OptimAI Review: Is node.optimai.network a Legitimate Investment?

This OptimAI review on Scams Radar examines the platform’s claims, ownership, rewards system, and potential risks. We analyze node.optimai.network, a decentralized platform promising rewards for sharing data and computing power. Using clear data, charts, and comparisons, this guide helps beginners understand if OptimAI is safe and sustainable..

Table of Contents

What Is OptimAI Network?

OptimAI Network claims to be a decentralized AI platform. Users run nodes to share bandwidth or computing resources, earning OPI tokens. It uses Layer-2 blockchain and DePIN (Decentralized Physical Infrastructure Network) technology. The platform promotes “passive income” through tasks like data mining and validation.

Ownership and Transparency

Understanding who runs a platform is key. OptimAI claims to be operated by OPTIMAI LABS LTD, registered in Liverpool, UK, since March 2024. However, no team members or executive profiles are disclosed. The domain uses privacy-protected WHOIS data via Namecheap, which limits transparency. No LinkedIn profiles or verifiable company details are available, raising concerns about accountability.

- Key Issue: Anonymous leadership increases risk.

- Comparison: Legitimate platforms like Coinbase list founders and regulatory details.

Compensation Plan Explained

The OptimAI compensation plan offers OPI tokens for running nodes (Browser, Edge, or Full Nodes). Users earn points through:

- Bandwidth Sharing: Contributing internet resources.

- Daily Missions: Completing tasks for extra points.

- Referral Bonuses: Earning from recruits’ rewards.

- Social Tasks: Linking social media for instant points.

Points convert to $OPI tokens via airdrops. However, tokenomics, conversion rates, and payout schedules are unclear. The referral system resembles multi-level marketing (MLM), where earnings depend on recruiting others. This structure raises sustainability concerns.

Reward Sustainability Analysis

et’s break down the math for clarity:

- Assumption: A user earns 100 OPI points daily, valued at $0.10 per point.

- Daily Earnings: 100 × $0.10 = $10.

- Annual Earnings: $10 × 365 = $3,650.

- Cost: $0.50/day (internet, electricity) = $182.50/year.

- ROI: ($3,650 – $182.50) / $182.50 × 100 = 1,900%.

If $OPI drops to $0.01, annual earnings fall to $365, reducing ROI to 100%. With 370,000+ nodes (claimed), daily token emissions could reach 37 million OPI. At $0.10, that’s $3.7 million daily in rewards, requiring massive revenue to sustain.

Reward Type | Points/Hour | Daily Cost (100K Nodes) | Sustainability Issue |

Bandwidth Sharing | 0.5–2 | $120,000 | High server costs |

Social Tasks | 5–10/task | $50,000 | No clear revenue source |

Referral Bonuses | 10–20/referral | Exponential growth needed | Pyramid-like structure |

Traffic and Public Perception

OptimAI claims 370,000+ users and 670,000+ nodes across 179 countries. Its Chrome extension has 90,000 users and a 4.9/5 rating from 37,500 reviews. However, these metrics lack independent verification. Traffic data shows a global rank of 1.2 million, with 75% from referral sources, suggesting paid promotions over organic interest.

- Positive: High app ratings indicate user satisfaction.

- Concern: Clustered reviews and airdrop-focused social media (e.g., @OptimaiNetwork on X, Telegram groups) suggest controlled narratives.

Security and Technical Performance

The platform uses TLS encryption and Cloudflare hosting, meeting basic security standards. However, no smart contract audits or security.txt files are disclosed. The Chrome extension requires broad permissions, posing privacy risks. Technical performance is unclear, with no uptime or processing speed metrics provided.

- Positive: Lightweight apps (1.6MB extension) suggest active development.

- Concern: Lack of audits increases vulnerability risks.

Payment Methods and Support

Rewards are paid in OPI points, convertible to $OPI tokens, but no exchange listings exist, making liquidity uncertain. Support is limited to contact@optimai.network and Telegram, with no live chat or phone options.

Red Flags

- Anonymous ownership and vague corporate details.

- Unsustainable ROI promises (1,900% vs. 8–15% for alternatives).

- MLM-like referral structure.

- No verified revenue or exchange listings for $OPI.

- Limited organic community engagement.

Social Media Promotion

Promotion is led by @OptimaiNetwork on X and Telegram (@OptimAI_Node_Bot). Community accounts on Reddit and Facebook focus on airdrops, often promoting other high-risk projects like CloudEarnings. This pattern suggests affiliate-driven marketing.

DYOR Tools

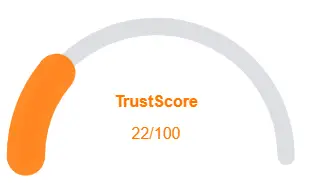

- ScamAdviser: Low trust score for node subdomain.

- WHOIS Lookup: Hidden ownership via Namecheap.

- Etherscan: Check $OPI token contracts post-TGE.

- VirusTotal: Scan apps for malware.

OptimAI Review Conclusion

This OptimAI review highlights significant risks in node.optimai.network’s model. Anonymous ownership, unclear tokenomics, and unsustainable ROI claims raise red flags. While the platform shows some technical promise, investors should prioritize safer options like real estate or regulated crypto staking. For comparison, you can also check our ARO Network Review to understand similar risks. Always verify claims independently before engaging.

Disclaimer: This review is for informational purposes only, not financial advice. Conduct your own research (DYOR) using tools like ScamAdviser and Etherscan. Consult professionals to assess risks in volatile crypto markets.

OptimAI Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 OptimAI currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with OptimAI similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New archive

- Hidden WHOIS data

Frequently Asked Questions About OptimAI Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

OptimAI is a decentralized platform where users can earn rewards by sharing data and computing power.

Our Scams Radar review highlights potential risks around transparency, ownership, and sustainability.

Rewards are earned by contributing computing resources and data to the network

As a decentralized and crypto-based system, risks include network volatility, operational issues, and uncertain ROI.

Yes, but understanding the platform’s model and inherent risks is essential before committing resources. Always DYOR (Do Your Own Research).

Other Infromation:

Website: node.optimai.network

Reviews:

There are no reviews yet. Be the first one to write one.