Odecent Review: Is This Crypto Trading Platform Legit or a Risky Investment?

This Odecent review on Scams Radar examines the legitimacy of a platform claiming high returns through automated trading bots. Odecent (odecent.com) raises serious concerns due to its ties to a collapsed Ponzi scheme, lack of transparency, and unsustainable ROI promises. This 2025 analysis evaluates the platform’s ownership, compensation plan, risks, and operations. Using clear data and comparisons, we highlight red flags and offer guidance on safer alternatives for investors seeking reliable trading solutions.

Table of Contents

What Is the Odecent Platform?

The Odecent platform markets itself as a cryptocurrency investment tool offering AI-driven trading bots. It combines automated trading with a multi-level marketing (MLM) structure, promising up to 700% returns over 70 weeks. However, its questionable practices and lack of regulation demand careful scrutiny.

Ownership and Background

The platform lacks clear ownership details. No verifiable information about its founders or headquarters appears on its website. Independent sources, like BehindMLM and Danny de Hek, link Odecent to individuals previously tied to Validus, a Dubai-based Ponzi scheme that collapsed in 2023 after warnings from regulators like the Dubai Financial Services Authority (DFSA), ASIC, and FSMA. Key figures include:

- Mansour Tawafi: Former Validus president, reportedly involved in Odecent events.

- Billal Ali, Salman Shahzad, Philippe Moser: Promoters with histories in failed MLMs like Validus, ACN, and NeXarise.

Concern: Ties to Validus and hidden ownership reduce trust in Odecent’s legitimacy.

Odecent Compensation Plan Explained

Odecent’s compensation plan blends automated trading subscriptions with MLM incentives, focusing heavily on recruitment. Here’s a breakdown:

- Managed Trading Subscriptions: Range from $50 (A50) to $10,000 (A10000).

- Own Exchange Trading Subscriptions: From $500 (B500) to $50,000 (B50000), with a $500,000 cap.

- Referral Commissions: 10% on managed subscriptions, 15% on exchange subscriptions; renewals pay 6% and 15%.

- Residual Commissions: 7–10% via a binary structure, capped at $35,000–$50,000 weekly.

- Matching Bonus: 5% on residual commissions across four levels, capped at $15,000.

- Rank Bonuses: From $50 (Team Leader) to $200,000 or a Lamborghini (Crown President).

The plan prioritizes recruitment over trading profits, with no retail product offered. Earnings depend on new investor funds, a hallmark of Ponzi schemes.

Concern: The recruitment-heavy model suggests returns rely on new investments, not trading success.

Feature | Odecent Platform | Legitimate Platforms |

Earnings Source | Recruitment commissions | Management fees |

Transparency | Opaque structure | Clear fee disclosures |

Regulation | None | SEC/FCA oversight |

Focus | Recruitment | Investment performance |

ROI Claims: Are They Sustainable?

Odecent claims up to 700% returns over 70 weeks, implying a 324% annual percentage yield (APY). Let’s break it down:

- Calculation: A $1,000 investment at 2.82% weekly growth yields $7,000 in 70 weeks.

- Formula: ((1 + 0.0282)^{70} = 7), annualized as ((1 + 0.0282)^{52} – 1 \approx 324%).

- Comparison:

- Bank Savings: 0.5–5% APY.

- Real Estate: 3–8% annual rental yield.

- Crypto Staking (Binance): 5–20% APY.

- Bank Savings: 0.5–5% APY.

Traffic Trends and Technical Performance

Odecent’s global traffic rank is low, around 284,300 (SimilarWeb), indicating limited reach. It uses CloudFlare hosting with a valid SSL certificate, ensuring basic encryption. However, there are no third-party audits, no bot performance data, and reports of downtime or URL changes.

Concern: Low traffic and lack of audited performance raise doubts about Odecent’s global operations and reach.

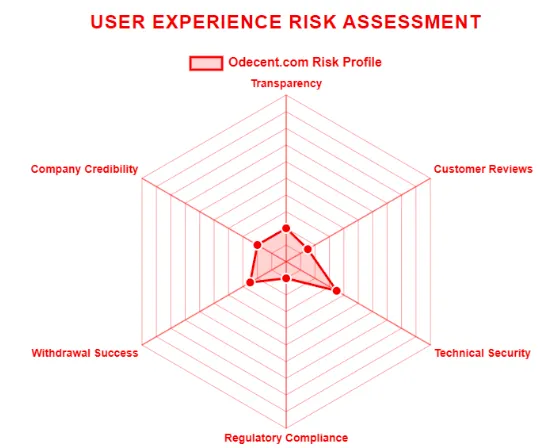

Public Perception and Reviews

Public sentiment is largely negative:

- Trustpilot: 2.4/5 stars (17 reviews), with complaints about withdrawal issues and Validus ties.

- Scamadviser: 61/100 trust score, with 1.2/5-star consumer reviews.

- Scamdoc: 16% trust score for the main site; app.odecent.com scores 76%, creating confusion.

- BehindMLM, InvestReviews, Ibisik: Label Odecent a potential scam, citing Ponzi-like traits.

A few positive reviews on BusinessforHome.org seem promotional and lack credibility.

Concern: Negative reviews and scam warnings dominate, undermining Odecent’s profit claims.

Security and Payment Methods

Odecent uses basic SSL encryption but lacks advanced security like two-factor authentication (2FA) or cold storage. It accepts only cryptocurrency payments, often via Binance API, which are irreversible and increase risk. No traditional payment options are offered.

Concern: Crypto-only payments and minimal security heighten Odecent withdrawal risks.

Customer Support

Support is limited to email or in-platform messaging, with no phone or live chat options. Users report unresponsive support and delayed withdrawals, common in scam platforms.

Concern: Poor Odecent support and withdrawal issues signal operational risks.

Social Media Presence

Odecent’s official accounts include:

- Facebook: facebook.com/odecent

- Instagram: instagram.com/odecentofficial

- X: x.com/Odecentofficial

- Telegram (GTN Network): Promotes ranks and events.

Promoters like Salman Shahzad and Philippe Moser, tied to Validus, use these platforms for recruitment. Their history of promoting failed MLMs raises concerns.

Concern: Promoters’ ties to collapsed schemes suggest Odecent follows a similar path.

Red Flags Summary

- No regulatory oversight (e.g., SEC, FCA).

- Ties to Validus Ponzi scheme.

- Recruitment-focused compensation plan.

- Unrealistic 700% ROI claims.

- Negative user reviews and scam warnings.

- Crypto-only payments with no chargeback options.

- Limited security and support.

Future Outlook

Odecent may operate for 6–18 months before facing withdrawal issues or regulatory action, mirroring Validus’s collapse. Investors risk losses as recruitment slows.

Recommendations for Investors

- Avoid Odecent: Its Ponzi-like structure and lack of regulation make it high-risk.

- Choose Regulated Platforms: Opt for Binance, Coinbase, or traditional options like Vanguard.

- Verify Claims: Use tools like Scamadviser, Trustpilot, and BehindMLM.

- Protect Funds: Avoid sharing private keys; report issues to regulators like the SEC or FCA.

- Start Small: Test withdrawals with minimal investment before committing more.

Odecent Review Conclusion

This Odecent review highlights significant risks tied to its legitimacy, compensation plan, and ROI claims. The platform’s ties to Validus, lack of transparency, and unsustainable 700% returns suggest a high likelihood of fraud. Investors should prioritize regulated platforms with verified performance. For an alternative review, check out our XG Robo Review to understand its risks and legitimacy. Conduct thorough research to protect your capital.

DYOR Disclaimer: This Odecent review is for informational purposes only, based on data as of August 28, 2025. Always conduct your own research, consult financial advisors, and verify regulatory compliance before investing. The crypto market is risky, and high returns often signal high risks.

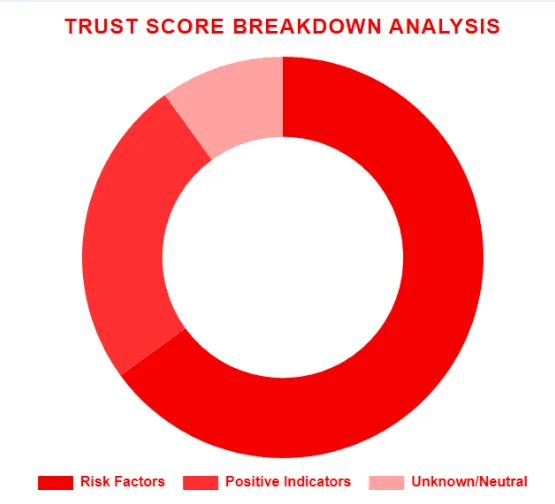

Odecent Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Odecent currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Odecent similar platforms.

Positive Highlights

- Website content is accessible.

- No spelling/grammar errors

Negative Highlights

- Low AI review rating.

- New domain

- New archive

- Hidden Whois data

- Domain not ranked in the top 1M

Frequently Asked Questions About Odecent Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Odecent is a platform claiming high returns through AI-driven trading bots, but questions about transparency and legitimacy remain.

While Odecent promises automated profits, our Odecent Review on Scams Radar reveals ties to a collapsed Ponzi scheme and unsustainable ROI.

Odecent uses AI bots to trade assets automatically, but unclear operations and compensation plans raise red flags for investors.

Key risks include Ponzi scheme associations, unsustainable ROI promises, limited regulatory oversight, and security vulnerabilities that may threaten your funds

Our review advises extreme caution. Investors should perform thorough research, understand the platform’s risks, and consider safer alternatives before using odecent.com.

Other Infromation:

Website: ODECENT.COM

Reviews:

There are no reviews yet. Be the first one to write one.