Opimee Review: Is This Survey Platform Legitimate or a Risky Scheme?

This Opimee review examines the legitimacy of a platform claiming to offer paid surveys for high returns. Operating on opimee.com, it requires users to buy licenses and join an affiliate program.

Our detailed analysis on Scams Radar reveals serious concerns about its ownership, compensation plan, and sustainability. Using clear data, charts, and comparisons, we highlight potential risks and help investors decide whether Opimee is safe or a risky scheme. Always perform your own research (DYOR) before investing.

Table of Contents

What Is Opimee?

Opimee positions itself as a survey platform connecting users with over 100 partner companies across seven sectors. Users purchase licenses (ranging from $9 to $72 monthly) to access surveys, complete tasks like clicks or videos, and earn rewards. It also offers a multi-level affiliate program with commissions up to 15% across eight levels. However, vague claims and lack of transparency raise doubts about its legitimacy.

Ownership and Transparency

The platform provides no clear information about its owners, leadership, or company registration. A WHOIS lookup shows the domain uses privacy protection, hiding registrant details. Legitimate survey platforms, like Swagbucks, openly share corporate details and regulatory compliance. This anonymity is a major red flag, limiting accountability and trust.

No Regulatory Oversight

There’s no evidence of registration with bodies like the SEC, FCA, or ASIC. Legitimate platforms disclose compliance with financial regulations. The absence of such details suggests potential risks for users, as there’s no legal recourse if issues arise.

Compensation Plan Breakdown

License-Based Earnings

Opimee requires users to buy licenses to participate:

- Basic ($9/month): 1 survey/day, $0.15-$0.25/survey

- Pro ($19/month): 2 surveys/day, $0.10-$0.25/survey

- Advanced ($32/month): Limited details

- Super Advanced ($72/month): 6 surveys/day, $1.50-$3.00/survey

For a $72 Super Advanced license, users could earn $9-$18 daily, totaling $1,620-$3,240 over 180 days. This implies an annualized ROI of over 3,600%, far exceeding legitimate investments.

Affiliate Program Concerns

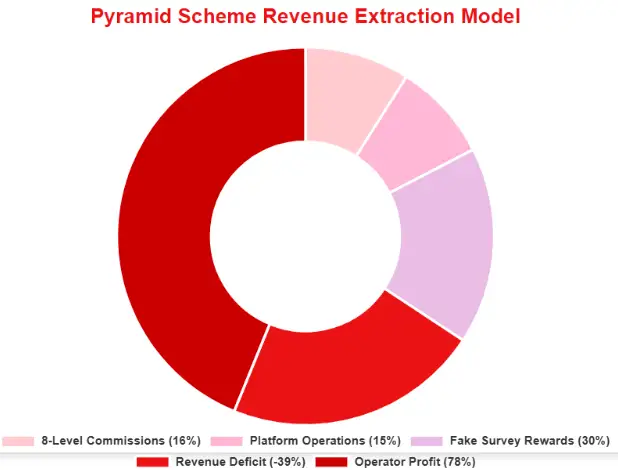

The affiliate program offers commissions (5%-15%) across eight levels, emphasizing recruitment over survey completion. This structure resembles a pyramid scheme, where earnings depend on new user investments rather than genuine survey revenue.

Mathematical Unsustainability

Let’s break down the economics:

- Assumption: $72 license, $2/day earnings

- Break-even: $72 ÷ $2 = 36 days (exceeds 30-day month)

- Platform Liability: 10,000 users earning $2/day = $600,000/month payout

- Market Reality: Surveys typically pay $0.50-$5, as seen with Qmee or Survey Junkie. Funding $600,000 monthly requires unrealistic client spending.

Investment Type | Annual ROI | Risk Level |

Real Estate | 3-10% | Low-Moderate |

Bank Savings | 0.5-5% | Low |

Crypto Staking | 1-10% | Moderate-High |

Opimee (Claimed) | 3,600%+ | Extremely High |

Traffic Trends and Public Perception

Traffic data from tools like SimilarWeb is unavailable, indicating low visibility or a new site. Sudden traffic spikes from regions like Brazil or Pakistan suggest paid promotions, not organic growth. Legitimate platforms show steady, diverse traffic.

Public Sentiment

No credible reviews exist on Trustpilot, Reddit, or similar platforms. Social media promotions, like Instagram posts (@opi_mee) or Brazilian Facebook groups, focus on affiliate links and “easy cash” claims, not user experiences. This lack of authentic feedback is concerning.

Security and Technical Performance

The site uses basic HTTPS but lacks details on 2FA, KYC, or GDPR compliance. Exclusive cryptocurrency payments (e.g., USDT, BNB) raise concerns, as they’re irreversible and hard to trace. Legitimate platforms offer regulated payment options like PayPal.

Technical Concerns

The website appears to use generic templates, with no evidence of robust infrastructure. Tools like GTmetrix or SSL Labs could reveal poor performance, but limited data suggests a low-budget setup, unlike established platforms.

Content Authenticity

Claims of partnerships with brands like Netflix or Amazon are unverified. Generic marketing phrases like “turn opinions into cash” and stock images suggest inauthentic content. Legitimate platforms provide clear survey details and client proof, which Opimee lacks.

Customer Support

No live chat, email, or phone support is listed. A vague “Help Center” in the footer is insufficient. Reliable platforms offer multiple contact channels, ensuring user trust and issue resolution.

Opimee Review Conclusion

This Opimee review highlights serious concerns: anonymous ownership, unsustainable returns, and a pyramid-like structure. Compared to real estate (3-10%), bank savings (0.5-5%), or crypto staking (1-10%), its claimed 3,600%+ ROI is unrealistic. Lack of reviews, weak security, and unverified claims further erode trust. Avoid this platform and prioritize regulated alternatives. Always conduct thorough research before investing. For similar insights, also check our detailed Arbmany Review.

DYOR Disclaimer: This review is for informational purposes only. It’s not financial advice. Verify all claims independently and consult licensed advisors. Never invest more than you can afford to lose.

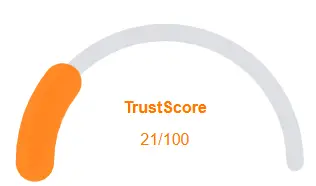

Opimee Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Opimee currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Opimee similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Whois data hidden

Frequently Asked Questions About Opimee Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Opimee raises red flags regarding ownership transparency and unsustainable earnings through licenses and referrals.

Users must buy licenses and recruit others via an affiliate program, which can resemble a pyramid structure.

High promised returns are not guaranteed and appear unsustainable compared to standard online survey platforms.

Payment methods and security measures are unclear, posing potential financial risks to users.

Investing carries high risk. Only participate after thorough research, and avoid investing more than you can afford to lose.

Other Infromation:

Website: OPIMEE.COM

Reviews:

There are no reviews yet. Be the first one to write one.