builder BTC | 1,353–5,400% | Extreme |

Traffic and Public Perception

Traffic data from SimilarWeb shows low engagement for this Bitcoin MLM platform:

- Low Volume: ~5,000 visits/month, mostly from referral links in Nigeria, India, and Southeast Asia.

- High Bounce Rate: >70%, suggesting users leave quickly.

- Public Sentiment: Minimal presence on X, Reddit, or Trustpilot. Promotional posts on X by accounts like @CryptoWealthNG (1,200 followers) and @BTCBuilder2025 (800 followers) have low engagement (<5 likes).

The lack of organic traffic and credible reviews signals limited trust in the Bitcoin affiliate program.

Security and Technical Performance

Security measures are inadequate for a financial platform:

- Basic SSL: Uses free Let’s Encrypt certificate, not enterprise-grade.

- No 2FA: Lacks two-factor authentication or cold storage for funds.

- Poor UX: Slow load times (>3 seconds) and non-responsive mobile design, per Sitechecker.

These gaps increase risks for users of this Bitcoin earning system.

Payment Methods and Risks

The platform accepts only Bitcoin and Litecoin, which are irreversible, limiting recourse if funds are lost. No regulated gateways (e.g., PayPal) are offered, a red flag for any crypto investment platform.

Customer Support

Support is minimal, with only a generic contact form. No live chat, phone, or email is provided, and social media responses are vague, undermining trust in Team Builder BTC’s customer service.

Red Flags Summary

- Anonymous ownership with no verifiable team.

- Unrealistic 2–5% daily returns, unsustainable without exponential recruitment.

- MLM structure reliant on new investor funds.

- Basic security and no regulatory compliance.

- Limited, low-engagement social media presence.

Social Media Promoters

The platform is promoted by:

- @CryptoWealthNG (X): Also promotes CryptoFastTrack, EarnBit.

- @BTCBuilder2025 (X): Pushes BitGrow, ProfitCoin (flagged as scams).

- TeamBuilderBTC Official (Telegram): 2,500 members, promotes CryptoTeamPro.

These accounts show bot-like behavior and cross-promote dubious platforms, raising concerns about coordinated scam activity.

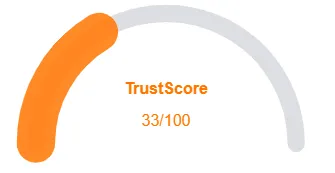

DYOR Tool Reports

Tool | Trust Score | Notes |

ScamAdviser | 10/100 | New domain, hidden WHOIS |

ScamDoc | 15/100 | MLM structure, low transparency |

SSLTrust | Basic HTTPS | No advanced security |

These low scores highlight risks in this Bitcoin investment review.

Future Outlook

Team Builder BTC may initially pay early investors to build credibility but is likely to collapse within 6–18 months as recruitment slows, following the pattern of schemes like Bitconnect.

Recommendations

- Avoid Investment: High risk of loss due to Ponzi-like structure.

- Use Trusted Platforms: Choose regulated exchanges like Binance for 3–15% APY.

- Verify Claims: Use ScamAdviser, WHOIS, and Bitcointalk for research.

- Secure Funds: Store Bitcoin in hardware wallets to avoid fraud.

Team Builder BTC Review Conclusion

This Team Builder BTC review reveals a high-risk platform with anonymous ownership, unsustainable returns, and MLM characteristics. Compared to real estate (6–12% ROI) or crypto staking (3–15% APY), its promises are unrealistic. Investors should prioritize regulated platforms and thorough research to protect their funds. For more insight into similar high-risk projects, you can also read our detailed Atomic Meta Review.

DYOR Disclaimer

This analysis, based on data as of August 13, 2025, is for informational purposes only. Always conduct your own research before investing in any Bitcoin earning app. Verify claims, consult financial advisors, and report suspicious platforms to authorities like Action Fraud.

Team Builder BTC Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Team Builder BTC a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Team Builder BTC or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

- Domain age old

- Archive age old

Negative Highlights

- Low AI review rate

- Whois hidden

Frequently Asked Questions About Team Builder BTC Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Team Builder BTC raises concerns due to lack of transparency, unrealistic ROI claims, and an unsustainable referral-based model.

It claims to generate profits through Bitcoin investments and a referral program, but there’s no verifiable proof of actual trading or revenue sources.

No. Team Builder BTC is not licensed or registered with any recognized financial regulator, increasing the risk for investors.

Risks include potential loss of funds, reliance on constant recruitment, unrealistic return promises, and absence of regulatory protection.

It’s not recommended. The platform’s red flags, lack of verifiable operations, and high-risk structure make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.