Quinex Review: Is This AI Trading Platform Legit in 2025?

In this Quinex review, Scams Radar looks at key details for potential users. Quinex positions itself as an AI-powered crypto arbitrage platform. It offers automated trading bots for daily profits. Launched recently, it claims stable returns led by Sebastian Abrego from Panama. But questions arise about its legitimacy. We examine ownership, compensation plans, and more to help you decide.

Table of Contents

Part 1: Understanding Quinex AI Trading and Arbitrage Basics

Quinex AI trading uses bots to spot price differences across exchanges. The platform says it scans over 15 exchanges and 30 cryptocurrencies. This aims to generate consistent daily profits. For beginners, Quinex investment strategies seem straightforward. You deposit funds, choose a plan, and let the bots work.

But how does Quinex AI arbitrage work? It claims real-time execution with transparent tracking. Yet, independent checks show no verified trade logs. This raises concerns for crypto investors asking, Is Quinex safe?

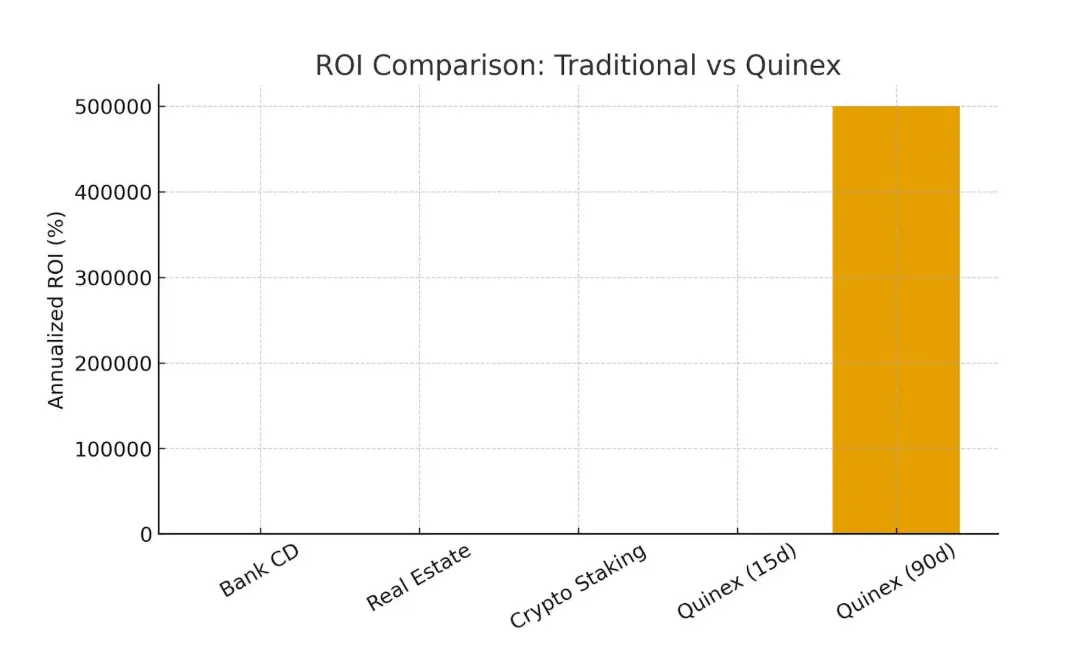

Bar chart illustrating ROI comparisons between traditional investments and Quinex claims, showing vast disparities.

The chart above compares annualized ROI. Bank CDs offer about 4.5%. Real estate gives 8-12%. Crypto staking yields 3-15%. Quinex claims soar to 494% for short plans and over 500,000% annualized for longer ones. Such gaps highlight potential issues.

1.1 Ownership Profile: Who Runs Quinex?

Sebastian Abrego is named as the leader. The site describes him as a Panama-based veteran in banking and risk management. He has over 30 years of experience, per their claims. A blog post and video share his vision for the Quinex cryptocurrency trading bot.

However, verification falls short. Searches for Sebastian Abrego in Panama finance show unrelated profiles. LinkedIn has matches, but none tie to Quinex or confirm his background. No company registration in Panama’s public records links to him or the platform. Domain details are hidden, registered May 3, 2025. This lack of transparency is common in opaque setups.

Without attested credentials, trust erodes. Legitimate leaders have public histories. Here, claims stay self-reported on the site.

Part 2: Detailed Compensation Plan Breakdown

Quinex investment plans come in four durations. Each has a daily rate range. Deposits return at the end, with accruals daily. Max investment hits $500,000 for the shortest plan.

Here’s a table of options:

Plan Duration | Daily Rate Range | Accrual Method | Max Investment |

15 Days | 0.90% – 1.10% | Calendar Days | $500,000 |

30 Days | 1.20% – 1.40% | Calendar Days | Not Specified |

60 Days | 1.50% – 1.70% | Calendar Days | Not Specified |

90 Days | 1.80% – 2.00% | Calendar Days | Not Specified |

The partner program adds MLM elements. It offers ranks, multi-level commissions, and bonuses for recruiting. This boosts earnings through referrals. But it prioritizes growth over trading gains.

For example, in the 90-day plan at 1.8% daily: Start with $1,000. Formula is Principal × (1 + rate)^days. That’s $1,000 × (1.018)^90 ≈ $4,983. At 2.0%, it’s ≈ $5,943. These promise 398-494% in three months.

Compare to benchmarks:

- Bank CDs: 4-5% APY.

- Real estate: 5-10% annual return after costs.

- Crypto exchanges like Binance: 5-20% APY for stablecoins, not guaranteed.

Quinex dwarfs these, making sustainability doubtful.

Part 3: Traffic Trends and Public Views

Traffic data is low for a new launch. SimilarWeb shows no direct stats; it redirects to established sites like CoinEx. Likely under 10,000 monthly visits. Mentions on X are sparse, mostly promo.

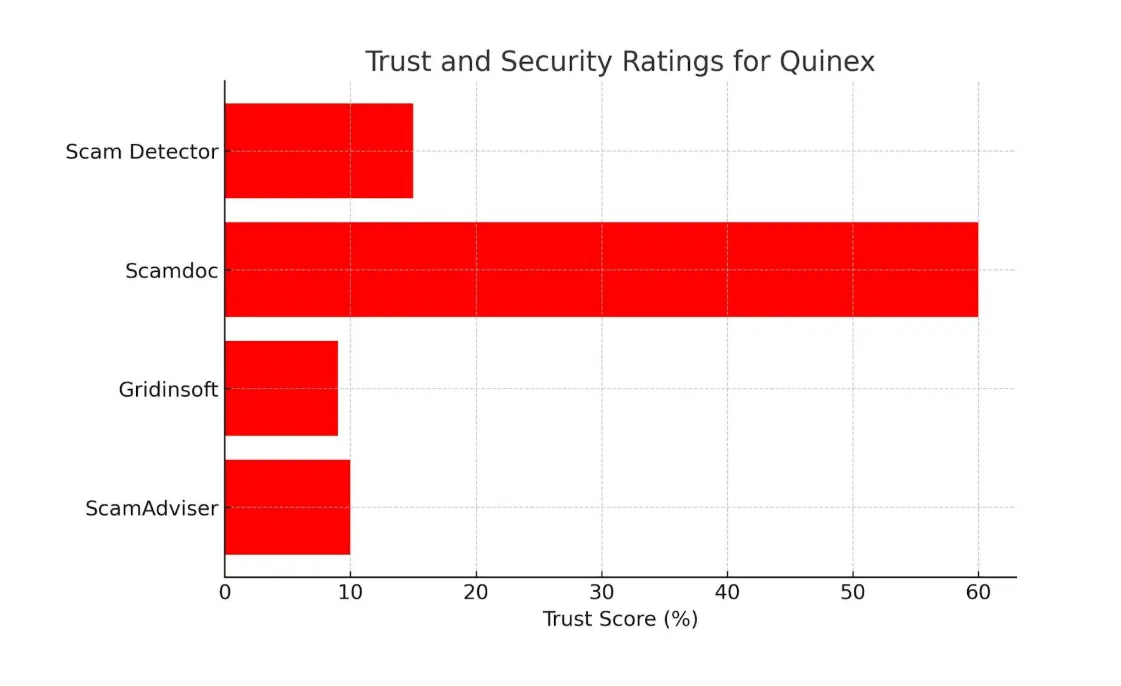

Public perception leans negative. ScamAdviser: Low trust due to hidden ownership. Gridinsoft: 9/100, suspicious from a young age. Scamdoc: 60% trust with few reviews. HYIP sites list it as “paying” early, but often shift to “scam.”

No Trustpilot positives. YouTube videos question “Quinex review scam or legit?” Sentiment warns of risks.

Part 4: Security, Content, and User Experience

Quinex platform security uses Sectigo SSL for data protection. But no audits or licenses were shown. Claims of transparent trading lack proof. No dashboards verified externally.

Content feels generic. Vague pitches on AI arbitrage. Multi-language UI is clean, but resembles HYIP templates. No original research backs claims.

Quinex user experience includes simple onboarding. But the FAQ has placeholders, signaling a rush. Quinex accepts crypto payments such as Bitcoin (BTC) and Tether (USDT) for deposits. Withdrawals are processed manually within 24 hours, requiring a minimum of $10 and charging a $1 transaction fee, with no fiat options available, adding volatility risk.No fiat, adding volatility.

Customer support: Email at support@quinex.io, icons for YouTube, X, Telegram, WhatsApp. No live chat or phone. Response times unstated.

Technical performance: Quick loads, but no uptime data. Potential glitches in new platforms.

Red Flags and Risk Assessment

Key warnings:

- New domain from May 2025.

- Unrealistic yields with short lockups.

- MLM focuses on recruitment.

- Low scanner trusts.

- No audits or licenses.

- High max deposits are odd for arbitrage.

These match failed schemes like Bitconnect. Quinex versus other crypto arbitrage bots? Legit ones offer modest, variable returns, not fixed highs.

Social Media and Promoters

Official: @QuinexLTD on X (joined July 2025), posts launches and tutorials. Telegram: @QuinexTrading (~726 subs), @Quinex_Support.

Promoters: @amy6888888 shares referral links. @allmonitors24_ reviews HYIPs, including past arbitrage sites. Instagram/YouTube, like allmonitors24, post “scam or legit?” videos, promoting indirectly.

Network shows cross-promo of similar schemes.

DYOR Tools and Reports

Use these:

- WHOIS: Shows 2025 registration.

- ScamAdviser: Low trust.

- Gridinsoft: Suspicious.

- Scamdoc: Average trust.

- VirusTotal: No malware.

- Trustpilot: No reviews.

- Scam Detector: Low trust.

For Quinex fee structure: Not detailed beyond withdrawals. Quinex trading bot accuracy: Claimed to be high, but unproven.

Future Outlook and Predictions

Based on HYIP patterns, early payouts may occur. Then, delays, freezes by Q1 2026. Collapse is likely as inflows slow.

Quinex app launch mentioned, but no mobile features yet. Quinex game center rewards? Not evident; perhaps future.

Recommendations for Investors

Always do your own Research before investing in any platform

Conclusion: Weigh the Facts in Your Quinex Review

This Quinex review highlights unverified leadership, extreme ROI claims, and MLM traits. While promising automated crypto trading, red flags suggest high risk. Visit https://quinex.io for claims, but verify independently. For safe yields, choose regulated paths. Always DYOR consult advisors. Crypto carries risks; invest wisely.

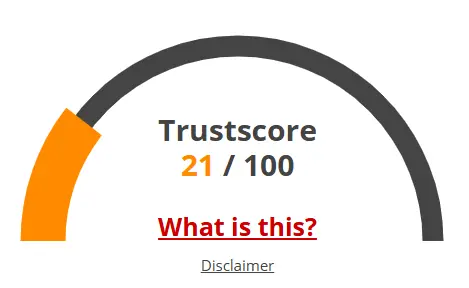

Quinex Review Trust Score

A website’s trust score is an important indicator of its reliability. Quinex currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Quinex or similar platforms.

Positive Highlights

- The owner of the site has claimed the domain name for a long time

- Valid SSL certificate found.

- DNSFilter marks the site as safe.

Negative Highlights

- Low website traffic

- Uses registrar linked to scams

- Mostly negative reviews found

- This website has only been registered recently.

Frequently Asked Questions About Quinex Review

This section answers key questions about Quinex Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Quinex claims to use AI-driven crypto arbitrage bots that scan multiple exchanges to earn small daily profits through price differences

Quinex shows red flags such as hidden ownership, unrealistic ROI promises, and MLM-style referrals, suggesting it may be a high-risk or unsustainable venture.

Quinex promises over 400% in 90 days far higher than real-world returns like real estate (10%) or crypto staking (15%), which raises serious sustainability concerns.

Watch for anonymous leadership, unverifiable trade data, exaggerated profits, and dependency on recruitment commissions, all typical of high-yield Ponzi-like programs.

While the Quinex Review exposes unsustainable ROI and unclear leadership, the Everstead Review focuses on regulatory checks and long-term project transparency.

Other Infromation:

Website: quinex.io

Reviews:

There are no reviews yet. Be the first one to write one.