Orbitra AI Review: Assessing Legitimacy and Investment Risks

In this Orbitra AI review, Scams Radar examines the platform at orbitraai.com. It claims to offer AI-driven crypto trading with high daily returns. We combine insights from multiple analyses to help you decide if it’s worth your money. Our focus covers ownership, compensation plans, returns, and red flags. This guide uses simple terms for everyday readers.

Table of Contents

Part 1: What Is Orbitra AI?

Orbitra AI positions itself as an AI-powered tool for crypto trading. It uses algorithms to predict market moves. Users deposit funds starting at $50. The system then trades automatically. It promises returns from 1% to 5% per day. The site highlights features like low-latency execution and risk management. It also includes videos on how to register and withdraw. But many reviews question its claims.

The platform ties returns to VIP levels. Higher deposits unlock better rates. It relies on referrals for growth. This setup raises concerns about sustainability. We found no evidence of actual AI technology, such as code or logs. The content feels generic, similar to other high-yield sites.

1.1 Ownership and Background Details

Ownership stays hidden on the site. No team names or bios appear. No LinkedIn links exist. This lack of info is common in risky schemes. The site shows certificates for registration, compliance, and trade authorization. But these lack details.

Searches show mixed company numbers. One is 15098313 for a basic UK firm. Another is 15900257 for ORBITRADE LTD, set up in August 2024. Its code is for retail, not finance. Directors include Khadijah Mohammed Gera and Ahmed Adewale Adeleke. Adeleke holds major shares. But no links to crypto or AI expertise. No public profiles for them. UK registration costs little and means no financial oversight. No FCA license found. This mismatch signals misdirection. Legit firms share full backgrounds.

Part 2: Complete Compensation Plan Breakdown

The plan centers on VIP tiers. Deposits in USDT activate levels. Each has daily returns, trade limits, and team needs. Team A means direct referrals. B+C covers indirect ones.

VIP Level | Deposit Range | Daily ROI | Daily Trades | Team Requirements (A: Direct, B+C: Indirect) |

1 | $50 – $500 | 1% – 1.5% | 2 | None |

2 | $501 – $2,500 | 1.5% – 1.95% | 3 | A: 5, B+C: 10 |

3 | $2,501 – $7,500 | 2% – 2.5% | 4 | A: 7, B+C: 23 |

4 | $7,501 – $30,000 | 2.5% – 2.95% | 5 | A: 20, B+C: 40 |

5 | $30,001 – $60,000 | 3.5% – 3.95% | 6 | A: 30, B+C: 90 |

6 | $60,001 – $100,000 | 4% – 5% | 8 | A: 50, B+C: 250 |

Earnings come from multiple streams. Level commissions reward network growth. Trading profit shares gives cuts from team trades. Staking adds passive rewards. Monthly salaries based on activity. Upgrade bonuses hit when levels rise. Direct commissions pay for new sign-ups. This focuses on recruitment over trading. It mirrors MLM setups where new funds pay old ones.

2.1 Referral System in Detail

Referrals drive the model. Users get codes to invite others. Rewards include direct pay and team profits. Leadership bonuses kick in for milestones. Profit sharing is tied to group performance. Staking and salaries encourage long holds. But team thresholds lock higher tiers. This pushes constant recruiting. Without it, returns stay low. Analyses link this to Ponzi traits.

2.2 ROI Claims and Proof of Unsustainability

Orbitra AI touts 1% to 5% daily. This sounds great, but fails math tests. Let’s calculate 2% daily on $1,000.

Use compound formula: Value = Principal × (1 + Rate)^Days

- After 30 days: $1,000 × (1.02)^30 ≈ $1,811

- After 90 days: $1,000 × (1.02)^90 ≈ $5,943

- After 180 days: $1,000 × (1.02)^180 ≈ $35,333

- After 365 days: $1,000 × (1.02)^365 ≈ $137,740,000

A small sum turns huge fast. At 5%: $1,000 becomes over $54 billion in a year. No real strategy sustains this. Markets fluctuate. Top funds average 15-30% yearly. This needs endless new money.

For a graph view, imagine a line chart. X-axis: Days (0-365). Y-axis: Value (log scale). It shoots up exponentially. Real investments grow steadily. This proves to collapse when recruits drop.

2.3 Comparisons to Legitimate Options

Investment Type | Typical Annual Return | Risk Level | Key Notes |

Bank Savings | 3-5% | Low | Insured, stable |

Real Estate | 7-10% | Medium | Physical asset, market risks |

S&P 500 | 10% | Medium | Historical average, diversified |

Crypto Staking | 5-20% | High | On regulated exchanges like Binance |

Orbitra AI Claim | 365-1,825% | Extreme | Unsustainable, unregulated |

Banks offer safety. Real estate gives steady yields. Crypto staking on Coinbase is 4-6% for ETH. Orbitra’s numbers dwarf these. They signal fraud per regulators.

Part 3: Traffic Trends and Public Perception

Traffic stays low, under 10,000 visits monthly. High bounce rates over 70%. Sources are direct or referrals, no organic search. Focus on India and Nigeria. This fits HYIP patterns.

Perception is poor. Scamadviser gives low trust. GridinSoft is flagged as a scam. No Trustpilot reviews. Reddit ties similar bots to fraud. X posts are promotional, not user stories. Links to failed schemes like Bitconnect.

3.1 Security, Payments, and Support

Security claims adaptive risks. But only basic SSL. No audits or 2FA. No cold storage.

Payments are limited to USDT on BEP20/TRC20. Irreversible, no fiat. Scams favor this.

Support lacks. No email, phone, or chat. Big warning.

The technical side is basic. Shared servers with shady sites. Low investment in setup.

3.2 Social Media Promoters

Many X handles push it. @CryptoCaesarTA touted AI agents, past gems. @GurlShild promoted trade patterns, past launches. @xiacalls did Solana, past Web3. Others like @Kemeebassey, @CryptoEnact promote similar. They often back failed projects. This hints at affiliate drives.

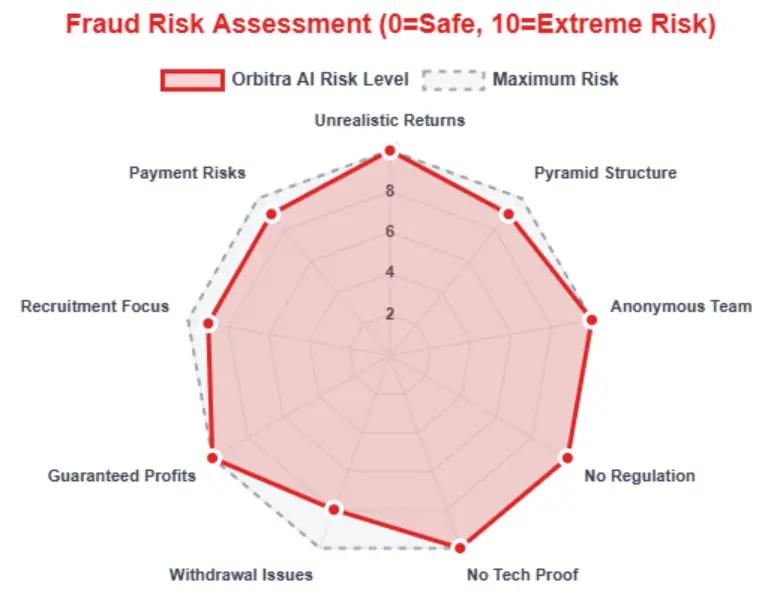

Key Red Flags

- Anonymous owners, no backgrounds.

- No real regulation, just a basic UK setup.

- Impossible returns, math shows failure.

- Referral-heavy, like Ponzi.

- Generic content, no AI proof.

- Crypto-only pays, no support.

- Low traffic, negative views.

- Mismatched company details.

DYOR Tool Reports

WHOIS: Hidden owner, young domain.

Scamadviser: Suspicious, low rank.

Trustpilot: No data.

Scam-Detector: High risk.

URLVoid: Potential flags.

Reddit: General warnings on AI bots.

Future Predictions

HYIPs like this pay early to build trust. In 6-12 months, recruitment slows. Then the collapse hits. Operators flee. Regulators may step in. Rebrands extend life, but the end comes.

Recommendations

Skip Orbitra AI. Choose regulated tools like QuantConnect. For crypto, use audited exchanges. Report suspicious sites to FCA or SEC.

Conclusion:

This Orbitra AI review highlights major risks. Hidden owners, wild returns, and referral focus point to trouble. Always check facts yourself. Markets reward patience, not quick wins. Consult experts before investing. This info is based on public data as of October 2025. Verify changes.

Now visit Qbotia Review.

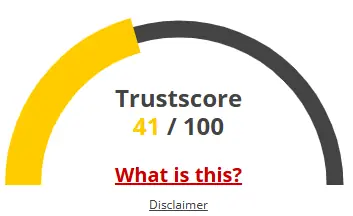

Orbitra AI Review Trust Score

A website’s trust score is an important indicator of its reliability. Orbitra AI currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Orbitra AI or similar platforms.

Positive Highlights

- Valid SSL certificate found.

- DNSFilter marks the site as safe.

Negative Highlights

- Tranco rank is low (low traffic).

- The server hosts multiple low-reviewed sites.

- The site is very young.

Frequently Asked Questions About Orbitra AI Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No proof of real AI trading, hidden owners, and unrealistic ROI make Orbitra AI a high-risk platform.

It says profits come from AI crypto trading, but no verified trading data or audits support this claim.

Anonymous founders, no regulation, and Ponzi-style referrals are the biggest warning signs.

Both platforms promise high daily returns with unclear operations, raising similar scam concerns.

Use regulated exchanges like Binance or Coinbase, or invest in real estate or index funds.

Other Infromation:

Website: orbitraai.com

Reviews:

There are no reviews yet. Be the first one to write one.