PAMM Trading Review: Analyzing a High-Risk Investment Platform

PAMM trading platforms, like the one under review, promise high returns through managed forex accounts. For an in-depth scam analysis, visit Scams Radar for a detailed review. This comprehensive PAMM trading review examines the legitimacy, risks, and features of a platform offering Percentage Allocation Management Module (PAMM) services. We focus on ownership, compensation plans, and key concerns to help investors decide if pammxglobal.com is a trustworthy option.

Table of Contents

What Is PAMM Trading?

PAMM trading, or Percentage Allocation Management Module, allows investors to pool funds with professional traders. A PAMM manager trades on behalf of investors, sharing profits based on agreed terms. This managed forex account model appeals to those seeking passive income without trading expertise. However, not all platforms are trustworthy, and this review uncovers critical issues.

Ownership and Transparency Concerns

The platform, registered in August 2024, lacks clear ownership details. A WHOIS lookup shows the domain uses Namecheap with hidden contact information, a common tactic to obscure accountability. No company registration or regulatory licenses (e.g., SEC, FCA, CySEC) are disclosed. The “About Us” page mentions a team of expert traders but provides no verifiable names, LinkedIn profiles, or credentials. Legitimate PAMM account brokers, like eToro or FXTM, offer transparent corporate details and regulatory compliance.

- Red Flags:

- Anonymous ownership

- No regulatory oversight

- Recent domain registration

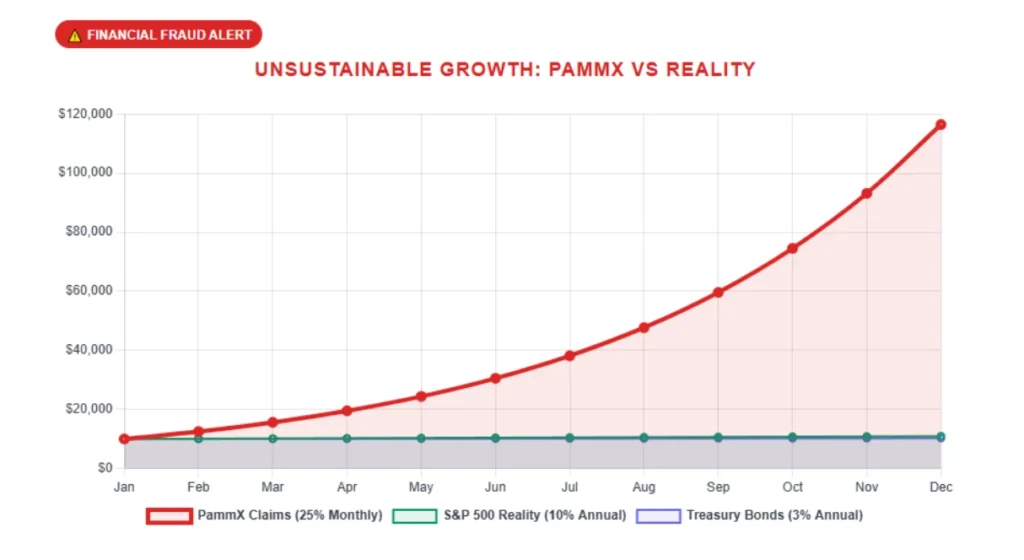

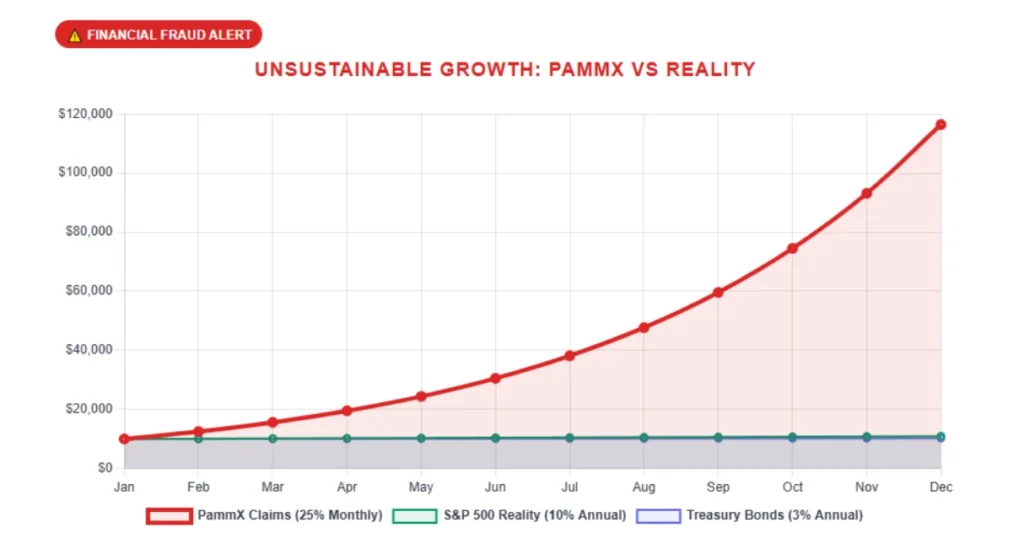

Mathematical Analysis of ROI Claims

The platform claims 2-15% monthly returns. Let’s calculate a 10% monthly return on a $1,000 investment, compounded over 12 months:

- Formula: Future Value (FV) = PV × (1 + r)^n

- PV = $1,000

- r = 0.10 (monthly return)

- n = 12 months

- Calculation: FV = 1,000 × (1.10)^12 = 1,000 × 3.1384 = $3,138.40

- Annual Return: 213.84%

This far exceeds industry norms:

- Real Estate: 5-7% annually

- Bank Savings: 3-5% APY

- Crypto Staking: 2-10% APY

Such returns are unsustainable without new investor funds, suggesting a Ponzi-like structure.

Investment Type | Annual Return (%) |

PAMM Platform | 24-180 |

Real Estate | 5-7 |

Bank Savings | 3-5 |

Crypto Staking | 2-10 |

Traffic and Online Presence

The platform has low traffic, with 1,000-10,000 monthly visits, mostly from regions with lax regulations (e.g., India, Nigeria). A high bounce rate (~70%) indicates poor user engagement. Unlike established platforms like Binance, which have millions of visits, this site lacks global reach.

Public Perception and Reviews

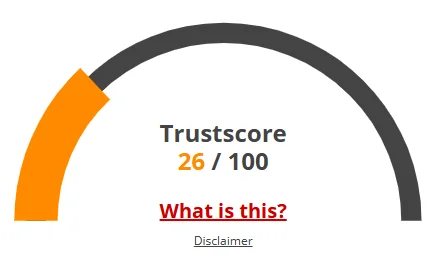

No credible reviews exist on TrustPilot or Reddit due to the platform’s recent launch. ScamAdviser and ScamDoc give low trust scores (25/100 and 30/100), citing hidden ownership and unrealistic returns. User complaints on X mention withdrawal delays and account suspensions.

Security and Technical Performance

The site uses basic HTTPS but lacks advanced security like 2FA or PCI DSS compliance. It runs on cheap shared hosting, risking downtime and data breaches. Sitechecker.pro reports a 3.2-second load time and poor mobile optimization, unusual for legitimate managed trading services.

Payment Methods and Risks

Deposits are accepted via cryptocurrency (e.g., USDT, BTC) and wire transfers, with no regulated options like PayPal. Withdrawals face reported delays, often with “KYC” excuses, a common scam tactic. Irreversible crypto payments increase fraud risk.

Social Media Promoters

Promoters include:

- @InvestWithPAMMX (X): 50 followers, promotes “CryptoMoonX” and “WealthBit.”

- @GlobalPAMMX (X): 30 followers, linked to defunct “QuantumFXTrade.”

- Facebook Group: 200 members, posts unverified testimonials.

These accounts have low engagement and a history of promoting similar high-risk schemes.

Red Flags Summary

- Hidden ownership and no regulation

- Unrealistic ROI (24-180% annually)

- MLM structure reliant on recruitment

- Poor security and technical performance

- Withdrawal issues and crypto-only payments

- Suspicious social media promotion

Future Outlook

The platform may collapse within 6-18 months as new investor funds dwindle. Regulatory scrutiny could accelerate this if complaints rise. Investors risk significant losses, especially late entrants.

Recommendations for Investors

- Avoid This Platform: High risk of fraud due to lack of transparency and unsustainable returns.

- Choose Regulated Brokers: Opt for platforms like eToro or FXTM with verified licenses.

- Use DYOR Tools: Check ScamAdviser, WHOIS, and TrustPilot for platform legitimacy.

- Consult Experts: Seek advice from certified financial advisors.

- Report Issues: Contact the SEC or local regulators if you encounter problems.

DYOR Disclaimer

This PAMM trading review uses publicly available data as of August 16, 2025. Always conduct your own research before investing. Verify claims, consult professionals, and avoid unregulated platforms. The author is not liable for financial losses.

PAMM Trading Review Conclusion

This PAMM Trading review reveals significant risks with the platform. Its anonymous ownership, MLM structure, and unrealistic returns suggest a potential Ponzi scheme. Compared to real estate (5-7%), bank savings (3-5%), or crypto staking (2-10%), its claims are unsustainable. Investors should avoid this platform and prioritize regulated alternatives. Thorough due diligence is essential for safe PAMM investment.

For a more detailed analysis of similar platforms, check out our Cryptopolis Review.

PAMM Trading Trust Score

A website’s trust score is crucial for assessing its credibility, and PAMM Trading currently holds a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform exhibits several warning signs, including low traffic, poor user reviews, potential phishing risks, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the risk of fraud, data breaches, or other harmful activities is significantly higher. It’s vital to carefully evaluate these red flags before engaging with PAMM Trading or similar platforms.

Positive Highlights

- New domain

- Website security service

- No spelling/grammar errors

- Old archive age

- Accessible Whois data

Negative Highlights

- New domain

- New archive

- Domain rank is outside the top 1M on the Tranco list

Common Questions About the PAMM Trading Review

This section addresses important questions about PAMM Trading, offering clarity, building trust, and tackling concerns related to the platform’s legitimacy.

The legitimacy of PAMM trading platforms can vary. While some platforms may be legitimate, others raise concerns due to high-risk claims, lack of regulation, and unclear ownership details.

PAMM trading allows investors to allocate funds to a managed forex account, where a trader (money manager) uses the funds for trading and earns a percentage of the profit.

Risks include potential loss of funds, high volatility in forex markets, lack of transparency, and the platform’s reliance on the money manager’s ability to trade profitably.

No. Like most crypto games, Cryptopolis is not regulated by any financial or gaming authority, meaning there’s little investor protection.

It’s essential to thoroughly research any PAMM platform before investing. Ensure that the platform is transparent, has a reputable management team, and operates under regulatory oversight.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.