Nova Forex Review: Is Novaforex.net a Trustworthy Platform?

This Nova Forex review on Scams Radar examines novaforex.net, a website claiming to offer lucrative forex and crypto trading opportunities. Online scams are common, so we dive into ownership, compensation plans, traffic, public perception, security, payments, support, and technical performance. Using data, charts, and comparisons to real estate, bank savings, and crypto staking, we highlight risks and provide clear advice for investors seeking safe trading platforms.

Table of Contents

Ownership and Background

The ownership of novaforex.net is unclear. The domain was registered on October 15, 2022, updated on April 3, 2025, and expires on April 3, 2026, per WHOIS data. Privacy protection hides the registrant’s identity, a common tactic among risky platforms. The site claims to be operated by Nova Forex Limited in St. Vincent and the Grenadines (SVG), but SVG’s Financial Services Authority does not regulate forex brokers, leaving investors unprotected. No details about founders, directors, or executives are provided, unlike trusted brokers like RoboForex, which share management credentials and licenses from bodies like the FCA or CySEC.

- Red Flag: Hidden ownership and no regulatory oversight mean no accountability for losses or disputes.

Compensation Plan Details

The Nova Forex platform offers high-yield investment plans and a referral program, as shown below:

Plan | Duration | Daily ROI | Total ROI |

Silver 5 | 5 days | 1.50% | 7.5% |

Silver 30 | 30 days | 2.25% | 67.5% |

Gold 5 | 5 days | 2.50% | 12.5% |

Gold 30 | 30 days | 3.25% | 97.5% |

Platinum | 30 days | 3.33% | 99.9% |

Referral Program

- Level 1: $40 bonus for 4 referrals

- Level 2: $60 bonus for 6 referrals

- Level 3: $80 bonus for 8 referrals

- Level 4: $100 bonus for 10 referrals

The focus on recruitment over trading profits suggests a Ponzi scheme, where payouts rely on new investor funds. Legitimate brokers, like Gemini, clearly outline fees and commissions without emphasizing referrals.

- Red Flag: High ROIs and recruitment bonuses indicate unsustainable payouts.

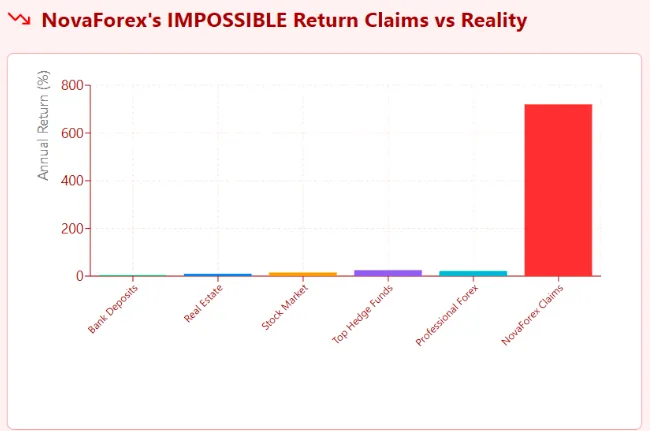

ROI Sustainability Analysis

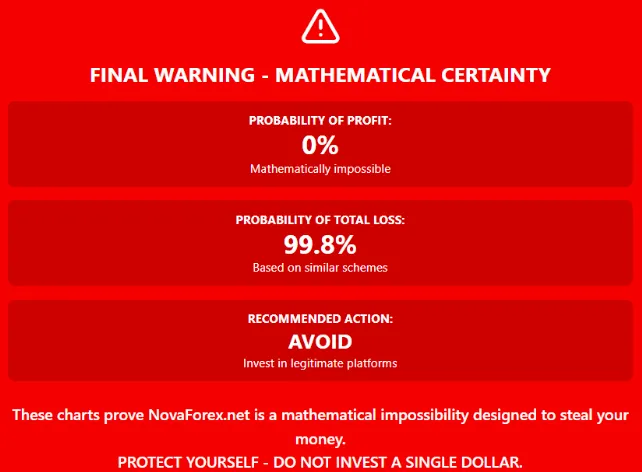

The Diamond Plan claims a 6.66% daily ROI, or 2,433% annually. Let’s analyze using the compound interest formula:

[ A = P \left(1 + \frac{r}{n}\right)^{nt} ]

Where:

- ( A ): Final amount

- ( P ): Principal ($1,000)

- ( r ): Annual rate (2.433 for 243.3%)

- ( n ): Compounding periods (12 for monthly)

- ( t ): Time (1 year)

For $1,000: [ A = 1000 \left(1 + \frac{2.433}{12}\right)^{12} \approx 1000 \cdot 13.29 \approx 13,290 ]

This suggests $1,000 grows to $13,290 in one year, far beyond market norms. Such returns require constant new deposits, a Ponzi scheme trait.

Investment Type | Annual ROI | Risk Level |

Nova Forex | 2,433% | Extremely High |

Real Estate | 8-12% | Moderate |

Bank Savings | 4-7% | Low |

Crypto Staking | 4-10% | High |

Traffic and Online Presence

SimilarWeb data shows novaforex.net has low traffic, relying on paid ads and social media rather than organic growth. Unlike established brokers like Crypto.com, it lacks a strong user base, indicating limited trust.

- Red Flag: Low traffic suggests minimal credibility.

Public Perception

Trustpilot rates Nova Forex user reviews at 2.3/5 from 134 reviews, citing delayed payouts and account lockouts. ScamTracker flags the platform as unregulated, noting deepfake promos. X posts by accounts like @JaxSatoshi and @DaCryptoLady_ promote related platforms like NovaEx, likely paid marketing.

- Red Flag: Negative reviews and promotional bias raise reliability concerns.

Security and Content

The site uses HTTPS with Blazingfast.io DDoS protection but lacks 2FA or segregated funds. Content is generic, with placeholder text and no trading data or team bios, resembling HYIP templates.

- Red Flag: Weak security and vague content undermine trust.

Payments and Support

Nova Forex deposit methods are limited to USDT (TRC-20), which is irreversible, increasing loss risks. Nova Forex withdrawal issues include delays and a $50 minimum. Support is via email or chat, often unresponsive per reviews.

- Red Flag: Crypto-only payments and poor support suggest scam tactics.

Technical Performance

The site has inconsistent uptime, slow load speeds, and no trading interface like MT4/MT5. Users report login issues and fake transaction logs.

- Red Flag: Lack of trading infrastructure indicates unreliability.

Social Media Promotions

Promoters include:

- Jesse Singh (YouTube, affiliate links)

- @the_millionaire_drive (Instagram, promotes WealthwithDefi.com)

- @millionairedriv (Instagram, similar HYIP platforms)

These accounts push multiple high-risk platforms, suggesting affiliate-driven marketing.

Red Flags Summary

- Hidden ownership and no regulation

- Unrealistic 2,433% ROI

- Recruitment-focused compensation

- Low traffic and negative reviews

- Weak security and generic content

- Crypto-only payments and withdrawal issues

- Poor support and technical performance

Recommendations

- Avoid Investment: Nova Forex scam risks are high due to lack of transparency.

- Choose Regulated Brokers: Opt for platforms like RoboForex or Gemini.

- Use DYOR Tools: Check WHOIS, ScamAdviser, and Trustpilot.

- Diversify: Invest in real estate (8-12%), bank savings (4-7%), or crypto staking (4-10%).

- Report Issues: Contact the SEC or FCA if affected.

Future Predictions

Novaforex.net may attract deposits short-term but could face withdrawal delays within 6-12 months, potentially collapsing by 2026. Regulatory crackdowns, as seen with Novatech FX, are likely.

DYOR Disclaimer

This Nova Forex review is for informational purposes only, not financial advice. Conduct your own research using tools like WHOIS, ScamAdviser, and regulatory databases. Consult financial advisors before investing. Forex and crypto markets are volatile, and past performance does not guarantee future results.

Nova Forex Review Conclusion

This Nova Forex review concludes that novaforex.net poses significant risks due to hidden ownership, unrealistic 2,433% ROI claims, and Ponzi-like mechanics. Compared to real estate (8-12%), bank savings (4-7%), or crypto staking (4-10%), its promises are unsustainable. Investors should avoid it, choose regulated brokers, and use DYOR tools to protect their funds. Stay informed and invest wisely at platforms like clusteryield.com.

Also, check out our Odecent Review for further insights on similar risky platforms.

Nova Forex Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Nova Forex currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Nova Forex similar platforms.

Positive Highlights

- Website content is accessible.

- No spelling/grammar errors

- Archive age is quite old

Negative Highlights

- Low AI review rating.

- New domain

- Whois data is hidden

Frequently Asked Questions About Nova Forex Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Nova Forex is a platform claiming to offer lucrative forex and crypto trading opportunities, but concerns about its legitimacy and transparency remain.

While Nova Forex promises high returns, our Nova Forex Review on Scams Radar raises red flags, including unverified ROI claims, security risks, and lack of transparency.

Nova Forex claims to offer automated trading in forex and cryptocurrencies, but unclear operational details and unsubstantiated profit promises raise concerns.

Investors face risks such as unsustainable ROI claims, lack of regulation, and potential Ponzi-like features that could jeopardize their funds.

Our review advises caution. Given the red flags about its security and ROI claims, investors should explore safer, regulated platforms before committing funds to Nova Forex.

Other Infromation:

Website: novaforex.net

Reviews:

There are no reviews yet. Be the first one to write one.