OLYONE DAO Review: What’s Really Behind This DeFi Platform?

This OLYONE DAO review examines the legitimacy of app.olyonedao.com, a platform claiming to offer high returns through a decentralized autonomous organization (DAO). We analyze ownership, compensation plans, security, and more to help investors make informed decisions. With blockchain-based investments growing, understanding the OLYONE DAO ecosystem is crucial. For in-depth scam analysis, visit Scams Radar for a detailed review of app.olyonedao.com.

Table of Contents

Ownership and Transparency

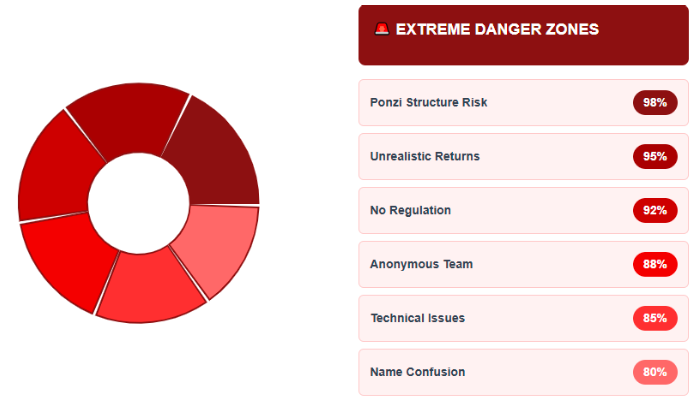

The OLYONE DAO platform lacks clear ownership details. No team members, company registration, or founder profiles are disclosed on the website or public records like WHOIS. Legitimate DAO projects, such as OlympusDAO, provide verifiable team information or governance structures. The only contact is an email (support@olyonedao.com), with no physical address or phone number.

- Red Flag: Hidden ownership raises accountability concerns.

- Comparison: Platforms like Binance list headquarters and regulatory licenses.

- Risk: Anonymous teams increase the chance of exit scams.

Without OLYONE DAO founder details, investors face risks, as there’s no way to verify who controls the platform.

Compensation Plan and ROI Claims

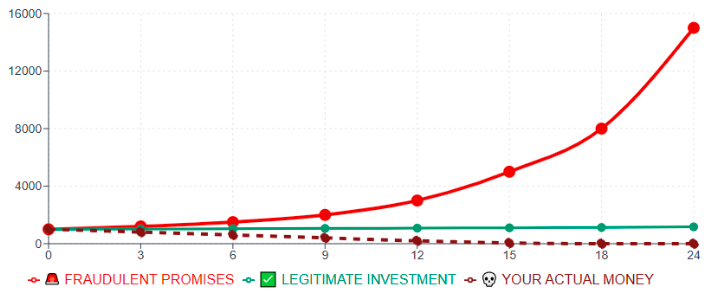

The OLYONE DAO compensation plan involves staking OLY tokens for governance and rewards, using “Smart Vesting Contracts” and “Bond Issuance Contracts.” Some sources claim daily returns upto 0.5–5%, translating to 532–1,800% APY. Let’s break this down mathematically:

- Formula: For 1% daily return, ( A = P \times (1 + 0.01)^{365} )

- $1,000 investment becomes $37,783 in one year (3,678% APY).

- At 0.5% daily, it’s $5,320 (532% APY).

- Problem: These returns rely on new investor funds or unsustainable token minting, resembling Ponzi schemes.

Investment Type | Annual ROI | Risk Level |

OLYONE DAO (Claimed) | 532–1,800% | Extreme |

Real Estate | 6–12% | Moderate |

Bank Savings | 4–7% | Low |

Crypto Staking (ETH) | 4–15% | Medium |

Traffic Trends and Public Perception

No traffic data is available on tools like SimilarWeb or Ahrefs, suggesting low user engagement. Established DAO platforms like Uniswap show consistent traffic. OLYONE DAO’s social media presence is limited to unverified Telegram groups, with no official X or Discord accounts. Community sentiment, where visible, is skeptical, citing transparency issues.

- Red Flag: Low visibility and lack of OLYONE DAO social media links indicate poor trust.

- Tip: Check platforms like Reddit for user reviews before investing.

Security Features and Content Authenticity

The platform lacks HTTPS, a basic security standard, and has no published smart contract audits from firms like CertiK. The whitepaper uses vague, ideological language about “on-chain civilization” without financial details or OLYONE DAO tokenomics explained.

- Red Flag: No OLYONE DAO smart contract audit increases hack risks.

- Concern: Unverified content lacks credibility.

Payment Methods and Customer Support

OLYONE DAO accepts only cryptocurrencies (e.g., USDT, OLY tokens), with no fiat options or refund policies. Customer support is limited to one email, with no live chat or FAQ section.

- Red Flag: Crypto-only payments and poor support limit recourse for issues.

q - Tip: Use OLYONE DAO wallet setup guides from trusted sources to avoid errors.

Technical Performance

The website often shows “Loading…” errors, indicating poor infrastructure. No uptime or performance metrics are provided, unlike reliable platforms with 99.9% uptime.

- Red Flag: Technical issues suggest an unprofessional setup.

Social Media and Promoters

Unverified Telegram groups and influencers like @dyorcryptoapp promote OLYONE DAO. These accounts have previously endorsed failed platforms like MineTXC and BigBang.Money.

- Red Flag: Promoters tied to past scams raise concerns.

DYOR Tools and Resources

No listings appear on ScamAdviser, DYOR.net, or CoinGecko for app.olyonedao.com. Investors should use these tools to verify OLYONE DAO token distribution and legitimacy.

Future Outlook

By 2026, DeFi platforms like OLYONE DAO may face stricter regulations. Without transparency or audits, the platform risks closure within 3–12 months, especially if it relies on new funds to pay returns.

Recommendations

- Avoid Investing: Multiple red flags indicate high fraud risk.

- Research Thoroughly: Use WHOIS, ScamAdviser, and CertiK for due diligence.

- Explore Alternatives: Consider Aave (3–8% APY) or REITs (6–10% annually).

- Report Issues: Notify authorities like the SEC if you suspect fraud.

OLYONE DAO Review Conclusion

This OLYONE DAO review highlights significant risks, including anonymous ownership, unsustainable returns, and poor security. Investors should avoid this platform and prioritize regulated, transparent alternatives. Always research thoroughly to protect your funds.

For a detailed analysis of a similar platform, check out our FXPROFITHOME Review.

DYOR Disclaimer: This analysis is for educational purposes only. Conduct your own research using primary sources like whitepapers and audits. Consult financial advisors before investing. The author is not liable for any financial decisions.

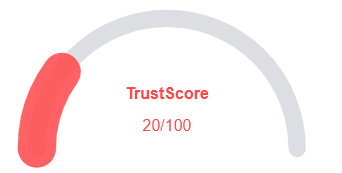

OLYONE DAO Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and OLYONE DAO a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with OLYONE DAO or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible.

- No spelling or grammatical errors.

Negative Highlights

- Low AI review rate.

- Whois data hidden.

Frequently Asked Questions About OLYONE DAO Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, OlyOneDAO lacks transparency, verifiable ownership, and has unrealistic ROI promises. It shows all the signs of a high-risk, potentially fraudulent platform.

Absolutely not. The promised daily returns of up to 5% are mathematically unsustainable and typical of Ponzi schemes that collapse once new investments slow down.

You should avoid OlyOneDAO due to its hidden ownership, lack of legal documentation, poor security measures, and questionable compensation plan. The platform’s high ROI claims are simply too good to be true.

No. OlyOneDAO has no visible customer support or contact options, leaving investors with no recourse if issues arise.

No, the website lacks HTTPS, and there are serious security concerns, making it unsafe for transactions or sharing personal information.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.