MaoPay Review: Legitimacy, Risks, and Investor Insights

This MaoPay review on Scams Radar investigates the platform’s claims as an AI-driven financial service promising high returns. Operating under MaoPay AI Limited, the platform claims to deliver predictable profits through algorithmic trading and asset management. However, concerns about transparency, sustainability, and regulatory compliance raise red flags. This analysis covers ownership, the MaoPay payment system, compensation plans, security, and more, using clear language and visuals for easy understanding of MaoPay (app.maopay.ai).

Table of Contents

Ownership and Corporate Transparency

MaoPay claims to be registered in Hong Kong at 8 Connaught Place, Central, with a business registration number (BRN 78436976) dated July 9, 2025. However, the Hong Kong Companies Registry provides no verifiable details about its leadership or corporate structure. The use of a prestigious address tied to virtual offices and WHOIS privacy through Namecheap (via Withheld for Privacy ehf, Iceland) suggests intentional anonymity.

- Key Concerns:

- No disclosed founders, executives, or advisory board.

- Hidden WHOIS data obscures true ownership.

- Recent incorporation raises doubts about claimed performance history.

- No disclosed founders, executives, or advisory board.

Comparison: Legitimate platforms like Coinbase list their leadership (e.g., Brian Armstrong, CEO) and regulatory filings with the SEC. MaoPay’s anonymity is a major red flag.

Compensation Plan and Sustainability

The MaoPay payment system promotes a multi-level marketing (MLM) structure with daily returns of 0.5%–3%, averaging 38% monthly (132%–792% annually). It includes a 20-level referral program, ambassador rewards, and tier-based incentives. Marketing materials highlight payouts like $197,500, with no withdrawal caps.

- Compensation Details:

- Investment Plans: Daily accruals of 0.5%–3% over 50–200 days.

- Referral Bonuses: Up to 20 levels, encouraging recruitment.

- Staking Rewards: Tied to the native MaoPay Token.

- Annual Yield: Claimed 132%–792%, far exceeding market norms.

- Investment Plans: Daily accruals of 0.5%–3% over 50–200 days.

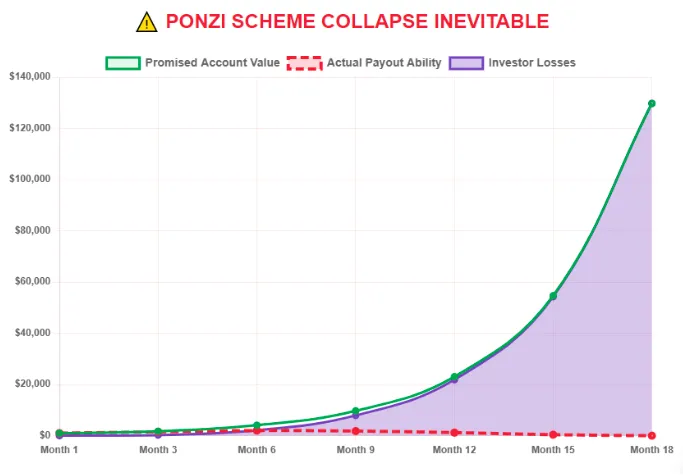

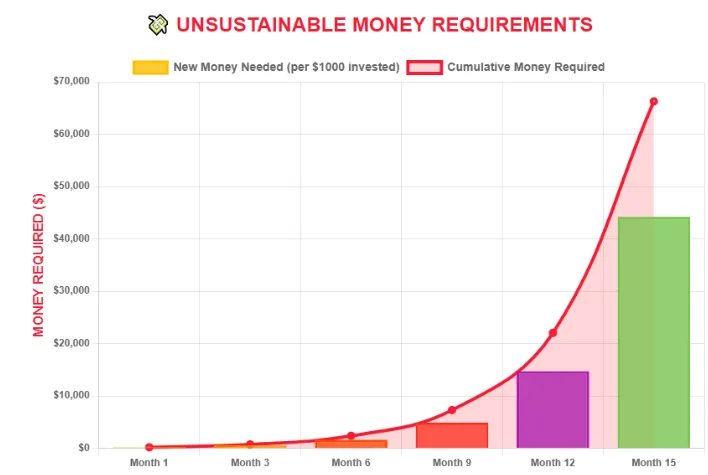

Sustainability Analysis

The promised returns are mathematically unsustainable. For a $1,000 investment at 2% daily:

- Daily Profit: $20.

- Monthly Profit: $600 (30 days).

- Annual Yield: $7,200 (720%).

For 1,000 investors, MaoPay needs $20,000 daily ($7.2 million annually) to cover payouts. Without a clear revenue model, it relies on new investor funds, a hallmark of Ponzi schemes.

Month | Total Deposits ($) | Monthly Payout ($) | New Investors Needed |

1 | 1,000,000 | 20,000 | 20 |

6 | 1,600,000 | 32,000 | 32 |

12 | 2,200,000 | 44,000 | 44 |

Comparison to Legitimate Investments

Asset Class | Typical Annual ROI | Risk Profile | Principal Guarantee |

MaoPay (Claimed) | 132%–792% | Extreme | None |

Real Estate | 8%–12% | Medium | Collateralized |

Bank Savings | 4%–5% | Low | FDIC Insured |

Crypto Staking (Kraken) | 5%–15% | High | Not Guaranteed |

MaoPay Security and Technical Performance

MaoPay claims 99.98% uptime with 1,200 GPU nodes and MaoPay fraud prevention via a predictive engine. However, it uses a basic Domain Validated (DV) SSL certificate and lacks independent security audits or PCI DSS compliance.

- Security Concerns:

- No evidence of MaoPay encryption or multi-factor authentication.

- Support via WhatsApp/WeChat lacks professional infrastructure.

- Client-side errors suggest technical instability.

- No evidence of MaoPay encryption or multi-factor authentication.

Comparison: Platforms like Mangopay provide PCI DSS Level 1 certification and detailed security documentation.

Traffic Trends and Public Perception

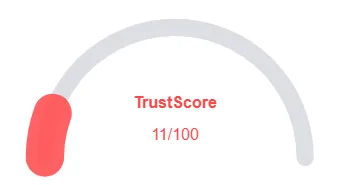

MaoPay has minimal online presence, with no organic traffic data from SimilarWeb or Alexa. Trust scores are low:

- ScamAdviser: 46/100 (suspicious, hidden WHOIS).

- ScamDoc: 25% (poor trust, new domain).

- GridinSoft: 53/100 (moderate trust).

Promotional accounts like @MaoPay_Official, @MaoPayInsider, and YouTube’s Income Hub push referral links, often tied to other high-risk platforms (e.g., BitHarvest, BitNest). This pattern suggests coordinated marketing typical of HYIPs.

Payment Methods and Customer Support

MaoPay accepts cryptocurrency payments (e.g., Litecoin) and fiat, but details are vague. MaoPay customer service relies on WhatsApp and WeChat, lacking a formal ticketing system or regulatory complaint process.

- Red Flags:

- Unclear MaoPay fees and settlement time.

- No banking partnerships disclosed.

- Withdrawal processes are underemphasized.

- Unclear MaoPay fees and settlement time.

Red Flags Summary

- Anonymous ownership with no verifiable leadership.

- Unrealistic ROI claims (132%–792% annually).

- MLM-style referral structure.

- Low trust scores and minimal online presence.

- Lack of MaoPay PCI DSS compliance or security audits.

- Crypto-centric payments with unclear withdrawal policies.

Recommendations for Investors

- Avoid Investment: Do not deposit funds until MaoPay provides regulatory proof, audited financials, and transparent ownership.

- Conduct Due Diligence: Check Hong Kong Companies Registry, SEC, or FCA databases for registration.

- Explore Alternatives: Opt for regulated platforms like Coinbase or Kraken, offering 5%–15% APY with transparency.

- Protect Data: Use strong passwords and monitor accounts if you’ve engaged with MaoPay.

Future Outlook

- Short-Term (6–12 Months): Aggressive marketing may attract early investors, but withdrawal delays are likely.

- Long-Term (1–3 Years): Without transparency, MaoPay risks collapse or regulatory action, as seen in similar HYIPs.

MaoPay Review Conclusion

This MaoPay review reveals a platform with high-risk characteristics, including anonymous ownership, unsustainable returns, and inadequate security. Investors should avoid MaoPay and prioritize regulated alternatives with proven track records. For a related analysis, check out our ClusterYield Review to understand similar risks. Conduct thorough research using tools like ScamAdviser and consult financial advisors before investing.

Disclaimer: This review is for informational purposes only and not financial advice. Always perform your own research (DYOR) and consult licensed professionals.

MaoPay Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 MaoPay currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with MaoPay similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- Hidden Whois data

Frequently Asked Questions About MaoPay Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

MaoPay is an AI-driven financial platform that claims to deliver predictable profits through algorithmic trading and asset management.

While MaoPay promises high returns, our MaoPay Review highlights transparency, regulatory, and sustainability concerns that investors should consider.

MaoPay offers digital payment options for deposits and withdrawals, but unclear policies and limited regulatory oversight raise questions about fund security.

Key risks include unsustainable ROI claims, potential regulatory issues, and lack of transparency, making it crucial to carefully assess before investing.

Our review recommends caution. Investors should conduct thorough research, understand the risks, and consider safer, regulated alternatives before committing funds.

Other Infromation:

Website: www.app.maopay.ai

Reviews:

There are no reviews yet. Be the first one to write one.