Node Waves Review: Is This Blockchain Platform Legit or Risky?

This Node Waves review examines the platform’s legitimacy, compensation plan, ownership, and risks For an in-depth scam analysis, visit Scams Radar for a detailed review.

Node Waves, accessible at nodewaves.com, combines wellness and crypto rewards, promising passive income through node licenses and NWS tokens. However, hidden ownership, unverified ROI claims, and potential regulatory concerns raise doubts. Read on to explore whether nodewaves.com is safe, covering features, compensation, security, and more.

Table of Contents

What Is Node Waves?

Node Waves is a decentralized ecosystem built on the Polygon blockchain. It offers node licenses, a Move-to-Earn fitness app, and governance rights via NFTs. Users earn NWS tokens through Proof of Stake (PoS) and Proof of Action for healthy behaviors like exercise. The platform claims a 10 billion NWS token supply with halvings to control emissions.

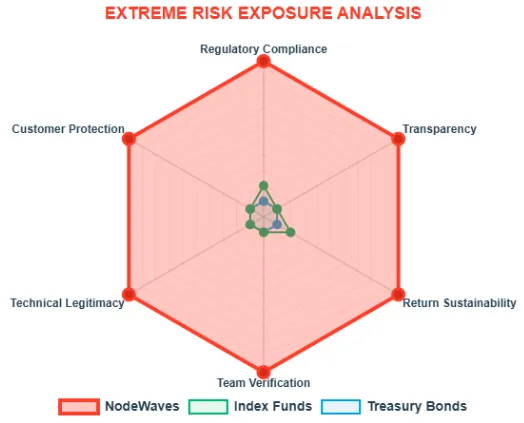

Ownership and Transparency Concerns

Node Waves provides no details about its founders or team. The website lacks names, credentials, or a company address. A listed address, “813 Howard St, Oswego, NY 13126,” appears in online templates, suggesting it’s not a real office. WHOIS data shows the domain, registered in June 2022 via Namecheap, uses privacy protection, hiding ownership.

Regulatory Issues

There’s no mention of KYC/AML compliance or registration with bodies like the SEC or FCA. Legitimate platforms like Ethereum or Binance share team profiles and legal details. This opacity raises doubts about accountability.

Red Flags

- No named founders or verifiable team.

- Questionable address and no regulatory compliance.

- Hidden domain ownership.

Node Licenses

Node Waves offers Lite Nodes (~$200) and Founder Nodes (~$600 during promotions). Users run node software (Windows 10, MacOS 10.10+, Ubuntu Linux 20.04; 4GB RAM, 2 CPU cores, 60GB disk) for at least 6 hours daily to earn NWS tokens. Founder Nodes claim 665 NWS/day, while Lite Nodes share a 2.6M NWS/day pool.

Referral System

The platform rewards users for recruiting others, resembling multi-level marketing (MLM). Rewards depend on invited users’ activities, not just platform utility.

Tokenomics

The 10B NWS token supply is allocated as follows:

Category | Percentage | Tokens | Vesting |

Node Rewards | 25% | 2.5B | None |

Community PoB Rewards | 25% | 2.5B | None |

Liquidity Pool | 15% | 1.5B | None |

Metaverse Partnerships | 3% | 300M | None |

Team & Private Sales | 8% | 800M | 12-month lock, 18-month vesting |

Red Flags

- MLM-like referral structure.

- Vague Proof of Action criteria (e.g., what qualifies as “healthy behavior”).

- High token emissions risk unsustainability.

ROI Claims: Are They Sustainable?

Node Waves promises daily NWS rewards but doesn’t specify ROI. Assume a Lite Node ($200) earns 520 NWS/day (2.6M NWS ÷ 5,000 nodes) at $0.001093/NWS:

- Daily: 520 × $0.001093 = $0.57

- Yearly: $0.57 × 365 = $207.05

- ROI: ($207.05 ÷ $200) × 100 = ~104% annually

For 50,000 nodes, rewards drop to 52 NWS/day, yielding ~10% ROI. Founder Nodes ($600) at 665 NWS/day yield ~44% ROI. These returns depend on NWS price stability and emission policies.

Sustainability Analysis

With 10,000 nodes, annual payouts (76,864 NWS/node × 10,000 = 768.64M NWS) strain the 10B supply, especially with halvings. A 260% APY claim requires $27,248 daily in new investment to maintain token value, indicating a Ponzi-like structure.z

Comparison Chart

Investment | APY | Risk | Regulation |

Node Waves | 10–104% | High | None |

Real Estate (Pakistan) | 6–10% | Moderate | SEC |

Bank Savings | 3–5% | Very Low | FDIC |

Crypto Staking (ETH) | 4–15% | Moderate-High | Variable |

Security and Technical Performance

Node Waves uses an ERC-20 token on Polygon but lacks a public audit. Cyberscope scores it 54% (high risk), with no KYC and 66% of tokens held by top 10 wallets. The website uses HTTPS but lacks SPF/DKIM/DMARC records. No whitepaper or code audits verify claims like “post-quantum security.”

Technical Performance

Google PageSpeed Insights scores nodewaves.com at ~70/100 (desktop) and ~50/100 (mobile), indicating poor mobile optimization. No blockchain metrics (e.g., TPS) are available.

Red Flags:

- No smart contract audit or KYC.

- Centralized token control.

- Poor mobile performance.

Public Perception and Traffic

Node Waves has low traffic (<10,000 monthly visitors), mostly referral-driven from India and Nigeria, per SimilarWeb. Legitimate platforms like Coinbase have millions of visitors.

Social Media

- X (@nodewaves): ~4,000 followers, low engagement.

- Telegram: ~2,000 members, minimal activity.

- Instagram/Facebook: Promote node sales and rewards (e.g., 665 NWS/day for Founder Nodes).

- Red Flag: Low engagement and reliance on promotional posts.

Payment and Support

Payments are crypto-only (likely ETH or NWS), with no fiat options. Support is limited to a web form and Telegram, with no live chat or phone. Manual reward verification (48–72 hours) risks errors.

Red Flag: Irreversible crypto payments and weak support.

Recommendations for Investors

- Avoid Investment: Lack of transparency, unsustainable tokenomics, and MLM-like structure make Node Waves high-risk.

- Verify Details: Demand a whitepaper, team identities, and audits before investing.

- Explore Alternatives: Consider regulated options like real estate (6–10% APY) or Ethereum staking (4–15% APY).

- Use DYOR Tools: Check ScamAdviser, Etherscan, and CoinMarketCap for updates.

- Secure Funds: Use hardware wallets to protect investments.

Future Outlook

Short-Term (2025–2026): Node Waves may attract wellness enthusiasts, but low traffic and engagement limit growth.

Long-Term (2027+): Without transparency or regulatory compliance, it risks collapse or regulatory action, like failed ICOs.

Node Waves Review Conclusion

This Node Waves review highlights significant risks: no clear ownership, unsustainable returns, and MLM-like rewards. Compared to real estate or bank savings, its ROI is speculative and fragile. Investors should avoid Node Waves until it provides verifiable details. For further insights into similar platforms, you can also check our detailed Zapp Wallet Review. Always conduct thorough research and consult advisors before investing.

DYOR Disclaimer: This analysis is for informational purposes only, not financial advice. Cryptocurrency investments are risky. Verify all claims independently and consult licensed professionals.

Node Waves Review Trust Score

A website’s trust score is a critical indicator of its reliability, and Node Waves currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Node Waves or similar platforms.

Positive Highlights

- Accessible content

- No spelling/grammar errors

- High AI review rate

Negative Highlights

- New domain

- New archive

- Hidden Whois data

Frequently Asked Questions About Node Waves Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Node Waves raises concerns due to hidden ownership, unverified ROI claims, and limited transparency regarding its operations.

The platform claims passive income through node licenses and its NWS token, but there is no verifiable evidence of actual trading or payouts.

No. Node Waves is not licensed or registered with any recognized financial regulator, which increases the risk for investors.

Risks include potential financial loss, lack of investor protection, unsustainable ROI claims, hidden ownership, and low transparency.

It is not recommended. The platform’s hidden ownership, unverified ROI claims, and lack of regulatory oversight make it a high-risk investment.

Other Infromation:

Website: NODEWAVES.COM

Reviews:

There are no reviews yet. Be the first one to write one.