Profit Miner Review: A Comprehensive Look at Legitimacy, Risks, and ROI Claims

ProfitMiner.pro is an online platform that claims easy earnings through crypto mining and trading. However, after a thorough investigation, we find numerous red flags that suggest this platform may be a high-risk investment or possibly a scam. Key concerns include its anonymous ownership, unsustainable return claims, and reliance on a multi-level marketing (MLM) structure. These characteristics are typical of Ponzi schemes. Additionally, the lack of regulatory oversight and the platform’s dependence on new investments to pay out returns raise significant concerns.

If you’re still uncertain about the legitimacy of ProfitMiner.pro, we recommend visiting Scam Radar, where the latest scams are published and reviewed. Stay informed and always conduct thorough research before making any investments.

Table of Contents

Part 1. Legitimacy and Ownership Transparency

One of the most critical aspects of any investment platform is transparency, especially regarding ownership and operational legitimacy. Profit Miner Pro fails to provide adequate details on its ownership, raising concerns about its authenticity.

- Domain Age: The platform was launched recently, with its domain being registered on April 8, 2025. A new domain is often a red flag for potential scams, as these platforms can operate briefly before disappearing with users’ funds.

- Anonymous Ownership: Transparency builds trust in any crypto mining platform. Yet, Profit Miner falls short. The domain profitminer.pro uses WHOIS privacy, hiding owner details. No company registration, physical address, or team backgrounds appear. Mentions of profiles like Zorisa Zhange or Jahmel Francis lack verifiable credentials, suggesting fabricated bios.

Regulatory Warnings: Similar platforms have already been flagged by financial authorities. It is like the UK’s Financial Conduct Authority (FCA) for operating without authorization, suggesting ProfitMiner.pro might follow the same pattern.

Part 2. Compensation Plan & ROI Sustainability

The most striking feature of ProfitMiner is its compensation plan, which promises unrealistically high returns. The platform uses a multi-level marketing (MLM) structure that incentivizes users to recruit others in exchange for commissions.

2.1 ROI Claims and Why They Don't Add Up

Promises include 15% monthly or higher. Let’s calculate sustainability. Also they promise 1.5% daily simple interest: 365 days x 1.5% = 547.5% yearly. Compounded, it jumps to over 22,000%.

No legit operation sustains this. Bitcoin mining yields 5-12% annually after costs. The math proves impossibility. A $1,000 deposit at 1.5% daily needs constant inflows to pay out. Without them, it collapses like a Ponzi.

2.2 Comparison table:

Investment Option | Typical Annual ROI | Key Notes |

Profit Miner Claims | 180-500%+ | Fixed, recruitment-based; high risk of loss |

Real Estate | 7-10% | Stable, asset-backed; long-term growth |

Bank Savings | 4-5% | Secure, low yield; insured deposits |

Crypto Exchange APY | 5-20% | Variable, regulated platforms like Binance |

Part 3. Unmasking the Red Flags and Public Concerns Behind the Hype

3.1 Red Flags & Risk Indicators

Several key characteristics of ProfitMiner.pro align with common Ponzi schemes:

- Anonymous setup: Hidden owners avoid scrutiny.

- Unreal yields: Exceed benchmarks by far.

- Referral focus: Profits depend on others joining.

- Low traffic: Minimal organic visits suggest hype-driven growth.

- Poor reviews: Sites like ScamAdviser rate it low trust.

- Crypto-only payments: No reversals if problems occur.

- Generic content: Testimonials seem fabricated, no proofs.

Public views lean negative. Forums and alerts label it risky. No positive, independent stories surface.

3.1 Public Perception

Traffic Trends

Based on third-party traffic analysis, ProfitMiner.pro shows limited organic traffic, with much of its website visits likely originating from paid ads and recruitment-based social media posts. This type of traffic pattern is commonly associated with scam websites, which rely on temporary promotional boosts to attract new investors before vanishing.

Online Reputation

A search for ProfitMiner.pro online reveals predominantly negative reviews across various platforms:

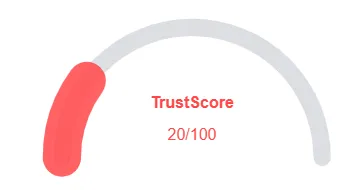

- ScamAdviser assigns a low trust score to the platform due to its anonymous ownership and lack of transparency.

- Social Media: The platform has a minimal and suspicious social media presence. Profiles promoting it often have low engagement and seem to be created solely for advertising purposes.

Part 4. Exposing the Risks of Crypto Payments, Weak Security, and Limited Support

4.1 Payment Methods & Withdrawals

The platform only accepts cryptocurrency for deposits, which is a significant red flag. Cryptocurrencies are irreversible and untraceable, meaning once funds are sent, there is no way to recover them if the site disappears.

4.2 Security Measures

While the website does use SSL encryption to secure data transfer, this is a basic measure that all websites, including scam sites, can implement. SSL certificates only ensure that data transmitted between the user and the site is encrypted; they do not guarantee the legitimacy or security of the platform.

4.3 Customer Support

The customer support on ProfitMiner.pro is limited to email and a generic contact form. The lack of live chat or phone support raises concerns about the platform’s ability to assist users if problems arise.

Recommendations:

- Do Not Invest: Due to the high risk of losing your funds, it is strongly advised not to invest in ProfitMiner.pro.

- Do Your Own Research: Always conduct thorough research before investing in any platform, especially those that promise high returns with little risk.

Profit Miner Review Conclusion

Based on a thorough analysis of ProfitMiner.pro, it’s clear that this platform exhibits all the hallmarks of a Ponzi scheme. The unrealistic ROI claims, lack of regulatory oversight, anonymous ownership, and reliance on a multi-level marketing structure make it a high-risk investment with significant potential for total loss. For more information on similar scams, check out our Decentralized Finance System Review.

DYOR Disclaimer

This analysis is provided for informational purposes only and does not constitute financial advice. Always consult a licensed financial advisor and perform due diligence before making any investment decisions.

Profit Miner Review Trust Score

A website’s trust score is a critical indicator of its reliability. Profit Miner currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Profit Miner similar platforms.

Positive Highlights

- Content accessible, no errors.

- Accessible and error-free content.

Negative Highlights

- AI Review Rate: Low

- Archive: New

- Whois Data: Hidden

- Domain Rank: Outside Top 1M on Tranco list

Frequently Asked Questions About Profit Miner Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, ProfitMiner.pro shows clear signs of being a Ponzi scheme, with unsustainable returns and anonymous ownership.

Promises include 15% monthly or higher, which is mathematically impossible and highly unsustainable.

Given its Ponzi structure, it’s unlikely that withdrawals will be processed as promised once the platform begins to collapse.

No, investing in ProfitMiner Pro is highly risky and could result in significant financial loss.

Other Infromation:

Website: profitminer.pro

Reviews:

There are no reviews yet. Be the first one to write one.