Nexora Review: Unpacking the Platform's Legitimacy and Features

In this Nexora review, Scams Radar explores the back-office portal tied to crypto investments, focusing on its compensation structure and leadership details. Launched in mid-2025, this site offers node packages and referral rewards within the Inception Chain ecosystem. Our goal is to provide a clear picture for potential users, drawing from public data as of January 2026.

Table of Contents

Part 1: Understanding Nexora's Ownership and Leadership

Ownership details for this crypto platform remain hard to pin down, a common issue in new blockchain ventures. The domain registration dates back to August 6, 2025, through Tucows Domains Inc., with all registrant info hidden for privacy. No clear corporate filings or legal entity names appear on the site, making it tough to trace accountability.

Public materials list key figures like Moray Hickes as CEO, Sam Singer as CTO, Lisa Akamu as COO, and Batista Ruben as CMO. Advisors include Michael Terpin, Liam Robertson, and Nick Harrington. However, checks show mixed connections. For instance, Moray Hickes links to MetaVersusWorld on LinkedIn, with a background in tech and agile methods, but no direct tie to this platform stands out. Sam Singer handles tech for both the site and Inception Chain, yet outside sources offer little confirmation.

Michael Terpin, a known crypto advisor involved in projects like Naoris Protocol, shows no public link here. Searches for his name on the platform yield unrelated hits, hinting at possible name-dropping for trust. Other team members match real finance pros, but verified involvement is absent. Some reports note AI-generated images in promo decks, adding to doubts. The branding overlaps with unrelated firms like a tech distributor and fintech software provider, which could confuse users.

CEO Ali emerges in some materials as a founder, with a Virginia, USA registration mentioned. Yet, no full doxxing or detailed bio confirms this. Team vesting for Ethereum rewards is noted, but without audits, it raises questions. Overall, the opaque setup predicts risks like sudden exits if user growth stalls.

Part 2: Diving into the Compensation Plan

The compensation plan blends binary and unilevel elements, with a focus on recruitment and node investments. It requires a paid subscription for full access, starting at 49 USDT per year, to unlock bonuses. This pay-to-play approach qualifies users for volume tracking and earnings.

Node packages range from Basic at 50 USDT to Creator at 100,000 USDT. Yields vary: 5-15% for Node ON mode or 3-7% for Node OFF. Timeframes are vague, but decks suggest monthly compounding, potentially hitting 100% annual returns. Crypto rewards come in 15, 30, or 90-day cycles, with NEX token involvement.

Bonuses include:

- Direct Bonus: 10% on personal sales volume from referrals.

- Team Bonus: 10% on the weaker binary leg’s volume.

- Matching Bonus: Rank-based, covering multiple levels.

- Fast Start Bonus: Recruit five directs in 30 days for up to 50% package rebate.

- Rank Rewards: From Builder upward, with weekly caps.

Payouts are split 85% withdrawable in USDT and 15% for buyback into nodes or ecosystem growth. This recycles funds internally. Liquidity is locked at 53% until 2027, and the token supply is capped at 100 million. Uniswap swap for NEX token is available, with BitMart listing claimed for legitimacy.

Node Tier | Cost (USDT) | Yield Range (Monthly %) | Estimated Annual Return (Compounded) |

Basic | 50 | 5-7 | Up to 79.6% |

Standard | 500 | 7-10 | Up to 159.4% |

Premium | 5,000 | 10-12 | Up to 259.4% |

Elite | 50,000 | 12-15 | Up to 435% |

These figures assume monthly compounding. Real math shows why high yields strain sustainability. For a 15% monthly rate: (1 + 0.15)^12 – 1 = 435% yearly. With 100 users investing 1,000 USDT each, monthly payouts hit 15,000 USDT, demanding constant new funds without external revenue.

A bar graph comparison helps visualize this against standard investments:

- Bank Savings: 3-5% annual (low risk).

- Real Estate: 8-12% annual (tangible assets).

- Crypto Staking: 5-10% APY (variable).

- Nexora Claims: 79-435% annual (high risk).

Imagine a bar chart where Nexora’s bar towers over others, highlighting the gap. Such returns often rely on inflows, not genuine growth.

The plan ties to referral signup, using codes like 2993877. Dashboard guides show how to join via backoffice login, track rewards, and vest tokens. Community growth at 5.5% is touted, but without audits, HYIP risks loom. Avoid Nexora HYIP warnings, stress checking for rug pulls, as admin tokens could enable quick exits.

Part 3: Security, Traffic, and Public Views

Security uses Cloudflare hosting and SSL, with WalletConnect for payments. Scans vary: Gridinsoft gives 68/100 trust, Scamdoc 25%, and VirusTotal mixed flags. No multi-factor details or audits appear, raising hack concerns.

Traffic is low for a five-month-old site, with growth via referrals over organic search. Public perception is sparse, with BehindMLM labeling it a node Ponzi. YouTube promos from channels like Nexora B push signups, but no strong testimonials exist. X posts mix with unrelated Nexora entities, causing confusion.

Payment methods stick to crypto like USDT, limiting reversals. Support lacks clear channels, often unresponsive. Technical performance is decent via Vercel, but scalability is untested.

Red Flags and Comparisons

Key concerns in bullet points:

- Hidden ownership and unverified team bios.

- Pay-to-play subscriptions and binary mechanics.

- Crypto-only rails reduce protections.

- Name overlaps with legit firms.

- No on-chain proofs or regulatory notes.

- Referral-heavy promo with thin footprint.

Compared to banks (5% APY), real estate (10%), or exchange staking (10%), this dwarfs norms, signaling speculation.

Future Outlook and Advice

Predictions point to short-term hype fading by mid-2026 if recruitment slows, leading to payout issues. For sustainability, demand audited revenues and clear roadmaps.

In conclusion, this Nexora review highlights a platform with ambitious crypto rewards but significant risks. Approach with caution, verify all claims, and consult experts. Only invest what you can lose.

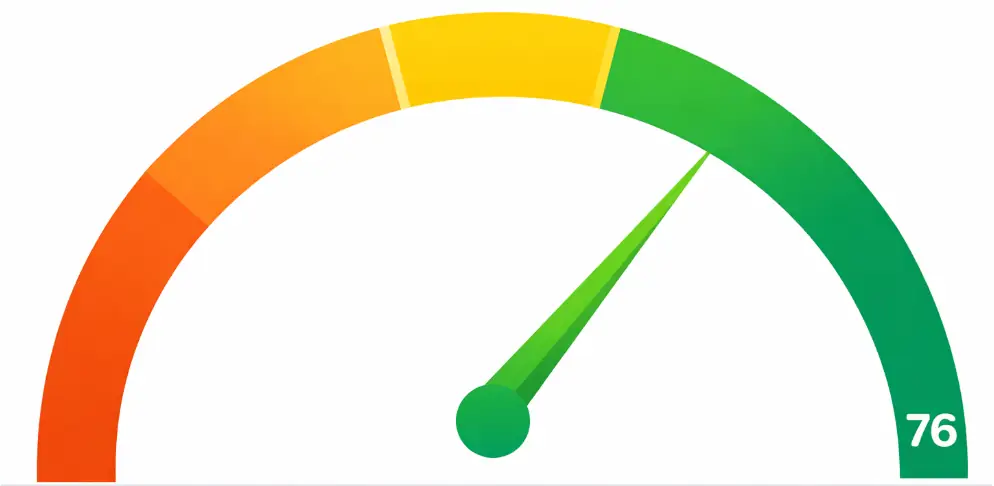

Nexora Review Trust Score

A website’s trust score is an important indicator of its reliability. Young Living currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Young Living or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Nexora Review

This section answers key questions about Nexora, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

This Nexora Review finds multiple red flags, including hidden ownership and unverified leadership, making it a high-risk platform.

Users earn through node packages and referral bonuses, with payouts largely tied to recruitment activity.

The claimed returns far exceed market norms, suggesting sustainability concerns.

Key risks include anonymous management, crypto-only payments, no audits, and a pay-to-play structure.

Both Nexora Review and Everstead Review highlight similar warning signs, like high ROI claims and unclear revenue sources.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.