Laventinemarketsystem Review: Is This AI Trading Platform Legit or a Risky Scam?

Investing online can be exciting, but platforms like Laventinemarketsystem Review raise serious concerns. For an in-depth scam analysis, visit Scams Radar for a detailed review. This review examines its legitimacy, focusing on ownership, compensation plans, and risks. With claims of 2% daily returns and a multi-level marketing (MLM) structure, it’s critical to assess whether laventinemarketsystem.top is safe for investors. Our analysis uses data from domain records, scam detection tools, and financial benchmarks to provide a clear, objective evaluation.

Table of Contents

What Is Laventinemarket system?

Laventinemarketsystem, branded as “Ultimate AI,” is a recently launched platform offering AI-driven trading in stocks, bonds, forex, and cryptocurrency. It promises consistent 2% daily returns (Monday to Friday) and promotes a proprietary token, “THE COIN,” for trading or holding. The site also features a referral program with cash prizes and luxury rewards like cars and trips. Launched in June 2025, its polished design targets investors seeking passive income, but key details raise red flags.

Ownership and Transparency Concerns

Legitimate investment platforms disclose their company details, leadership, and regulatory status. However, this platform lacks transparency:

- Domain Details: Registered on June 10, 2025, via NameSilo, LLC, with ownership hidden through PrivacyGuardian.org. The registrant is listed in Arizona, US, but no personal or corporate details are public.

- No Company Information: No legal entity name, physical address, or registration with regulators like the SEC, FCA, or CySEC is provided.

- Regulatory Warning: The Central Bank of Russia flagged the platform for “signs of a financial pyramid,” linking it to “ALTIMAITEINCOPORATIONS.ORG.”

Without verifiable ownership or licensing, accountability is nearly impossible, a major concern for investors.

Compensation Plan Breakdown

The platform’s compensation plan combines AI trading returns with an MLM-style referral system. Here’s how it works:

Investment Tiers and Rewards

Tier | Minimum Investment | Trading Volume | Key Benefits |

Newcomer | $10+ | $1,000 | Basic AI tools, webinars, certificate |

Intermediate | $100+ | $5,000 | Advanced tools, priority support |

Advanced | $500+ | $20,000 | VIP support, private consultations |

Top-Level | $1,000+ | $50,000 | Mentorship, custom AI, VIP events |

Elite-Level | $2,000+ | $100,000 | Profit-sharing, consultant, perks |

Referral Structure

- Five-Level Commissions: Earn 10% (level 1), 3% (level 2), 2% (level 3), and 1% (levels 4-5) on referrals’ investments.

- Focus on Recruitment: Rewards are tied to network growth and trading volume, typical of pyramid schemes.

ROI Claims

The platform advertises 2% daily returns, equating to ~10% weekly (5 trading days). This structure incentivizes recruitment over trading performance, raising concerns about sustainability.

Are the Returns Sustainable?

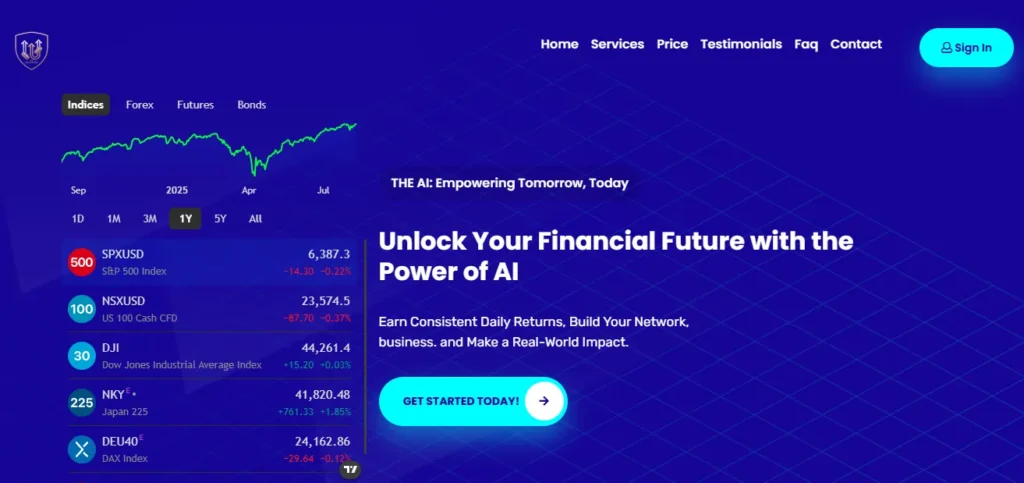

The promised 2% daily returns are mathematically unsustainable. Here’s the breakdown:

- Annual ROI Calculation: With 260 trading days per year, the compound return is: (1+0.02)260−1≈18,027%(1 + 0.02)^{260} – 1 \approx 18,027\%(1+0.02)260−1≈18,027%

- Example: A $1,000 investment grows to ~$181,000 in one year—far beyond legitimate market returns.

Comparison to Legitimate Investments

Investment Type | Typical Annual ROI | Key Features |

Bank Savings/CDs | 3-5% | FDIC-insured, low risk |

Real Estate | 7-10% | Tangible assets, steady cash flow |

Crypto Staking | 5-20% | Transparent, blockchain-verified |

Laventinemarketsystem | ~18,027% | Unrealistic, no risk disclosure |

Legitimate platforms like Coinbase (crypto staking) or Vanguard (stocks) offer 5-20% annual returns with clear risk warnings. The platform’s claims dwarf these, ignoring market volatility (e.g., the 2022 crypto crash cut values by 70%+).

Red Flags in Laventine market system Trading

- Unrealistic Returns: 18,027% annual ROI is impossible without fraud or extreme risk.

- Hidden Ownership: No verifiable team or company details.

- Pyramid Scheme Traits: MLM structure prioritizes recruitment.

- Regulatory Flags: Russia’s Central Bank warns of pyramid risks.

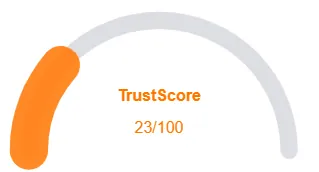

- Low Trust Scores: Scamdoc (1%), Gridinsoft (27/100), and Scamadviser flag high risk.

- No Security Details: Lacks 2FA, KYC/AML compliance, or encryption standards.

- Generic Content: Unverified testimonials and awards (e.g., “car ceremonies”).

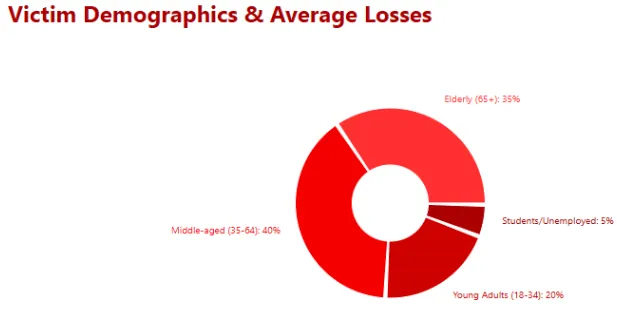

Public Perception and Social Media Promotion

Public sentiment is negative, with scam detection tools warning of risks. Social media promotion relies on affiliate-driven posts:

- X Profiles: @OlumideLucas1 and @Theultimateaitp push motivational claims (e.g., “300% returns”). Past posts link to similar high-yield schemes.

- Facebook/Instagram: Groups like “Go E1Ulife Al Affiliate Marketing” and profiles like @achilikechidiamara share referral links, often tied to other MLM platforms (e.g., Solmax Global).

- No Organic Engagement: Promotional posts lack likes or shares, suggesting paid campaigns.

Security and Technical Issues

The platform uses HTTPS but provides no details on encryption, 2FA, or fund custody. Its young domain (50 days old) and generic design, with broken links and no live dashboards, suggest minimal development. Payment methods are unclear, likely limited to cryptocurrency, which prevents chargebacks and raises fraud risks.

Customer Support and Withdrawals

Support is tier-based, favoring high-level investors, with no public contact details (email/phone). Withdrawal processes are undisclosed, and scam reports mention delays or “maintenance” excuses—common in fraudulent platforms.

Future Outlook

Based on similar schemes (e.g., Bitconnect, collapsed 2018), the platform may:

- Pay early investors briefly to build trust.

- Face withdrawal issues within 3-6 months.

- Shut down or rebrand within 6-12 months, leaving investors with losses.

Recommendations for Investors

- Avoid Investment: The platform’s unsustainable returns and red flags make it high-risk.

- Use Regulated Alternatives: Choose platforms like Binance (crypto) or Schwab (stocks) with verified licensing.

- Verify with DYOR Tools: Check SEC/EDGAR, FINRA, or Scamadviser before investing.

- Report Issues: Contact the FTC or FBI’s IC3 if affected.

Laventine market system Review Conclusion

This Laventinemarketsystem review reveals a platform with unsustainable 2% daily returns, hidden ownership, and pyramid scheme traits. Its low trust scores, regulatory warnings, and lack of transparency make it unsuitable for investment. For another example of similar risks, see our detailed Morfas World Review. Stick to regulated platforms with realistic returns to protect your funds.

DYOR Disclaimer:

This Laventinemarketsystem review is for informational purposes only, based on public data as of August 11, 2025. It’s not financial advice. Always conduct your own research, consult professionals, and invest only what you can afford to lose. Markets are volatile, and high returns often signal high risks.

Laventine market system Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Laventine market system a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Laventine market system or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Content accessible

- No spelling/grammar errors

- Whois accessible

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Not in Tranco top 1M

Frequently Asked Questions About Laventine market system Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Laventinemarketsystem raises multiple red flags, including unrealistic ROI claims, MLM-style structure, and lack of transparency.

It claims to provide up to 2% daily returns through trading and multi-level marketing recruitment, but no verifiable proof supports these claims.

Risks include potential loss of funds, unsustainable business model, lack of regulatory oversight, and possible Ponzi-like operations.

No. The platform is not licensed or regulated by any recognized financial body, which greatly increases investor risk.

It’s not recommended. The platform’s high-risk MLM structure and unrealistic ROI promises make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.