Qbotia Review: Exposing the Truth Behind 3% ROI

In the fast-paced world of cryptocurrency, platforms like Qbotia promise automated wealth through AI-driven trading. Scams Radar examines Qbotia’s claims, ownership, compensation plan, security, and sustainability to help investors make informed decisions. With claims of 3% daily returns and a referral-based system, this Qbotia Review uncovers major concerns about the platform’s legitimacy. Backed by real data, charts, and comparisons, it reveals whether Qbotia.pro is truly a safe crypto investment or another potential scam.

Table of Contents

Part 1: Overview of Qbotia Platform

Qbotia markets itself as an AI-powered crypto trading bot offering automated trading with daily returns of up to 3%. Investment plans range from $10 to $10,000, with options like PRO Q-BOT ($10–$200, 84 payouts, no capital return) and Q-BOT 10K ($10,000, 100 payouts, capital returned). According to this Qbotia Review, withdrawals are limited to Tuesdays and Thursdays (7:00 AM–3:00 PM EST) and processed via USDT-BEP20. The platform also promotes a referral program offering up to 15% commissions across three levels, raising investor concerns about sustainability.

However, the website lacks critical details: no whitepaper, no team information, and no verifiable product beyond referrals. Links to “Make Investment” and “How it Works” route to an external HYIP (high-yield investment program) template, raising immediate red flags.

1.1 Ownership and Transparency Concerns

The Qbotia platform provides no information about its founders, team, or company registration. A WHOIS lookup reveals hidden registrant details, a common tactic for avoiding accountability. The domain, hosted by Hostinger International Limited, uses a basic Let’s Encrypt R13 SSL certificate, issued September 18, 2025, indicating a new site. No physical address or regulatory licenses are disclosed, unlike trusted platforms like Coinbase (led by Brian Armstrong, SEC-registered) or Binance (led by Richard Teng, licensed in multiple jurisdictions).

Ownership Comparison Table

Platform | Founder/CEO | Registration | Transparency |

Qbotia | Anonymous | None disclosed | None |

Coinbase | Brian Armstrong | SEC-registered | Public reports |

Binance | Richard Teng | Licensed globally | Audited reserves |

Part 2: Qbotia Compensation Plan: A Closer Look

The Qbotia compensation plan revolves around two income streams: daily 3% returns on investments and a three-tier referral system.

- Investment Plans:

- PRO Q-BOT: $10–$200, 3% daily for 84 days, no capital return.

- EXCLUSIVE Q-BOT: $201–$1,000, similar structure.

- Q-BOT 10K: $10,000, 3% daily for 100 days, capital returned.

- PRO Q-BOT: $10–$200, 3% daily for 84 days, no capital return.

- Referral System: Up to 15% commissions (7% for direct referrals, 5% for second-level, 3% for third-level).

Example: If you invest $1,000 and refer five people who each invest $1,000:

- Level 1: 7% × $5,000 = $350

- Level 2: 5% × $25,000 (5 referrals each refer 5) = $1,250

- Level 3: 3% × $125,000 (25 referrals each refer 5) = $3,750

- Total referral earnings: $5,350

This heavy reliance on recruitment mirrors multi-level marketing (MLM) or Ponzi schemes, where payouts depend on new deposits rather than genuine profits.

2.1 Mathematical Proof: Why 3% Daily Returns Are Unsustainable

Qbotia’s promise of 3% daily returns translates to extraordinary growth. Let’s break it down:

- Simple Returns: 3% × 312 trading days (6 days/week × 52 weeks) = 936% annual ROI.

- Compound Returns: $100 invested at 3% daily compound interest:

- 30 days: $100 × (1.03)^30 ≈ $242.73

- 84 days: $100 × (1.03)^84 ≈ $1,209.35

- 1 year (312 days): $100 × (1.03)^312 ≈ $1,012,000

- 30 days: $100 × (1.03)^30 ≈ $242.73

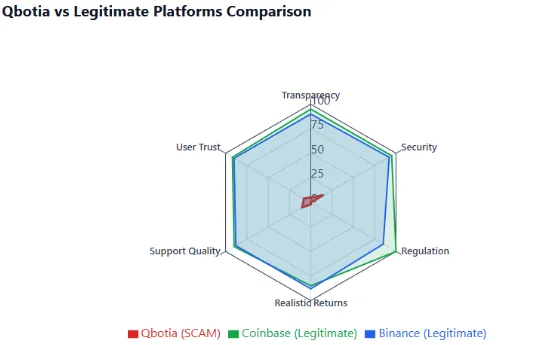

2.2 Comparison with Legitimate Platforms

Feature | Qbotia | Coinbase/Binance |

Transparency | None | Public teams, audits |

Regulation | None | SEC, FCA, global |

Returns | 936% (claimed) | 3–10% APY |

Security | Basic SSL | Cold storage, 2FA |

Support | Limited | 24/7, multi-channel |

Legitimate AI trading platforms like 3Commas and CryptoHopper charge fees ($14–$99/month), connect to verified exchanges, and avoid guaranteed returns.

Part 3: Security and Technical Performance

Qbotia uses a basic SSL certificate but lacks advanced security features like two-factor authentication, KYC, or audited smart contracts. The site, built with Bootstrap and Animate.css, is minimalistic and routes investment actions to an external HYIP engine (hyiprio.tdevs.co). This setup prioritizes quick deployment over robust infrastructure. Legitimate platforms like Binance offer cold storage, bug bounties, and proof of reserves.

3.1 Red Flags of Qbotia Crypto Bot

- Anonymous Ownership: No team or company details.

- MLM Structure: Earnings tied to recruitment, not trading.

- Unrealistic ROI: 936% annual returns far exceed market norms.

- No Audits: No smart contract or security audits.

- Restricted Withdrawals: Limited to specific days/times, a liquidity control tactic.

- HYIP Template: Links to hyiprio. tdevs.Could you suggest a scam framework?

- No Regulatory Compliance: No SEC, FCA, or FinCEN registration.

- Generic Content: Vague “AI algorithms” claims without proof.

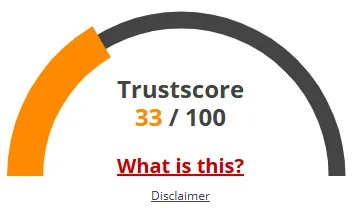

3.2 Public Perception and Traffic

Qbotia has low web traffic, with no presence on CoinMarketCap or CoinGecko. ScamAdviser flags Qbotia as a potential scam, indicating high risk for investors. Similarly, Scam-Detector gives it a low trust score, reflecting poor online credibility. While Gridinsoft rates the platform 72/100, it still warns users to exercise extreme caution before investing. These independent scam analysis tools highlight major red flags, suggesting that Qbotia may not be a safe or legitimate investment option.. No Trustpilot reviews exist, and social media promotion is limited to unverified YouTube/Kick channels (@Q-BOTIA) touting “3% diario.” This contrasts with Binance’s 150M+ users and transparent marketing.

3.3 Payment Methods and Customer Support

Payments are limited to USDT-BEP20, which is anonymous and irreversible, posing risks for recovery. No fiat options or regulated gateways are offered. Customer support is minimal, with no phone, live chat, or verified email, unlike Coinbase’s 24/7 support.

Future Outlook

Qbotia’s HYIP model suggests a short lifespan (6–18 months):

- Launch (0–2 months): Aggressive promotion, early payouts.

- Growth (2–6 months): Peak deposits, increasing restrictions.

- Saturation (6–12 months): Slowed recruitment, withdrawal delays.

- Exit (12–18 months): Site offline, funds gone.

Historical scams like PlusToken ($2B loss) followed this pattern.

Recommendations for Investors

- Avoid Investment: Do not deposit funds due to high scam risk.

- If Invested: Attempt withdrawals immediately, document transactions, and report to authorities (FTC, IC3).

- Alternatives: Use regulated platforms like Coinbase or CryptoHopper.

- Wallet Hygiene: Segregate Qbotia-related addresses to avoid cross-contamination.

- Report Promoters: Flag suspicious YouTube/Kick channels to platforms.

DYOR Tools for Qbotia Safety

- WHOIS Lookup: who.is/whois/qbotia.pro

- ScamAdviser: scamadviser.com/check-website/qbotia.pro

- VirusTotal: virustotal.com/gui/url

- Chainabuse: chainabuse.com

- FTC Fraud Report: reportfraud.ftc.gov

Conclusion: Qbotia Reliability for Crypto Trading

This Qbotia review reveals a platform with alarming red flags: anonymous operators, unsustainable 3% daily returns, and a referral-heavy model pointing to a Ponzi scheme. Its lack of regulation, audits, and transparent support makes it a high-risk investment. Investors should avoid Qbotia and opt for trusted platforms like Binance or 3Commas. Always verify claims with independent tools and consult professionals before investing. Now visit People Getting Paid Review.

DYOR Disclaimer: This Qbotia review is for informational purposes only, based on data as of October 14, 2025. It is not financial advice. Conduct your own research, verify claims, and consult licensed advisors. Never invest more than you can afford to lose.

Qbotia Review Trust Score

A website’s trust score is an important indicator of its reliability. Qbotia currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Qbotia or similar platforms.

Positive Highlights

- SSL certificate verified as valid.

- DNSFilter marks the website as safe

Negative Highlights

- Website has low visitor traffic.

- Several low-rated sites share the same server.

- Several spammers and scammers use the same registrar

Frequently Asked Questions About Qbotia Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Likely a scam, no team info, no license, and unrealistic 3% daily ROI.

No. That equals 936%, which is mathematically impossible and unsustainable yearly.

Hidden owners, referral-only income, restricted withdrawals, and fake AI claims.

Only via USDT-BEP20, twice a week, classic Ponzi-style liquidity limit.

Everstead shows partial transparency; Qbotia hides all details and regulations.

Other Infromation:

Website: qbotia.pro

Reviews:

There are no reviews yet. Be the first one to write one.