Knowo Review: Is Knowo World a Legitimate Platform or a Potential Scam?

In this Knowo review, Scams Radar examines the platform’s claims as an education-based quiz app. Many users seek details on its features, but concerns arise from its investment and referral system. Launched recently, Knowo. The world promises rewards through quizzes and more. Yet, red flags suggest risks for investors. This analysis combines public data, user reports, and math to help you decide.

Table of Contents

Part 1: Understanding the Knowo App and Its Core Features

Knowo positions itself as an innovative education management tool. The site describes quizzes for learning, with app instructions for easy use. Users can track progress, but the app includes reward systems. These tie into daily free rewards from ads and engagement. The Knowo app aims for parental engagement by offering notifications on activities. However, a deeper review shows a focus on financial aspects over pure education.

The platform mentions school communication through alerts. For instance, it could send updates on quiz results. Student tracking appears in basic forms, like attendance via app check-ins. Knowo school fee management is not directly stated, but payment methods link to deposits for premium features. Transportation alerts are absent, but general notifications are customized for user needs.

Knowo e-commerce for schools is unclear, yet the site hints at rental services for items. The mobile app works on Android and iOS, with a dashboard for schools to monitor data. Security features include IP monitoring and one account per device. User experience varies, with a simple interface for non-tech-savvy users. Multi-language support may exist, but details are sparse.

1.1 Ownership and Background: What We Know About the Team

Ownership details remain hidden. Domain registration from late August 2025 shows redacted WHOIS data. No company name, registration number, or directors appear on the site. The app developer is listed as Parvinder on trackers like AppBrain. No team bios or HQ address exist. This lack of transparency raises concerns in a Knowo review.

Searches for owners yield no results. No public profiles or backgrounds for directors. In Pakistan, where the platform targets users, SECP requires disclosure for deposit-taking entities. Without this, accountability is low. Past schemes with anonymous owners often collapse. Investors face risks if funds vanish without traceable parties.

Part 2: The Complete Compensation Plan Explained

The compensation plan drives much of the platform’s appeal. It has five pillars: daily free rewards, investment rewards, referral rewards, rental rewards, and meeting/league bonuses.

- Daily Free Rewards: Earn from ads and quiz engagement. This seems low-risk but insufficient for big payouts.

- Investment Rewards: Tiers include Silver, Gold I/II, and Premium I-V. Minimum deposit is $50. Returns range from 3.6% to 4.5% over 45 days. Unlocking higher tiers needs direct recruits, like 25 Gold members for Gold I.

- Referral Rewards: Get 10% on downline upgrades. This pays repeatedly as members advance from Bronze to Premium.

- Rental Rewards: 10% initial charge and 10% monthly fee. Total 86.75% is distributed across 10 upline levels.

- Meeting and League Bonuses: Cash for recruiting 25 to 1,000 Gold IDs. League milestones add more.

Rules include $50 minimum withdrawal, 5% TDS fee, and IP checks. One account per device limits abuse. The plan relies on recruitment. Over 90% of rewards come from new money, not external sources like ads.

2.1 ROI Claims: Mathematical Proof of Unsustainability

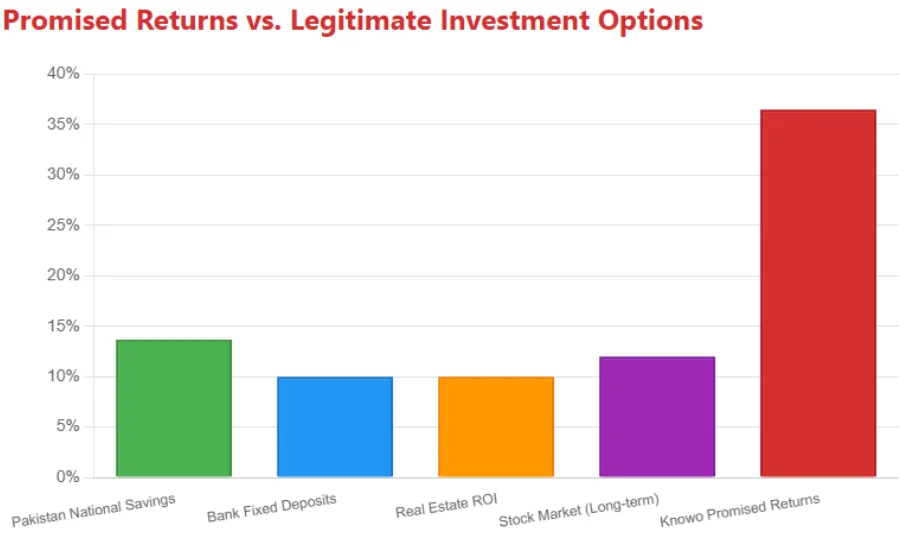

Promised returns are high. A 4.5% per 45 days equates to about 37% annualized simple, or 43% compounded.

Consider this calculation: For $100 at 4.5% over 45 days, the value becomes $104.50. Rolled yearly (8 cycles), it grows exponentially.

To visualize, imagine a graph where days on the x-axis (0 to 365) and value on the y-axis. Starting at $100, it curves up sharply, reaching over $140 by year-end. This growth demands constant new funds.

Quiz ad revenue averages $0.01-0.05 per user daily. For 10,000 users, that’s $100-500 daily. It can’t cover payouts on a $100,000 pool.

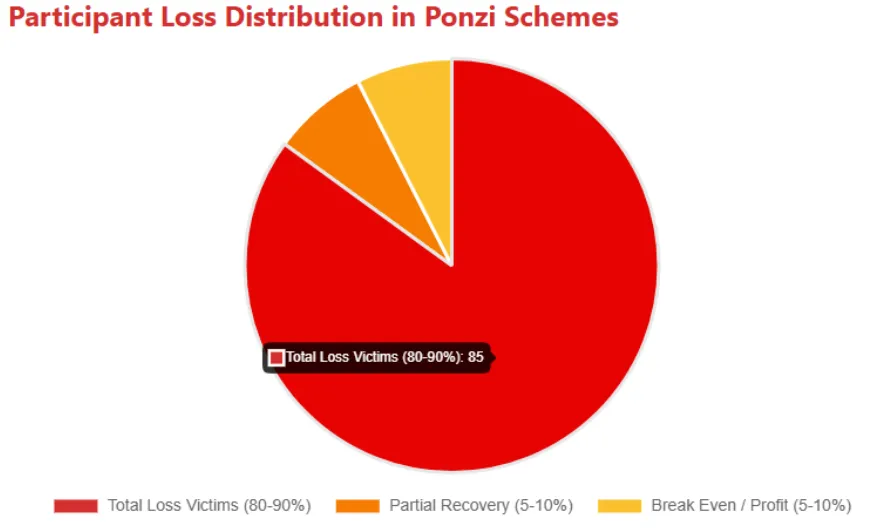

Ponzi math: 10-level payouts need exponential recruits. Each level requires 2.5 new members daily to sustain. It saturates fast.

ROI Source | Annual Yield (%) | Risk Level | Sustainable? |

Knowo | 37-43 | Very High | No |

Pakistan Bank FD | 15-20 | Low | Yes |

Real Estate Rental | 8-12 | Medium | Yes |

Crypto Staking ETH | 3-5 | High | Partial |

Part 3: Traffic Trends and Public Perception

Traffic data shows under 1,000 monthly visits. No organic growth; it depends on social hype. Public perception is mixed. No reviews on Trustpilot or Reddit. X searches find no mentions. Facebook groups promote it as secure, but proofs are screenshots only.

YouTube channels push earning tutorials with a referral focus. Promoters like Arshid Hussain in groups claim high returns. Their history includes similar MLM videos. No X presence for these accounts.

3.1 Security Measures, Content Authenticity, and Technical Performance

Security uses basic SSL. No 2FA or KYC noted. Content is authentic as a React app, but quiz education seems a facade for investments. Payments are unspecified, likely crypto for anonymity. Support lacks email or phone; groups hint at Telegram.

Tech performance is fast, but the app was unpublished from Google Play on October 20, 2025. Only 50 installs, no ratings. This signals compliance issues.

Red Flags and Comparisons

Red flags include hidden ownership, a delisted app, a recruitment focus, and no audits.

Compared to banks, Knowo offers 4x higher yields without regulation. Real estate provides tangible assets at a lower ROI. Crypto exchanges cap APY at 10% for safety.

Category | Red Flags | Score (/10) |

Transparency | Hidden details, no team | 10 |

Returns | High without proof | 10 |

Recruitment | Multi-level, pay-to-upgrade | 10 |

Exit Barriers | Fees, bans | 9 |

Tech | Delisted app | 9 |

DYOR Tool Reports and Promoter Profiles

Scamadviser gives high trust due to SSL, but ignores newness. AppBrain confirms delisting. VirusTotal is clean. SECP alerts match perfectly.

Promoters: Facebook groups like “Knowo App | Work From Home” (167 members) by Arshid Hussain. Another “Knowo App” mixes forex/MLM. The YouTube “Knowo” channel has earning videos. Past promotions involve similar schemes.

No X profiles found.

Recommendations and Future Predictions

Avoid deposits. Report to SECP. Choose regulated options like banks or REITs.

Predictions: Hype lasts 1-2 months with early payouts. Then, freezes in month 3. Collapse likely in 3-6 months, like OneCoin

Conclusion:

This Knowo review highlights serious issues. The compensation plan favors recruitment over education. Ownership lacks transparency. Math proves returns are unsustainable. For safety, stick to verified platforms. Always DYOR and consult experts. Your financial choices matter. Choose wisely to avoid losses..

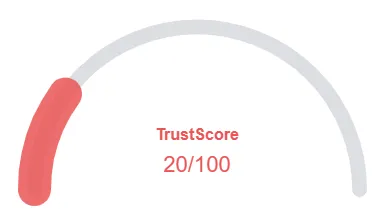

Knowo Review Trust Score

A website’s trust score is an important indicator of its reliability. Knowo currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Knowo or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- DNSFilter considers this website safe

Negative Highlights

- Financial services (or content) identified with a high risk/return

- Characteristics of a HYIP site detected

- This website does not have many visitors

- The website's owner is hiding his identity on WHOIS using a paid service

Frequently Asked Questions About Knowo Review

This section answers key questions about Knowo, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Knowo claims to be an education app, but hidden ownership and investment-based payouts make it risky.

It gives small quiz rewards but mainly relies on referrals and deposits.

Anonymous owners, unrealistic returns, and a delisted app raise major concerns.

Both face issues with transparency and unsustainable ROI claims.

No, its 37- 43% annual ROI is unrealistic and unsustainable.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.