Savvy Mining Review: Is This Cloud Mining Platform Legitimate?

In this Savvy Mining review, Scams Radar examines the cloud mining service for its legitimacy, risks, and investor value. Many seek Savvy Mining cloud mining for passive income, but questions arise about Savvy Mining’s legitimacy, investment safety, and returns. We combine details from multiple sources to help you decide.

Table of Contents

Part 1: Ownership and Regulation Concerns

Savvy Mining claims a UK base at 58 Dene Hall Drive, Bishop Auckland. Yet, this address links to Savvy Financial Ltd, a separate firm since 2012. The platform displays that company’s certificate, a tactic to seem credible without proof. No record of Savvy Mining exists on the UK Companies House or FCA register.

Searches for Savvy Mining’s owner’s background yield no profiles. Ownership stays hidden via privacy services, a common issue in risky ventures. FCA checks in 2025 show no authorization, despite repeated claims in press releases. The FCA warns against such unauthorized firms, leaving investors without protection.

This lack of transparency raises doubts. Without clear owners or regulation, accountability is low.

Part 2: Complete Compensation Plan Breakdown

Savvy Mining investment starts with a $15 signup bonus. Daily login rewards add $0.60. The referral program offers commissions up to $100,000 monthly, encouraging recruitment.

Mining plans vary by investment and duration:

- Free Plan: $15 for 1 day, returns $15.60 (4% ROI).

- Starter: $100 minimum investment, 2 days, returns $107.32 (7.32% ROI).

- Standard: $1,200, 12 days, returns $1,404.48 (17% ROI).

- Enterprise: Up to $200,000, 45 days, returns $194,500 (94.5% ROI).

How mining contracts work on Savvy Mining: Users buy hashing power for fixed periods. Earnings are calculated daily, with no hardware needed. Savvy Mining cryptocurrency mining focuses on BTC, ETH, DOGE, and more. Withdrawal process requires a $100 minimum, via crypto wallets.

Savvy Mining fees include upfront, but users report hidden costs like “verification” charges. Calculation of mining earnings on Savvy Mining uses fixed rates, ignoring market changes.

Plan | Investment | Duration | Total Return | Daily ROI |

Free | $15 | 1 day | $15.60 | 4% |

Starter | $100 | 2 days | $107.32 | 3.66% |

Standard | $1,200 | 12 days | $1,404.48 | 1.42% |

Enterprise | $100,000 | 45 days | $194,500 | 2.1% |

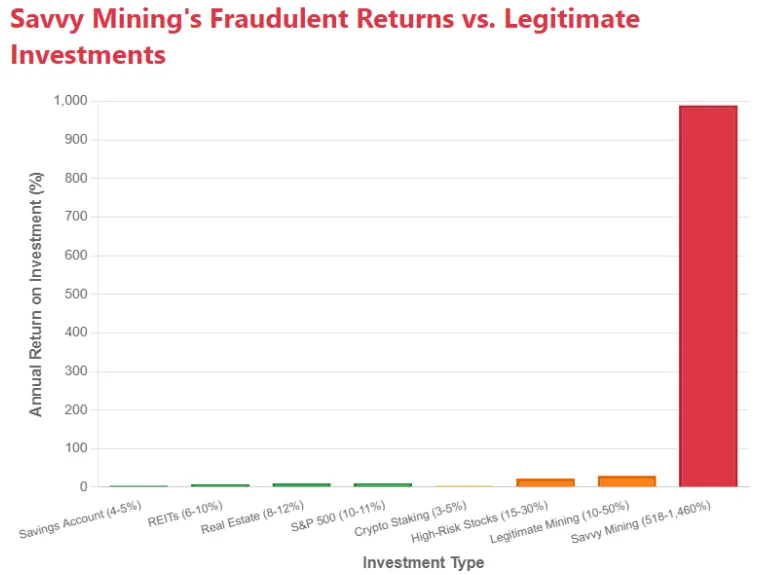

2.1 ROI Claims: Mathematical Proof and Comparisons

Savvy Mining Bitcoin mining promises high yields, but math shows issues. For the Starter plan: 7.32% in 2 days equals 3.66% daily. Annualized: (1 + 0.0366)^365 – 1 ≈ 65,000% APY.

Enterprise: 94.5% in 45 days is 2.1% daily, annualized to ~1,800%.

Real mining faces difficulty adjustments, power costs ($0.05-0.10/kWh), and halvings. Legit yields: 5-15% yearly.

Comparison graph (bar chart, log scale for clarity): Bank savings at 4.5%, real estate 8%, crypto staking 5%, legit cloud mining 15%. Savvy Mining towers over by 100-1,000 times. This disparity signals unsustainability, like Ponzi models needing constant inflows.

If 100 investors put $10M, payouts need $19.45 in 45 days. Without real revenue, it fails.

Part 3: Public Perception and Traffic Trends

User testimonials and reviews of Savvy Mining are mixed. Trustpilot scores ~2/5, with complaints on withdrawal procedures and payment methods. Reddit labels it a scam, citing blocks after small payouts.

ScamAdviser gives low trust due to hidden WHOIS and low traffic. Sitejabber has no reviews, odd for a 2017 domain.

Traffic relies on paid press, not organic growth. No major promotions on X in 2025.

3.1 Security, Support, and Technical Details

Savvy Mining security claims SSL and McAfee, but no 2FA or audits. Crypto-only payments (BTC, ETH, USDT) prevent reversals.

Savvy Mining customer support via email promises quick replies, but reports show delays and scripts. No phone or live chat reliability.

Platform interface and user experience: Basic menus, login walls hide details. Savvy Mining’s mobile app functionality claims tracking, but lacks reviews.

As of November 2025, https://savvymining.com/ shows insufficient content, possibly indicating downtime or closure.

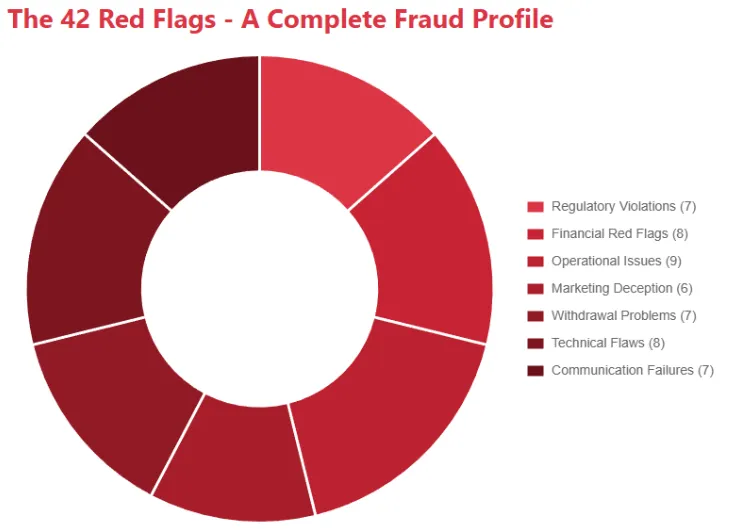

Red Flags and Risks

- False FCA claims and cloned details.

- Unrealistic ROIs without proof.

- Negative reviews on withdrawals.

- Hidden fees and costs.

- No transparency on hardware or technology.

- Geographic availability unclear, risks in unregulated areas.

Risks and precautions for investing in Savvy Mining: High loss chance, no recourse.

Comparison of Savvy Mining with other cloud mining platforms like Binance or Hashing24: Others offer variable, realistic yields with audits.

Environmental impact and sustainability of Savvy Mining: Claims green energy, but unverified.

Frequently reported issues: Account blocks, extra fees.

Recommendations

Avoid Savvy Mining contracts. If invested, document and report to authorities like the FCA or local cyber units.

Safer options: Regulated staking on exchanges.

How to start cloud mining with Savvy Mining? Skip it; choose verified platforms.

Investment strategies using Savvy Mining mining plans? Not advised due to risks.

Conclusion

This Savvy Mining review highlights major concerns. Legitimacy falters without regulation or proof. Investors should steer clear of safer paths.

DYOR: This Savvy Mining review is informational. Verify independently; crypto carries a loss risk.

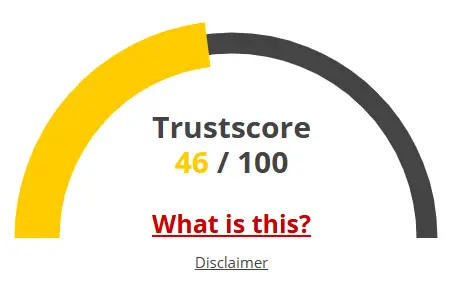

Savvy Mining Review Trust Score

A website’s trust score is an important indicator of its reliability. Savvy Mining currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Savvy Mining or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Savvy Mining Review

This section answers key questions about the Savvy Mining, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No clear proof confirms Savvy Mining’s legitimacy. The lack of verified ownership, regulation, and transparent mining operations raises major red flags.

Savvy Mining claims to pay returns through mining revenue, but calculations show the ROI structure is unsustainably high and likely relies on new deposits.

No. The promised daily and monthly returns far exceed real mining profitability averages, which typically range between 5% to 15% annually.

Risks include loss of funds due to unregulated operations, hidden withdrawal fees, blocked accounts, and the possibility of a Ponzi-style collapse.

Both platforms share concerns regarding transparency and unverified ROI claims, so investors should proceed cautiously and research thoroughly.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.