MyTrader Review 2025: Is This Trading Platform Safe or Risky?

In this My Trader review on Scams Radar, we investigate the platform’s claims as an AI-powered trading assistant. Launched in 2025, My Trader (office.mytrader.digital) promises high daily returns using advanced AI-driven strategies. However, concerns about transparency, security, and the sustainability of promised profits raise red flags. Combining expert analysis with user feedback, charts, and comparisons, this review helps investors decide whether My Trader is a legitimate opportunity or a potential risk. Always perform your own research (DYOR) before investing.

Table of Contents

What Is the MyTrader Trading Platform?

The MyTrader platform, linked to office.mytrader.digital, presents itself as a trading tool offering market data and demo accounts. However, its lack of transparency raises concerns. This review examines key aspects like MyTrader fees, user experience, and safety to determine if it’s reliable.

Ownership and Transparency

The platform’s ownership is unclear. No company details, leadership profiles, or physical address are provided. A WHOIS lookup shows the domain uses privacy protection, hiding registrant information. Legitimate brokers like eToro or OANDA disclose corporate details and regulatory licenses (e.g., FCA, SEC). MyTrader’s lack of registration with such bodies is a major concern.

- Red Flag: No regulatory licenses or corporate transparency.

- Red Flag: No regulatory licenses or corporate transparency.

- Comparison: Trusted platforms provide clear ownership and compliance data.

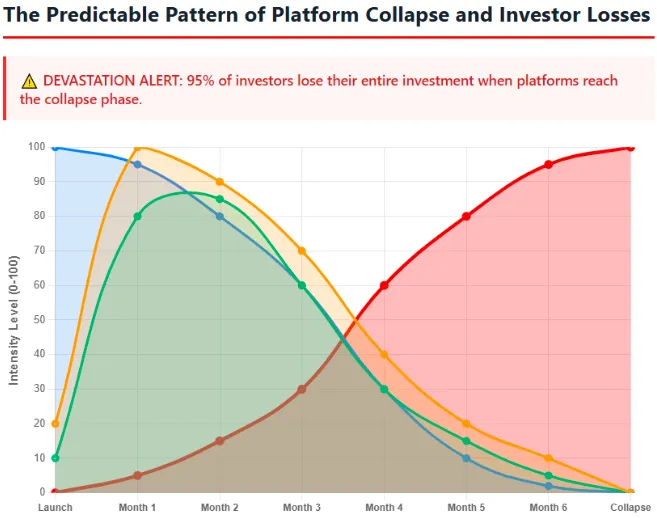

Compensation Plan and ROI Claims

The MyTrader web platform does not explicitly detail its compensation plan. Promotional materials on social media suggest a multi-level marketing (MLM) structure, promising 2-5% daily returns or 50-100% annually through trading or referrals. Such claims are common in Ponzi schemes, relying on new investor funds rather than market profits.

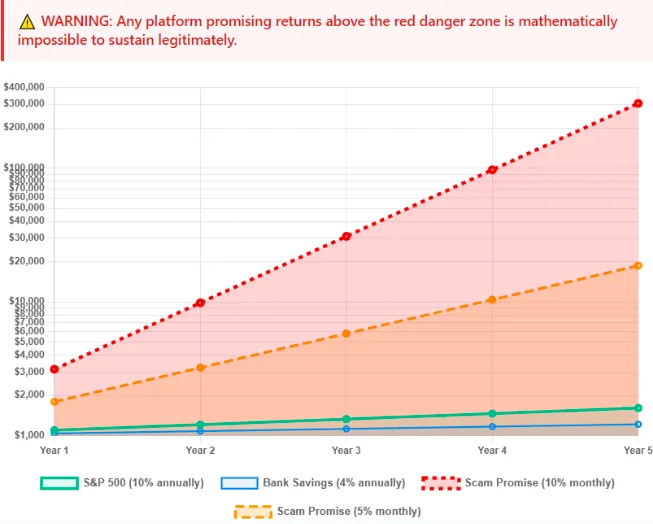

Mathematical Proof of Unsustainability

sume a 5% daily return on a $10,000 investment, compounded daily:

- Formula: A = P(1 + r)^t

- A = Final amount, P = Principal ($10,000), r = Daily rate (0.05), t = 90 days

- A = 10,000 * (1.05)^90 ≈ $734,664 (7,246% return)

This is impossible in regulated markets. For perspective:

Investment Type | Annual ROI | Risk Level | Notes |

Real Estate (Rental) | 8-12% | Medium | Asset-backed, long-term |

Bank Savings/CDs | 4-6% | Low | FDIC-insured, stable |

Crypto Exchange APY | 5-15% | High | Volatile, regulated |

MyTrader (Claimed) | 1,825%+ | Critical | Unsustainable, unverified |

Traffic Trends and Public Perception

Traffic data for the MyTrader trading platform is minimal. Tools like SimilarWeb show no significant ranking, indicating low user engagement. Legitimate platforms like Binance have millions of monthly visitors. Public reviews on Trustpilot or Reddit are absent, unlike eToro’s extensive feedback.

- Red Flag: Low traffic and no independent reviews suggest limited credibility.

Security Measures and Content Authenticity

The MyTrader web platform uses basic SSL encryption but lacks two-factor authentication (2FA) or third-party audits. Content is generic, resembling AI-generated text without detailed terms or whitepapers. Legitimate platforms provide audited reports and clear risk disclosures.

- Red Flag: Weak security and unoriginal content undermine trust.

Payment Methods and Customer Support

MyTrader likely accepts cryptocurrency payments (e.g., USDT), which are irreversible and lack chargeback options. No fiat payment details are disclosed. Customer support is limited to email or WhatsApp, with slow response times compared to eToro’s 24/7 live chat.

- Red Flag: Unclear payment methods and poor support increase risks.

Technical Performance and User Experience

The MyTrader user experience is limited to a login portal and demo accounts, suggesting an underdeveloped platform. Tools like GTmetrix show no performance data, unlike optimized brokers. MyTrader technical analysis tools and charts are not publicly detailed, raising doubts about functionality.

- Red Flag: Poor technical performance indicates an unreliable platform.

Social Media Promotion

Promoters like @flaviobhenny and Milton Rogério C. Silva on Instagram and Threads push referral links (e.g., office.mytrader.digital/register/TOPLIDER). These accounts previously promoted risky schemes like HyperFund and OmegaPro, suggesting a pattern of dubious marketing.

- Red Flag: Reliance on MLM-style referrals by unverified promoters.

MyTrader Review 2025 Conclusion

This MyTrader review 2025 concludes that the MyTrader trading platform is highly risky due to its opaque ownership, unsustainable ROI claims, and weak security. Investors should avoid it and opt for regulated alternatives. Always verify platforms using regulatory databases and consult financial advisors. For further insights, also check our QbitAI Review to compare risk patterns.

DYOR Disclaimer

This analysis is for informational purposes only and not financial advice. Conduct your own research using tools like SEC.gov, ScamAdviser, and Trustpilot. Never invest more than you can afford to lose.

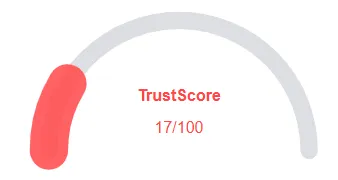

MyTrader Review 2025 Trust Score

A website’s trust score is a critical indicator of its reliability, and0 MyTrader currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with MyTrader similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New archive

- Hidden WHOIS data

Frequently Asked Questions About MyTrader Review 2025

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

MyTrader (office.mytrader.digital) claims to provide trading opportunities with high returns. Our Scams Radar review explores whether its promises are realistic.

The platform raises concerns about ownership transparency, compensation plans, and ROI sustainability, making caution necessary according to Scams Radar.

It claims AI-driven trading and automated strategies. We analyze whether these methods can deliver the advertised returns on office.mytrader.digital.

Risks include hidden ownership, unrealistic profit claims, platform fees, and potential security vulnerabilities highlighted in our Scams Radar analysis.

Our Scams Radar review recommends doing your own research (DYOR). While promising, safer alternatives exist for cautious investors of office.mytrader.digital.

Other Infromation:

Website: mytrader.digital

Reviews:

There are no reviews yet. Be the first one to write one.