SparkChain Review: Is This AI Platform Legitimate or Risky?

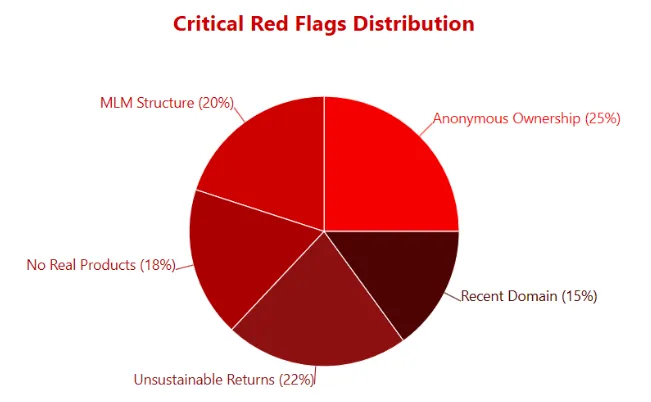

This SparkChain review on Scams Radar examines the legitimacy and risks of SparkChain AI (sparkchain.ai), a platform claiming to combine blockchain and artificial intelligence for decentralized computing. The platform promises rewards through bandwidth sharing and a referral program. We analyze its ownership, compensation plan, and sustainability, using clear data, charts, and visuals to guide potential investors and help them make informed decisions.

Table of Contents

What Is SparkChain AI?

SparkChain AI builds a decentralized AI data network. Users run Spark Lite (browser-based) or full nodes (desktop) to share unused bandwidth. This supports AI training data networks. Participants earn Spark Points, later convertible to $SPARK tokens on the Solana blockchain. The platform claims a “Sovereign Data Rollup” ensures AI data provenance using zero-knowledge proofs (ZKPs). Yet, technical details are vague, and no full audits exist.

Ownership and Team Background

SparkChain AI’s ownership is unclear. The domain, registered on December 7, 2024, uses private registration, hiding the owner’s identity. The company lists a Sheridan, Wyoming address (1309 Coffeen Avenue, Suite 16882), a common spot for shell companies. Marketing names “Ethan Cole” as CEO, but no verifiable background exists. Searches show other Ethan Coles in tech, none linked to SparkChain. This opacity is a red flag, as credible firms share team details.

- Red Flag: Anonymous leadership and unverifiable founder credentials.

Compensation Plan Explained

The compensation plan centers on earning Spark Points. Users run nodes to share bandwidth, earning points based on uptime. These points convert to $SPARK tokens post-Token Generation Event (TGE) in Q2 2025. A multi-level referral program boosts earnings:

- Level 1: 20% of direct referrals’ points.

- Level 2: 10% of their referrals’ points.

- Level 3: 5% of third-level referrals’ points.

Level | Commission Rate |

Direct (Level 1) | 20% |

Indirect (Level 2) | 10% |

Level 3 | 5% |

Traffic Trends and Public Perception

SparkChain claims 600,000 users, 2.5 million AI tasks, and 223.5 million bandwidth shared. No third-party data (e.g., SimilarWeb) verifies this due to the site’s recent launch. Social media shows 265,000 Telegram and 100,000 X followers, driven by airdrop incentives. Sentiment is mixed: some praise the decentralized compute power, but critical reviews, like BehindMLM’s, label it a “node ruse MLM crypto Ponzi.” ScamAdviser rates it 11/100, citing hidden ownership. Withdrawal complaints surface on X.

Metric | Claimed | Verified? |

Users | 600,000 | No |

AI Tasks | 2.5M | No |

Bandwidth | 223.5M | No |

Security Measures

SparkChain claims ZKPs ensure privacy. The privacy policy states IP addresses may be shared with verified institutions for tasks like price comparison. No recent audits confirm security. A SolidProof audit covered only the token sale contract, not the network. The desktop app raises malware concerns, as bandwidth-sharing apps can be exploited.

Red Flag: Unaudited security claims and potential IP exposure.

Payment Methods and Customer Support

Users deposit SOL for full participation. Rewards come as $SPARK tokens, unlisted on major exchanges. Withdrawal issues are reported on social media. Support is limited to [email protected] and community channels (Telegram, X). No phone or live chat exists.

Red Flag: Limited payment options and reported withdrawal delays.

Technical Performance

SparkChain claims high-performance AI computing. No metrics on latency or scalability are public. Competitors like Grass Network offer more transparency. The platform’s dashboard is login-gated, blocking external verification.

Red Flag: Unproven technical claims.

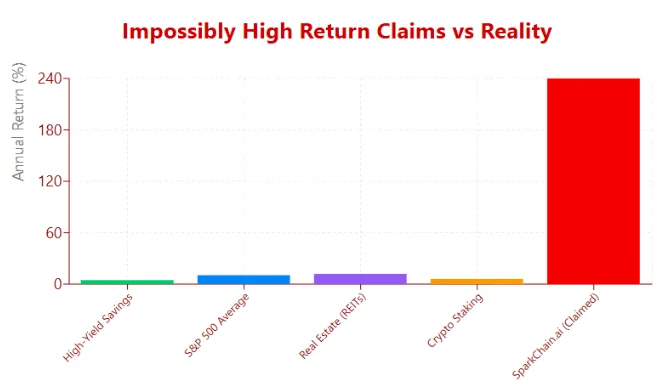

ROI Claims and Sustainability

SparkChain implies returns via points-to-token conversion. Assume 265,000 users contribute $10/month bandwidth, generating $2.65M revenue. With 80% to users, each earns ~$8/month (96% APY). This assumes unverified AI client revenue. If reliant on new user SOL deposits, it’s unsustainable.

Calculation:

- Revenue: 265,000 × $10 = $2.65M

- User Rewards: 0.8 × $2.65M = $2.12M

- Per User: $2.12M ÷ 265,000 = ~$8/month

Comparison

Investment | Annual ROI |

SparkChain AI | ~96% (speculative) |

Real Estate | 8-12% |

Bank Savings | 4-5% |

Crypto Staking | 5-10% |

SparkChain vs. Grass Network

Grass Network also uses bandwidth for AI but offers clearer client partnerships. SparkChain’s opaque model lags in trust.

Social Media Promoters

Official accounts (@SparkChain_AI, t.me/SparkChainAI) push airdrops. Affiliate accounts like @Airdroptrex promote SparkChain, NodePay, and DeSpeed, showing a pattern of speculative project hype.

DYOR Tools and Checklist

Use these to verify SparkChain:

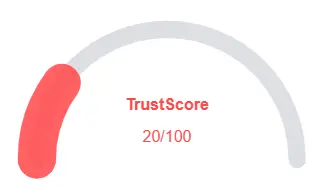

- ScamAdviser: Low trust score (11/100).

- Whois.domaintools.com: Check private registration.

- Chainalysis: Monitor $SPARK post-TGE.

- BehindMLM: Read critical reviews.

Checklist:

- Verify team identities.

- Check revenue sources.

- Save ScamAdviser reports.

- Compare ROI to Solana staking (5-7% APY).

SparkChain Review Conclusion

This SparkChain review highlights serious risks. Hidden ownership, MLM-style referrals, and unverified revenue signal a potential Ponzi scheme. Compared to real estate (8-12%), bank savings (4-5%), or crypto staking (5-10%), its implied 96% APY is unsustainable. Investors should avoid SparkChain AI until transparency improves. Explore regulated alternatives like ETFs or crypto exchanges for safer returns.

For further insights, you can also read our BTRL Exchange Review to compare how similar platforms operate and why investors should be cautious.

DYOR Disclaimer:

This SparkChain review is for information only, not financial advice. Conduct your own research. Verify claims with tools like ScamAdviser. Consult advisors. Crypto investments carry high risks, and losses are possible.

SparkChain Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 SparkChain currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with SparkChain similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammar errors

- Old domain age

- Old archive age

- Domain ranks in top 1M (Tranco)

Negative Highlights

- Low AI review rate

- Whois data hidden

Frequently Asked Questions About SparkChain Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

SparkChain AI is a platform claiming to combine blockchain and artificial intelligence for decentralized computing, offering rewards through bandwidth sharing and referrals.

Our analysis highlights concerns regarding ownership transparency, sustainability of returns, and the legitimacy of its reward system.

Ownership information is limited and not clearly disclosed, raising red flags for potential investors.

The platform claims to reward users through bandwidth sharing and referrals, but the promised returns may be unsustainable.

Due to limited transparency and unclear security measures, withdrawal of funds may be risky. Always perform your own research (DYOR) before investing.

Other Infromation:

Website: sparkchain.ai

Reviews:

There are no reviews yet. Be the first one to write one.