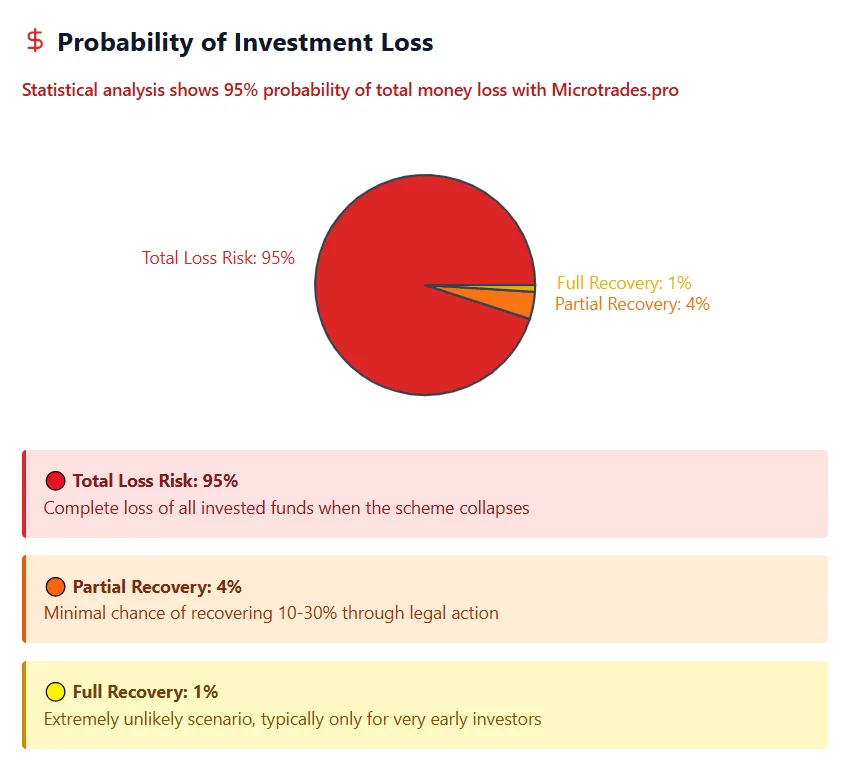

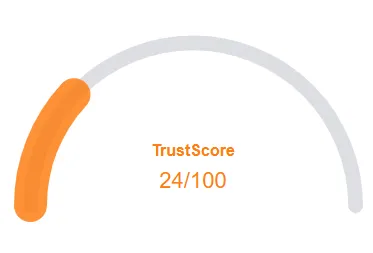

This Micro Trade Review examines a newly launched trading platform that claims to offer massive returns through automated crypto and forex trading. With promises of 200% returns within 4–6 months, MicroTrade raises serious red flags about its legitimacy and sustainability. In this detailed analysis, we break down its ownership transparency, compensation structure, and potential risks, making it easier for beginners to assess whether it’s safe or a scam. For a broader look at similar high-risk platforms, explore our Scams Radar section for investigative reviews and alerts.