Omnisphere Review: A Close Look at This Crypto Staking Platform

If you’re searching for an Omnisphere review, you likely want straight facts on its staking and referral setup. This platform promises daily rewards through crypto deposits, but questions linger about its long-term viability.

Launched late last year, it draws users with high yields on USDT stakes. Yet, as we’ll explore, transparency gaps and math that doesn’t add up raise concerns. Let’s break it down with scams radar step by step.

Table of Contents

Part 1: What Sets Omnisphere Apart in Crypto Space?

Omnisphere positions itself as a decentralized exchange and staking hub, much like Uniswap but with built-in earning tools. Users swap tokens, lock in USDT for rewards, and build teams via referrals. The site highlights peer-to-peer trading and seamless security. At its core, it’s a Polygon-based system where you deposit stablecoins to earn its native OMNI token.

Key draws include flexible contracts from 30 to 360 days. Post a recent “halving” event in August 2025, rates adjusted downward for sustainability. No external products exist just investment opportunities. This focus appeals to those eyeing passive income in volatile markets. But does it deliver? Our dive into features shows promise mixed with pitfalls.

1.1 Ownership and Team: Digging for Answers

One sticking point in any Omnisphere review is the lack of clear leadership. The site lists no founders, executives, or bios. Domain records, registered privately in December 2024, hide registrant details. This anonymity isn’t unusual in crypto, but it erodes trust for a platform handling funds.

Hints point to a Philippines base. The official Facebook group, active since launch, shows management from there a hub for network marketing due to lax oversight. No corporate filings or regulatory nods appear in public databases. Independent checks, like those from scam watch sites, flag this as a risk. Without named faces, accountability feels distant. If builders stay hidden, what happens during disputes?

Part 2: Breaking Down the Compensation Plan

Omnisphere’s earnings model blends staking yields with multi-level referrals and rank bonuses. It’s straightforward on paper: deposit USDT, earn OMNI daily, and grow via recruits. But layers add complexity, favoring early joiners.

2.1 Staking Basics

Contract Length | Daily Rate | Monthly Estimate |

30 Days | 0.1% | 3% |

90 Days | 0.2% | 6% |

180 Days | 0.3% | 9% |

360 Days | 0.4% | 12% |

A 5% fee hits claims to fund liquidity. Withdraw anytime, but fees encourage holding. Pre-halving rates topped 0.8% daily far higher, now scaled back.

2.2 Referral Rewards

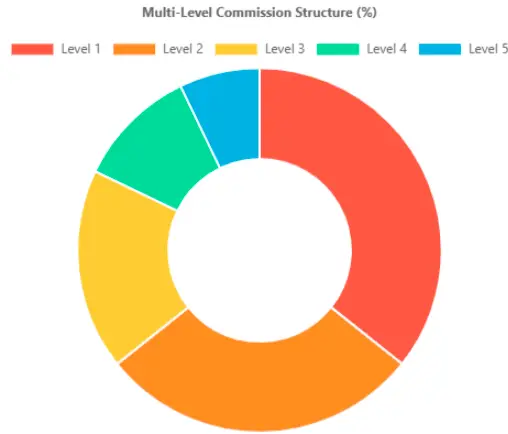

Invite others for a five-tier cut of their daily earnings:

- Level 1: 10%

- Level 2: 8%

- Level 3: 5%

- Level 4: 3%

- Level 5: 2%

This unilevel tree rewards broad networks, not just depth.

2.3 Rank System and Bonuses

Rank | Min. Personal Stake (USDT) | Group Volume Needed (USDT) | Bonus % on Group Rewards | Daily Cap (USDT) |

Basic | 100 | N/A | Standard referrals | N/A |

Solana | 500 | 30,000 | 10% | 200 |

Cardano | 1,500 | 100,000 | 20% | 400 |

Ripple | 3,000 | 300,000 | 30% | 600 |

Ethereum | 5,000 | 800,000 | 40% | 800 |

Bitcoin | 10,000 | 2,000,000 | 50% | 1,000 |

Satoshi | Bitcoin + 2 BTC recruits | Platform-wide pool | 3% of total stakes | Uncapped |

Part 3: Tokenomics and Why Returns Raise Eyebrows

OMNI totals 1 billion tokens: 800 million for staking, 200 million for liquidity. It starts at 1:1 with USDT but goes market-driven post-halving. Paired internally on Polygon, it’s not listed elsewhere.

Promised yields sound appealing up to 146% annually at 0.4% daily, compounded. But let’s crunch numbers. For a $1,000 stake:

Future Value = Principal × (1 + Rate)^Days

At 0.4% daily over 365 days: $1,000 × (1.004)^365 ≈ $4,953

That’s 395% growth. Even halved rates demand exponential new money to pay out.

3.1 Required inflows ballooning:

Days Elapsed | Cumulative New Stakes Needed (USDT, from $100 base) |

30 | ~135 |

90 | ~248 |

180 | ~615 |

365 | ~3,953 |

Part 4: Red Flags, Comparisons, and Real-World Checks

Several issues stand out in this Omnisphere review. Guaranteed returns ignore market risks, a securities red flag. Centralized cashouts contradict “decentralized” claims. Fees (5% on claims/swaps) lock users in.

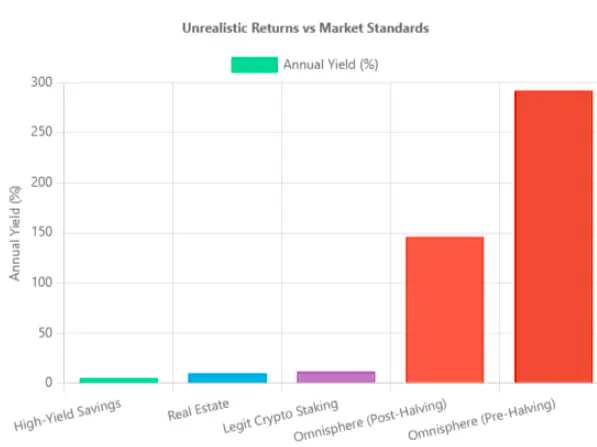

4.1 Stack it against standards:

Option | Annual Yield | Risk Level |

High-Yield Savings | 4-5% | Low |

Real Estate Rentals | 6-10% | Moderate |

Legit Crypto Staking | 3-12% | High |

Omnisphere (Post-Halving) | 109-146% | Extreme |

4.2 Real-World Checks

Public views lean negative. Scam trackers give low trust scores due to youth and privacy. Social buzz is sparse, mostly Philippines-linked Facebook ads. No major X promotions tie to verified influencers; echoes of past MLMs surface in group chats.

4.3 Security

Omnisphere has only basic HTTPS security and shows some Polygon links, but it has no independent audits and all swaps are centrally controlled. Support is limited to social media pages with no email or phone, making security and trust much weaker than legitimate crypto platforms.

Looking Ahead: Stability or Storm Clouds?

Short-term, inflows might sustain it. But patterns from similar setups predict stumbles by mid-2026. Regulatory eyes in places like the US or UK could probe unregistered offerings. If OMNI devalues, exits turn chaotic. For cautious users, test small. Demand proofs like audits.

Wrapping Up: Weigh Risks Before Diving In

This Omnisphere review uncovers a platform with flashy yields but shaky foundations. Strong on referrals, weak on transparency. If crypto staking fits your goals, chase audited options over unproven promises. Stay informed, and you can check out our latest article about Omniwinai Review published on our website.

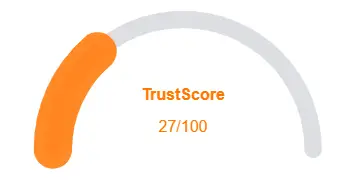

Omnisphere Review Trust Score

A website’s trust score is a critical indicator of its reliability. Omnisphere currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Omnisphere similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About Omnisphere Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

It offers high rates, but anonymity and math point to risks. Research deeply.

Earn 10% to 2% across five levels from recruits' rewards, plus rank matches.

1B OMNI supply, now volatile post-halving, paired with USDT internally.

Searches often mix this with Spectrasonics' Omnisphere synth. For music tools, check presets and wavetable features there. This review covers the crypto side.

Proceed with caution, no guarantees beat due diligence.

Other Infromation:

Website: omnisphere.org

Reviews:

There are no reviews yet. Be the first one to write one.