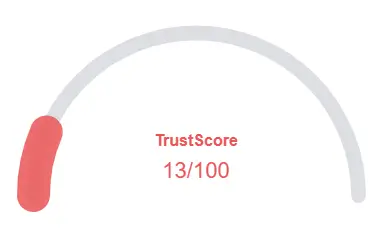

This Routine Coin review examines the legitimacy of RoutineCoin.info, a platform promoting the ROUTINE cryptocurrency. Scams Radar analyzes ownership, ROI claims, security, and more to uncover risks for investors seeking to buy ROUTINE coin. With a crypto market full of opportunities and scams, due diligence is crucial.

RoutineCoin.info markets the ROUTINE token, a decentralized coin on the Polygon network, promising utility in daily transactions like bill payments. Launched in July 2024, the platform lacks detailed public information, raising questions about its credibility. This Routine Coin review dives into key factors to assess its safety.

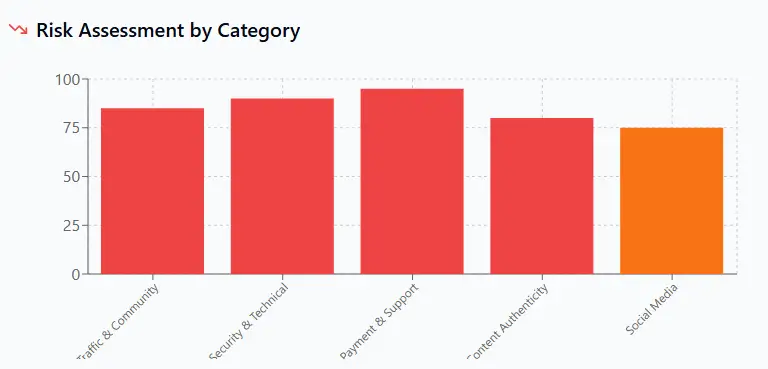

The domain, registered via NameSilo, LLC on July 24, 2024, uses PrivacyGuardian.org to hide ownership details. No team or company information is disclosed, a red flag in the crypto space. Legitimate platforms like Binance provide clear corporate details, while anonymity often signals ROUTINE coin investment risks.

Red Flag: Hidden ownership and no regulatory registration (e.g., SEC, FCA) suggest potential non-compliance.

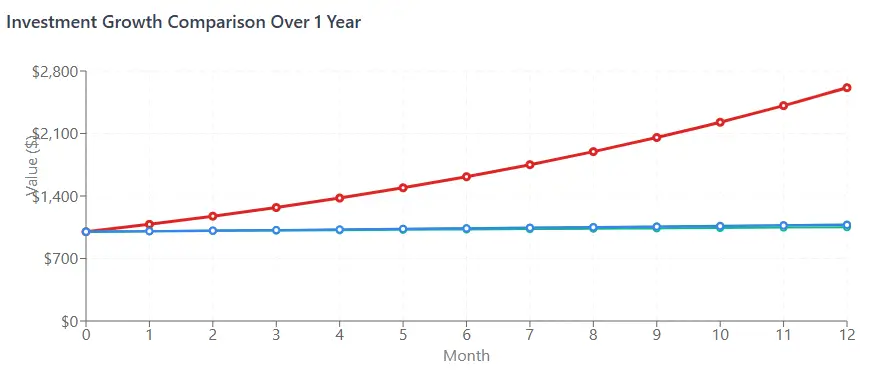

Routine Coin does not explicitly state ROI but implies high returns through “earn” mechanisms. Assuming a hypothetical 100% annual ROI, let’s analyze sustainability:

Formula: ( A = P(1 + r/n)^{nt} ), where ( P = $1,000 ), ( r = 1.0 ), ( n = 12 ), ( t = 1 ).

Calculation: ( A = 1000(1 + 1/12)^{12} \approx $2,657 ).

Reality: A 100% return requires constant new capital, resembling a Ponzi scheme. Compare this to:

Red Flag: No verifiable business model supports such ROUTINE crypto price growth. This compansion scam is similar to Zarraz World who claims to provide high ROI.

Traffic data from tools like SimilarWeb is unavailable due to the site’s recent launch, indicating low visibility. Searches on X, Reddit, and Bitcointalk show no significant ROUTINE coin community and future prospects discussions. Social media presence includes @Routine_Coin on X and “routinecoinofficial” on Facebook, but engagement is minimal.

Red Flag: Lack of organic community or media coverage (e.g., CoinDesk) suggests limited trust.

The site uses basic HTTPS encryption but lacks details on advanced security like two-factor authentication or cold storage. CoinGecko flags the ROUTINE token’s smart contract as centralized, allowing the creator to mint tokens or block sales—a rug-pull risk. The platform’s low trading volume ($15,000 daily) and market cap ($600,000) indicate high ROUTINE coin liquidity and volatility risks.

Red Flag: No third-party audits or security transparency.

Payments are crypto-only via Quickswap (Polygon), with no fiat options or clear withdrawal policies. No customer support channels (email, live chat) are listed, and social media accounts show no active engagement, unlike trusted platforms.

Red Flag: Opaque payment and support systems increase fraud risks.

No whitepaper or technical documentation is available, and claims of partnerships (e.g., GoPay) lack verification. Generic crypto buzzwords dominate, raising concerns about content authenticity.

Red Flag: Missing ROUTINE blockchain token documentation signals potential scam behavior.

The @Routine_Coin X account and “routinecoinofficial” on Facebook promote the token, but no evidence links them to other scams like BitConnect. Low follower engagement suggests artificial promotion.

This Routine Coin review highlights significant risks with RoutineCoin.info, including hidden ownership, no regulatory compliance, and centralized contract vulnerabilities. Compared to real estate (6-10%), bank savings (4-6%), or crypto staking (3-12%), ROUTINE coin’s implied returns are unsustainable. Investors should prioritize regulated alternatives and stay cautious.

DYOR Disclaimer: This analysis, based on data as of June 13, 2025, is for informational purposes only. Conduct independent research and consult financial advisors before investing. Cryptocurrency carries high risks, and funds may be lost.

These commonly asked questions address the issue of how to confirm the accuracy of the Routine Coin crypto Network’s findings. We have provided the following questions and answers to help allay any worries you might have:

Routine Coin is a decentralized digital currency based on blockchain technology, designed for secure transactions and available on multiple networks such as Ethereum and Solana

You can buy Routine Coin by using compatible wallets like Phantom for Solana variants, then swapping other cryptocurrencies for ROUTINE on decentralized exchanges (DEX) such as Raydium.

As of March 2025, the price on the Ethereum network is approximately $0.00014214, with variations across different platforms and networks.

Besides its unique branding, Routine Coin’s value and future depend heavily on its community engagement and ability to maintain trading volume beyond viral popularity.

Price predictions suggest potential growth (up to around $0.03677 by April 2025), but as a meme coin, it is highly volatile and depends on community support and market trends.

Title: Routine Coin – ROU

There are no reviews yet. Be the first one to write one.