Movve Wallet Review 2026: A Close Look at This Crypto Investment Platform

Movve Wallet gained attention in 2026 as many people looked for passive income opportunities in cryptocurrency. The platform claims that its AI-powered trading system delivers steady returns, which has attracted significant investor interest. However, due to these promises, Movve Wallet has also been reviewed on Scams Radar, a site that tracks and analyzes high-risk crypto and investment platforms. This review examines the platform’s business structure, leadership, compensation plan, and potential risks, using public data, expert analysis, and basic financial mathematics. While high daily returns may sound appealing, deeper details reveal serious issues, and independent sources continue to highlight ongoing concerns for investors.

Table of Contents

Part 1: Ownership and Leadership

Transparency matters in investments. Movve Wallet lacks clear company details. Investigations name Melk Franco as CEO. He operates from Dubai. Franco targets Portuguese-speaking users.

Franco previously ran MFX Trading School. It launched in 2019. The venture failed by 2023. Its sites went dark.

Dubai is often linked to risky MLM schemes. Watchdogs flag it as a scam hub. Regulation is weak there.

Sann Rodrigues promotes the platform heavily. He earned big in TelexFree, a massive Ponzi. It caused billions in losses. Rodrigues faced U.S. settlements. His involvement is a major warning.

No licenses appear in the records. Domains hide ownership. Traffic is low for the claimed scale.

1.1 The Compensation Plan

Movve Wallet mixes passive returns with MLM. Users deposit crypto, usually USDT TRC20. Minimum starts at $35–$100.

Key features:

- Passive returns reach 1.5% per weekday.

- Credits apply only on trading days.

- Total payout caps at 300%. This includes principal.

- Reinvestment is needed after the cap.

- Referrals pay 7% on direct recruits’ deposits.

- Binary pays 7% on the weaker leg.

- Qualification needs $100 personal investment plus two recruits.

- Withdrawals carry a 7% fee.

- A “savings” option gives 7% monthly for not withdrawing.

No retail product exists. Income comes from new deposits and recruitment.

Part 2: Why Returns Are Unsustainable

The 1.5% daily claim attracts users. Math shows the issue.

Here is the growth for $1,000 at 1.5% compounded per trading day:

Trading Days | Months (Approx.) | Balance |

0 | Start | $1,000 |

20 | 1 | $1,347 |

40 | 2 | $1,814 |

60 | 3 | $2,443 |

73 | 3.5 | $3,000 (cap) |

100 | 5 | $4,432 |

200 | 9 | $19,643 |

260 | 12 | $47,992 |

The cap hits in 3–4 months. Without it, one year yields nearly 48 times the start.

Compare to real options:

Type | Annual Return | Risk | Guaranteed |

High-Yield Savings | 4–5% | Very Low | Yes |

Stock Market (S&P 500) | 7–10% | Medium | No |

Real Estate Rentals | 5–12% | Medium | No |

Crypto Staking | 5–15% | High | No |

Top Hedge Funds | Up to 39% | High | No |

No legit trader delivers 1.5% daily consistently. Payouts need constant new funds. Commissions take cuts upfront.

Key Red Flags

- Returns far exceed market norms.

- Strong recruitment focus.

- Fees and rules trap funds.

- False “two-year” track record claim. Platform launched mid-2025.

- Dubai-based with problematic leaders.

- Irreversible crypto deposits.

- No audits or trading proof.

- Hidden domains and low traffic.

Early users may get paid. Growth slows eventually. Delays or collapse follow.

Final Thoughts

Movve Wallet promises easy AI profits. The plan, leaders, and math show high risks. Experts label it a recruitment-driven scheme.

Approach with caution. Verify everything first. Test small withdrawals. Regulated options offer safer paths.

Movve Wallet Review Score

A website’s trust score is an important indicator of its reliability. Movve Wallet currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Movve Wallet or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Movve Wallet Review

This section answers key questions about the Movve Wallet, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

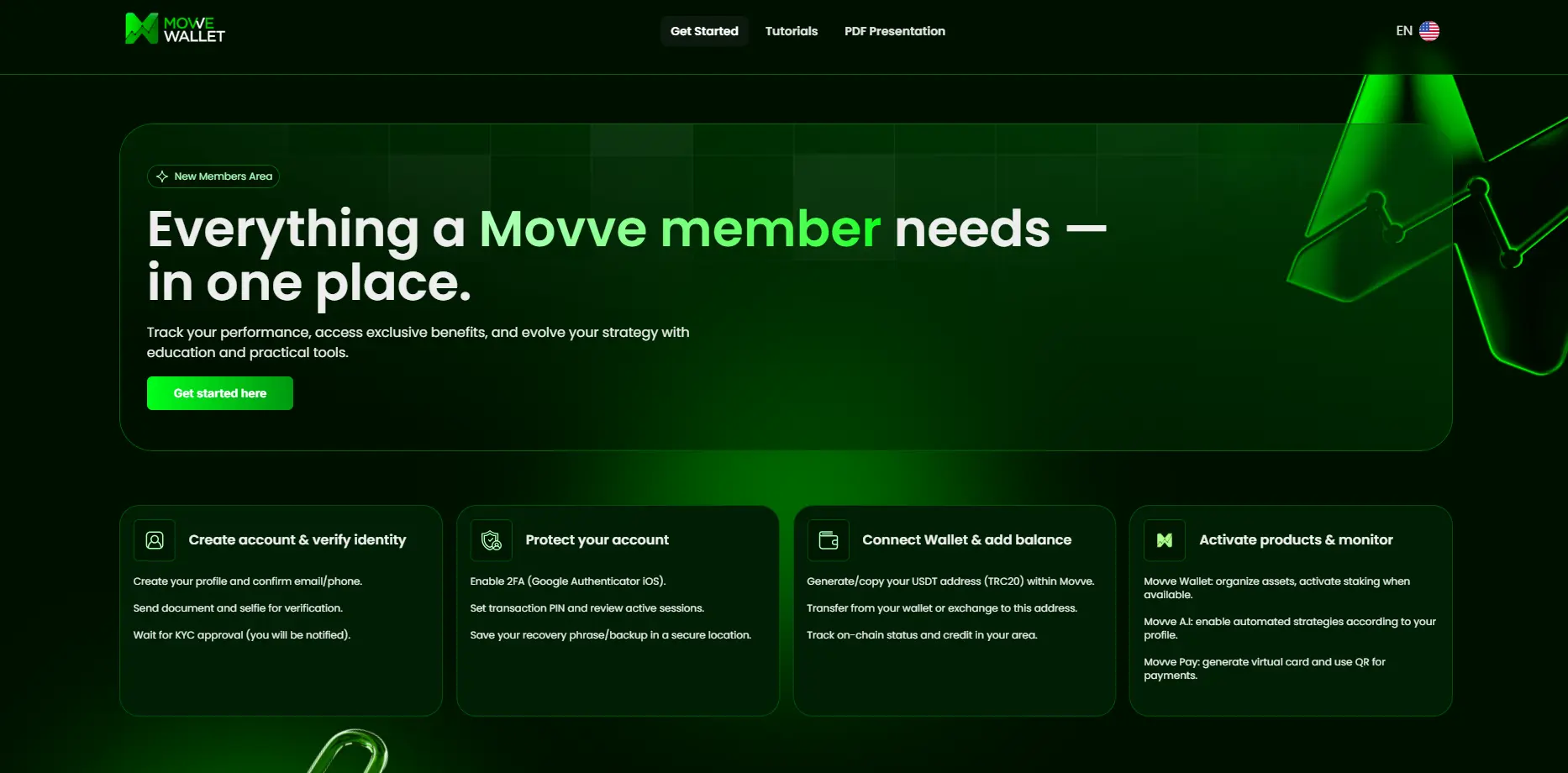

Movve Wallet is a digital crypto wallet that allows users to store, send, receive, and manage multiple cryptocurrencies securely.

Based on this Movve Wallet Review, the wallet uses standard security features like encryption and private key control to protect user funds.

Movve Wallet supports major cryptocurrencies and selected tokens, enabling users to manage different digital assets in one place.

Compared to platforms mentioned in an Everstead Review, Movve Wallet focuses more on ease of use and simplified crypto management.

Movve Wallet is suitable for beginners and casual crypto users looking for a simple, secure, and user-friendly wallet solution.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.