Suibasket Review: Is It a Legitimate Investment Platform?

This Suibasket review examines the platform’s legitimacy, risks, and suitability for investors. For an in-depth scam analysis of suibasket.online, visit Scams Radar for a detailed review.

Suibasket promotes itself as a blockchain-based platform offering cloud mining, staking, airdrops, and referral rewards. However, concerns about transparency, unrealistic returns, and hidden ownership raise doubts. Read on to explore whether suibasket.com is safe, covering ownership, compensation, security, user feedback, and more, supported by clear language and visuals for easy understanding.

Table of Contents

What Is Suibasket?

Suibasket promotes itself as a crypto investment platform offering daily returns and referral bonuses. It claims users can stake SUI tokens, participate in airdrops, and earn passive income. The platform’s slogan, “Your Basket, Your Future,” suggests easy wealth creation. But is Suibasket reliable, or does it pose risks?

Ownership and Transparency

Understanding who runs a platform is key to assessing its legitimacy. Suibasket’s domain, registered in June 2025 via Hostinger, uses a privacy protection service (PrivacyProtect) to hide ownership details. This lack of transparency is concerning, as reputable platforms like Coinbase or Binance openly share their leadership and regulatory compliance. No company name, address, or team bios are provided, and there’s no evidence of licensing from regulators like the SEC or FCA.

Red Flags in Ownership

- Hidden Identity: No verifiable founders or company details.

- Recent Domain: A June 2025 registration suggests a lack of established reputation.

- No Regulatory Oversight: Absence of financial licenses increases risk.

Compensation Plan and ROI Claims

The Suibasket compensation plan involves staking SUI or USDT for daily returns, starting at 0.5% to 3.5% daily, with some promotions claiming up to 4% daily after six weeks. Referral bonuses offer up to 40% for recruiting others. Let’s break down the math for a $100 investment at 4% daily:

- Daily Return: $4

- Monthly Return: $4 × 30 = $120

- Annual Return: $4 × 365 = $1,460 (1,460% APY)

If reinvested at 0.5% daily, the compounding growth is:

[ (1 + 0.005)^{365} \approx 6.17 \times \text{ initial investment} = 517% \text{ annual return} ]

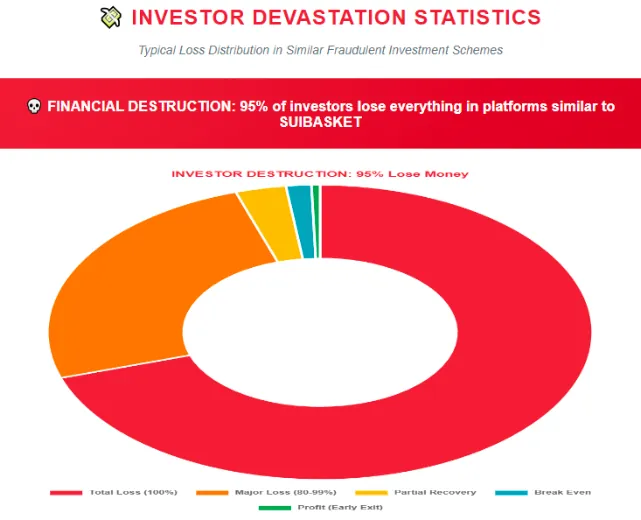

Comparison with Legitimate Investments

Investment Type | Typical Annual Return | Risk Level |

Real Estate | 6–10% | Medium |

Bank Savings | 4–10% (Pakistan, 2025) | Low |

Crypto Staking (SUI) | 2–5% | High |

Suibasket | 517–1,460% | Very High |

These returns are unsustainable without exponential new investments, a hallmark of Ponzi schemes. Legitimate platforms like Coinbase offer 2–5% APY for SUI staking, while banks like HBL provide 8–10% APY with regulatory protection.

Security and Technical Performance

Suibasket uses a basic Let’s Encrypt SSL certificate for HTTPS, but this is standard even for risky sites. It operates on shared hosting (Hetzner, Finland), which is vulnerable to attacks. There’s no mention of two-factor authentication (2FA) or cold storage for funds, unlike secure platforms like Kraken. Frequent downtime (Error 503) and poor mobile optimization further question its reliability.

Security Concerns

- Basic Encryption: No advanced security features.

- Shared Hosting: Increases vulnerability.

- No 2FA: Lacks user account protection.

Payment Methods and Customer Support

Suibasket accepts crypto-only deposits (SUI, USDT), which are irreversible and risky. No fiat options or refund policies are mentioned, unlike regulated platforms with chargeback protections. Customer support is absent—no live chat, email, or phone support is listed, raising concerns about resolving issues.

Public Perception and Promoters

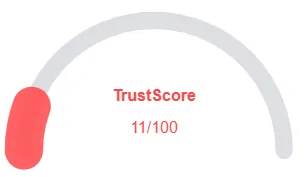

Public feedback is scarce due to the platform’s newness. ScamAdviser gives it a very low trust score, and no reviews exist on Trustpilot or Reddit. Promotional content appears on YouTube (e.g., CEKITAN channel’s “SuiBasket Business Plan Explained”) and Facebook (e.g., posts by Aishwarya Bisht and MLM groups). These promoters often push other high-yield schemes like Sui Bison, a red flag per FTC warnings about unsolicited investment offers.

Promoter Red Flags

- Low Credibility: Promoters lack verifiable credentials.

- Cross-Promotion: Linked to other questionable schemes.

Traffic and Content Authenticity

Traffic data from SimilarWeb shows negligible visits, indicating low adoption. The site’s content is vague, with no whitepaper, roadmap, or risk disclosures. Generic marketing phrases dominate, lacking the depth of legitimate platforms like Binance.

Red Flags Summary

- Unrealistic Returns: 517–1,460% APY is unsustainable.

- Anonymous Ownership: No team or company details.

- Crypto-Only Payments: High risk of loss.

- No Support: Lack of customer service channels.

- Low Traffic: Minimal user engagement.

Recommendations for Investors

Avoid Suibasket due to its high-risk profile. Instead, consider:

- Regulated Crypto Platforms: Coinbase or Kraken for 2–5% APY.

- Bank Savings: HBL or UBL for 8–10% APY in Pakistan.

- Due Diligence: Use ScamAdviser, WHOIS, or Twitter Audit to verify platforms.

Suibasket review Conclusion

This Suibasket detailed review 2025 highlights significant concerns about its legitimacy. Hidden ownership, unsustainable returns, and lack of transparency make it a risky choice. For safe investments, stick to regulated platforms or banks. Always verify claims independently to protect your funds. For comparison, you can also read our in-depth Qutom Review.

DYOR Disclaimer

This Suibasket review is based on data as of August 18, 2025, and is not financial advice. Conduct your own research using trusted sources like ScamAdviser or regulatory databases. Never invest more than you can afford to lose.

Suibasket review Trust Score

A website’s trust score is an important factor in judging its reliability, and Suibasket currently holds a dangerously low rating—raising serious doubts about its legitimacy. Users are strongly urged to proceed with caution.

The platform shows multiple red flags, such as low web traffic, negative user feedback, potential phishing risks, hidden ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other malicious activities is much higher. It’s crucial to review these warning signs carefully before engaging with Suibasket or any similar platforms.

Positive Highlights

- Accessible website content

- No spelling or grammar errors

Negative Highlights

- Low AI reviews

- New archive

- Hidden WHOIS

- New domain

Frequently Asked Questions About Suibasket Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Suibasket raises concerns due to hidden ownership, unverified claims, and the lack of regulatory oversight.

The platform claims profits through cloud mining, staking, airdrops, and referral programs, but there is no verifiable evidence of sustainable earnings.

No. Suibasket is not licensed or registered with any recognized financial regulator, which increases the risk for investors.

Risks include potential financial loss, lack of transparency, unverified ROI claims, and reliance on referral-based earnings.

It is not recommended. The platform’s hidden ownership, unrealistic promises, and lack of regulation make it a high-risk investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.