LexStay Review: Is This Futures Trading Platform Safe?

In this LexStay review, Scams Radar examines whether it’s a trustworthy platform for investors. We examine LexStay’s security, payments, and more. Many seek a safe trading platform with daily payouts. But questions arise about LexStay investment options. We combine details from various sources to help you decide.

Table of Contents

Part 1: Understanding LexStay as an Online Trading Platform

LexStay offers staking and futures trading. It claims high daily returns. The site launched in May 2025. It focuses on crypto like Bitcoin and Ethereum. Users deposit funds to earn through automated systems. But transparency is key in any trading platform.

The company is LEXSTAY PTY LTD. It has ACN 686 098 331 and ABN 37 686 098 331. Registered in Australia, but details are thin. No clear physical address shows up. Ownership stays hidden. WHOIS data uses privacy protection. This raises flags for trading transparency.

We searched for owners’ profiles. No directors’ names appear in public records. LinkedIn shows no linked profiles for LEXSTAY PTY LTD leaders. Backgrounds remain unknown. Legit firms often share team bios. Here, anonymity prevails. This lacks a safe trading platform.

Domain registered April 28, 2025. Registrar is NICENIC INTERNATIONAL GROUP CO., LIMITED. The country is listed as Greenland. This mix confuses. For LexStay’s industry licensing and regulation status, none is disclosed. No SEC, FCA, or AUSTRAC mentions. Unregulated platforms carry risks.

1.1 LexStay Investment Strategies Overview and Compensation Plan

LexStay provides tiered plans. These promise fixed daily returns. Here’s the complete compensation plan:

- Newbie Plan: 2% daily. Min deposit $5. Max $1,000. Lasts 10 days. Principal returns. Daily withdrawals.

- Expert Plan: 2.8% daily. Min $1,001. Max $2,500. 20 days. Principal back. Daily payouts.

- Trader Plan: 4% daily. Min $2,501. Max $250,000. 30 days. Principal included. Withdraw anytime.

Compounding boosts gains. But fixed rates ignore market swings. LexStay futures and staking trading options use crypto volatility. Yet, guarantees seem off.

Affiliate program adds layers. Earn 7% on direct referrals. Then 3% level 2, 2% level 3, 1% level 4. Bonuses for turnover: $25 to $5,000 based on activity. This MLM style focuses on recruitment. It mirrors pyramid setups.

LexStay fee and commission structure? Not detailed. Deposits in crypto like USDT, BTC. No fiat. LexStay’s minimum deposit requirements start low at $5. Appeals to beginners. But is LexStay good for beginner traders? High risks say no.

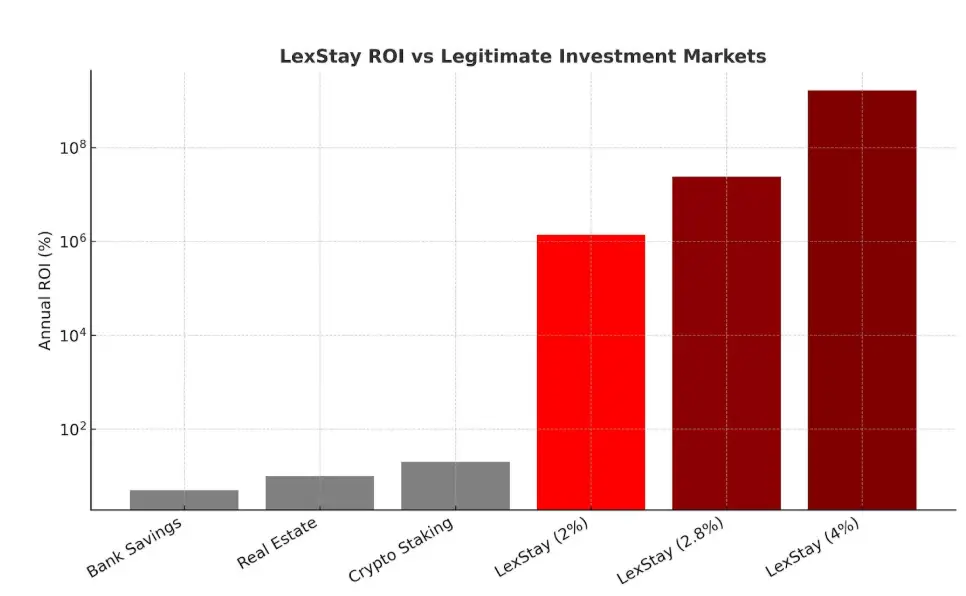

1.2 Mathematical Look at ROI Claims

Promised returns look too high. We calculate to show why.

For 2% daily, annualized: (1 + 0.02)^365 – 1 ≈ 1,376,408% APY.

2.8%: ≈ 23,848,916% APY.

4%: ≈ 1,648,802,285% APY.

Use formula A = P(1 + r)^n. P is principal, r daily rate, n 365.

A $1,000 investment at 2% daily grows fast:

Time | Balance |

1 Month | $1,811 |

3 Months | $5,943 |

6 Months | $35,320 |

1 Year | $1,377,410 |

This beats real markets. No legit strategy sustains it.

Compared to others:

- Bank ROI: 1-5% yearly.

- Real estate: 6-10% annual.

- Crypto APY on exchanges: 5-20% variable.

LexStay claims 730-1,200% yearly. Unsustainable without new funds. Points to Ponzi math.

Part 2: LexStay Security and How It Protects User Funds

The site has an SSL from Google Trust Services. DDoS protection via Cloudflare. Claims “security of funds.” But no audits or insurance. No 2FA details. How does LexStay protect user funds? Vague answers.

Content seems generic. No whitepaper. Terms missing. Phishing flags from ScamAdviser. Trust score is low at 1/100 from GridinSoft. Scamdoc at 25%.

Technical performance: Fast load. But low traffic, under 10,000 visits monthly. Global rank ~764,982. Self-claims: 5,909 users, $9.9M invested. Mismatch raises doubts.

2.1 LexStay Payments, Withdrawal, and Customer Support

LexStay payments use crypto: BTC, ETH, USDT (TRC20, ERC20, BEP20), SOL, LTC, DOGE. Irreversible transfers. LexStay withdrawal claims daily. But reviews note delays, locks.

How to withdraw funds from LexStay? Process unclear. Users report issues after deposits.

LexStay customer support: Email at support@lexstay.net. Claims 24/7. But the response time is poor. Unresponsive to problems. LexStay’s customer support quality and response time fall short.

Part 3: Public Perception and User Reviews

Trustpilot: 3.2/5 from 9 reviews. Positives scripted. Negatives: scams, no payouts. Reddit r/CryptoScams labels it fraud. Fake reviews suspected.

Social promotions from low-follow accounts on X: @Kevin45290225 pushed it and Tensorium. @shoumugou999 linked to Aitimart. @Vanessalaynch shared “paying” posts, history with other HYIPs.

Warnings from @kyle_yi6688, @Repentful1: fraud alerts.

User reviews and testimonials for LexStay mix. But negatives dominate.

3.1 Risks Involved with Trading on LexStay

High risks here. Unreal returns. No regulation. Hidden owners. MLM focus. Withdrawal woes. Low trust scores.

Future outlook: May collapse in 6-12 months. Like BitConnect or OneCoin.

Comparison of LexStay with other trading platforms: Unlike Binance or Kraken, no licenses. Those offer 5-10% APY max.

LexStay platform user interface review: Simple, but lacks depth.

3.2 Steps to Start Trading on LexStay and Alternatives

Steps: Register, deposit crypto, pick a plan. But pause. How to monitor trading performance on LexStay? Dashboard claims stats, but unverified.

Technology behind LexStay trading platform: Undisclosed.

LexStay’s approach to data privacy and security: Minimal info.

Better options: Regulated sites like Coinbase. Real staking on Ethereum: 4-6% APY.

LexStay trading community: Small, mostly affiliates.

Conclusion

This LexStay review shows red flags. Is LexStay a trustworthy platform? Evidence says no. High returns tempt, but risks loom. Lack of owners’ backgrounds hurts trust. Compensation relies on recruits. Now visit Orbitra AI Review.

Steer clear. Use regulated platforms. If invested, withdraw fast. Report issues.

DYOR: This isn’t advice. Research fully. Consult experts. Never risk what you can’t lose.

LexStay Review Trust Score

A website’s trust score is an important indicator of its reliability. LexStay currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with LexStay or similar platforms.

Positive Highlights

- Valid SSL certificate found.

- DNSFilter marks the site as safe.

Negative Highlights

- Low website traffic

- Uses registrar linked to scams

- Mostly negative reviews found

- Flagged by iQ Abuse Scan for phishing

- Newly registered domain

- Unusually high number of early reviews

Frequently Asked Questions About LexStay Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

LexStay has multiple red flags, including high returns, lack of transparency, and hidden ownership, making it a risky platform.

The risks include unrealistic returns, no regulation, delayed withdrawals, and hidden ownership, indicating a high-risk platform.

LexStay offers tiered plans promising daily returns, but it relies heavily on new investments, resembling a Ponzi scheme.

LexStay uses SSL encryption and DDoS protection, but lacks audits and 2FA, which leaves funds unprotected.

Yes, like Everstead, LexStay offers unsustainable returns and a recruitment-based compensation plan, posing significant risks.

Other Infromation:

Website: lexstay.net

Reviews:

There are no reviews yet. Be the first one to write one.