Pool Pays Review: Legit DeFi Platform or Hidden Scam?

In this Pool Pays review, Scams Radar examines the platform’s claims and risks. Many people search for Pool Pays scam details or Pool Pays Ponzi warnings. Launched in late 2025, it promises easy earnings from gaming. But questions arise about its structure. We look at ownership, compensation, and sustainability. This helps you decide if it’s safe.

Table of Contents

Part 1: What Is Pool Pays? Key Claims and Operations

Pool Pays calls itself a DeFi gaming system. It runs on Arbitrum, a blockchain network. Users deposit crypto like USDC or ETH. The minimum starts at $10. They say you earn from games like slots and casinos. Profits come from the house edge. This means users share in betting wins.

The site defaults to Portuguese. It targets places like Brazil. They claim $80 million in early revenue from 2023 to 2025. Yet the domain was registered in September 2025. No proof backs this history. Pool Pays fake history, new domain red flags stand out here. No real games show up. No licenses for gaming exist. This raises doubts.

Part 2: Ownership and Leadership: Who Runs Pool Pays?

Ownership stays hidden. Domain details are private. No names appear on the site. One link points to Thiago Malcher. He made a marketing slide deck. It uses stock photos and vague promises.

Malcher has no crypto background. Searches show engineering papers from Brazil. He posts tech tips on TikTok. No LinkedIn or finance ties. Pool Pays anonymous operators, no transparency fits scam patterns. Without clear leaders, accountability vanishes. If issues hit, no one to contact.

This differs from real platforms. They list teams and records. Here, it’s all secret. Pool Pays promoter profiles lack depth. No past ventures show up.

Part 3: The Compensation Plan: How Pool Pays MLM Works

Pool Pays uses a multi-level setup. Join for free, but invest $100 USDC to start. Earnings come from investments and recruits. No products sell. Pool Pays no product means it’s membership-only. This is flagged as a pyramid.

Duration | Daily ROI | Total Return | Example on $100 |

1 Day | 0.5% | 0.5% | $0.50 |

5 Days | 0.6% | 3.0% | $3.00 |

10 Days | 0.7% | 7.0% | $7.00 |

20 Days | 0.9% | 18.0% | $18.00 |

3.1 Why Pool Pays Unsustainable Fixed Returns: Warnings Apply

No outside income exists. Why poolpays.com has no real games or revenue, is clear. Funds are recycled from new users. For 1,000 investors at $100 each, daily payouts hit $700. Add commissions; more are needed. Growth must double fast. Pool Pays crypto Ponzi no gaming license exposed here.

Compare to real options.

Pool Pays vs real crypto gaming platforms like Axie shows gaps. Real ones have audits and variable yields.

Red Flags and Pool Pays Pyramid Risks

- Fixed gains with no risk talk.

- Recruitment drives 70% earnings.

- Low traffic, spam marketing.

- Trust scores: ScamAdviser 1/100.

- Pool Pays withdrawals may freeze soon.

- User complaints, Pool Pays withdrawal delays emerge early.

- Risks of Pool Pays’ financial empowerment pitch hide losses.

- Pool Pays productless MLM collapse risks 2025 loom.

- How Pool Pays recycles deposits,s Ponzi blueprint matches old scams.

Public Perception and Promotion

Social media shows little buzz. @Poolpaysglobal posts hype with few likes. No big backers. Pool Pays promoter membership-only model pushes referrals. Past promoters tied to flops like OneCoin.

Future Outlook: Pool Pays Guaranteed Shutdown Timeline Signs

Patterns suggest an end by mid-206. Early wins fade as recruits drop. Is Pool Pays a legitimate or carnival rigged game? Signs point to a rigged.

Conclusion: Stay Safe in Your Pool Pays Review

This Pool Pays review shows high risks. Avoid if seeking stable gains. Choose audited options like Aave. Recovering funds from the Pool Pays membership scam may prove hard. Report issues to the SEC or the FTC. Always check facts. Invest wisely.

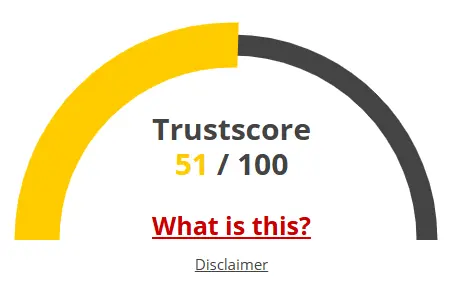

Pool Pays Review Trust Score

A website’s trust score is an important indicator of its reliability. Pool Pays currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Pool Pays or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Pool Pays Review

This section answers key questions about Pool Pays, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Pool Pays is risky with hidden ownership and no gaming licenses, making it questionable for investors.

It’s an MLM system relying on investments and recruitment, with no actual products sold.

Yes, it uses new funds to pay old ones, showing Ponzi-like traits.

There are no verified games or licenses, despite claims of earnings from gaming.

Both platforms have high risks, focusing on recruitment and fixed returns rather than real products.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.