Pol Queen Review: Uncovering the Truth Behind Polqueen.com

In this Pol Queen review, Scams Radar dives deep into polqueen.com, a platform claiming high returns through crypto staking. Many seek quick gains in digital assets. Yet, promises often hide risks. This analysis combines facts from multiple sources. It covers ownership, compensation plans, and more. Scams Radar aims to help everyday investors decide wisely.

Table of Contents

Part 1: What Is Pol Queen and How Does It Work?

Pol Queen refers to polqueen.com, marketed as a Polygon-based investment site. It offers staking with 5% daily ROI forever. Users start with as little as 1 POL token. The site uses a rewards page for wallet connections. It shows contract balances and user deposits. Promotions highlight “safe, secure” long-term gains without quick-rich schemes.

The setup involves connecting a Web3 wallet. Users deposit POL assets. Earnings accrue daily. Withdrawals go directly to wallets. But details on revenue sources stay vague. No clear explanation of how funds grow exists. This raises questions for new users.

1.1 Ownership and Background: Who Runs Pol Queen?

Ownership details remain hidden. WHOIS data shows registration on September 5, 2025, via Hostinger. Privacy services mask the registrant’s identity. Hosting ties to Indonesian IPs. DNS uses ns1.dns-parking.com & ns2.dns-parking.com. These obscure true locations.

No team profiles appear on the site. Public records lack company registration or legal presence. No physical address or regulatory licenses show up. This anonymity fits scam patterns. Legit platforms share founder bios and credentials. Here, operators avoid accountability. Past similar sites often lead to rug pulls, where funds vanish.

Profiles of promoters offer clues. Social media accounts push the site. For example, Facebook user Marvin Montenegro shares referral links. Posts claim “no scam” but lack proof. Telegram channel @polqueen has about 179 subscribers. It promotes 5% daily plus bonuses. These accounts show no verifiable histories. Many shift to new schemes after old ones fail. No established experts back Pol Queen.

Part 2: Compensation Plan Breakdown

The plan centers on staking and referrals. Users stake POL for 5% daily returns. This compounds over time. A multi-level referral system adds income:

- Level 1: 10% commission on referrals’ deposits

- Level 2: 5% from their referrals

- Level 3: 3%

- Level 4: 2%

Payments hit wallets instantly. Promotions call it a “kingdom” for wealth building. But no caps or timelines apply. This MLM structure relies on recruitment. It mirrors Ponzi schemes, where new money pays old users.

Simple example: Stake $100 worth of POL. Daily earn $5. In 30 days, the balance grows to about $432 (compounded). Refer one person staking $100: Earn $10 upfront. Their referrals add more. Yet, sustainability depends on constant inflows.

2.1 Why the ROI Claims Don't Add Up: Math Explained

5% daily forever sounds great. But math shows it’s impossible. Use compound interest formula: A = P(1 + r)^t

- P = principal ($1,000)

- r = daily rate (0.05)

- t = days (365)

A ≈ $1,000 * (1.05)^365 ≈ $54 billion. That’s unreal. No asset grows like this without huge risks.

For scale: With 1,000 users at $100 each, daily payouts would require $ 100,000. To grow, it requires an endless supply of new funds. Real markets can’t match.

Investment Type | Annual ROI | Risk Level | Sustainability |

Bank Savings | 1-5% | Low | FDIC-backed, stable |

Real Estate | 5-10% | Medium | Tangible assets, steady |

Legit Crypto Staking (Polygon) | 5-15% | High | Audited, volatile |

Pol Queen Claims | ~182,500% | Extreme | Ponzi-reliant, collapses |

Part 3: Traffic Trends and Public Views

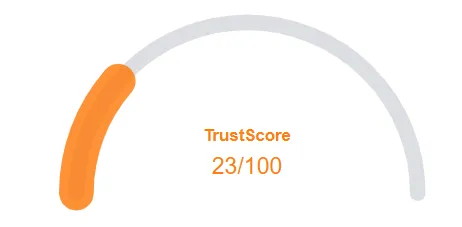

Traffic stays low. SimilarWeb shows minimal visitors. This fits new scams targeting niches. Public views are poor. Scamadviser gives a 1/100 trust score. It flags as a high-risk HYIP. No positive reviews on Trustpilot. Searches yield scam warnings only.

On socials, no buzz on X. Promotion via Telegram and Facebook uses referral IDs like #1086. Anonymous accounts hype luxury gains. Past posts from similar profiles push defunct HYIPs.

3.1: Security, Content, and Support

SSL exists via ZeroSSL. But it’s basic, not a trust seal. No 2FA or audits noted. Content feels sparse. Main site loads dynamically; rewards page shows 0 POL balance often. This suggests low activity or issues.

Payments use crypto wallets. Irreversible transfers aid scammers. Support? Non-formal. Rely on social DMs. No emails, chats, or phones.

Technical side: Proxied hosting hides origins. Domain youth (one month old) amps risks. Scams run short before shutdowns.

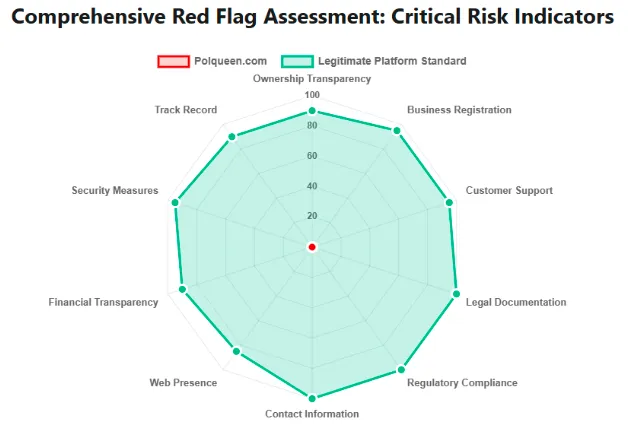

Red Flags and Tool Reports

Key warnings:

- Unreal 5% daily: Defies economics.

- Hidden owners: No accountability.

- No audits or regs: Illegal vibe.

- MLM focus: Recruitment over value.

- Low trust scores: Scamadviser 1/100.

Future Outlook and Predictions

Pol Queen fits the Ponzi lifecycle. Early payouts build trust. Then delays hit. The site may vanish in 3-6 months. Victims lose all. Regs struggle with crypto borders. Expect more shilling before exit.

Recommendations for Investors

Skip Pol Queen. Report to ScamAdviser or BBB. Use hardware wallets. Choose audited platforms like Binance for staking.

Stick to real options: Banks for safety, real estate for growth, legit crypto for higher yields.

Key concerns: Long presale, no mainnet, opaque ownership, high referral incentives, unverified partnerships. Unlike banks with FDIC insurance or real estate with tangible assets, this is a speculative investment.

BlockDAG smart contract compatibility claims EVM, but no proof. Vs Bitcoin security, it adds DAG for speed but lacks a track record.

Pol Queen Review Trust Score

A website’s trust score is an important indicator of its reliability. Pol Queen currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Pol Queen or similar platforms.

Positive Highlights

- Website content is accessible

- According to the SSL check the certificate is valid

Negative Highlights

- This website does not have many visitors

- Cryptocurrency services detected, these can be high risk

- Several spammers and scammers use the same registrar

Frequently Asked Questions About Pol Queen Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

A Polygon staking site promising 5% daily returns, but with no real revenue proof.

It hides owners, lacks audits, and shows Ponzi-style red flags.

Pays up to 10% on recruits’ deposits across four levels.

Everstead Review evaluates real firms; Pol Queen pushes unsustainable 5% daily payouts.

Unlikely crypto transfers are irreversible, and the team is anonymous.

Other Infromation:

Website: POLQUEEN.COM

Reviews:

There are no reviews yet. Be the first one to write one.