KGF-Mine Review: Uncovering the Truth Behind This Investment Platform

In this KGF Mine review, Scams Radar examines whether the platform lives up to its claims or raises serious concerns. Drawing from detailed analysis, we look at ownership, compensation plans, and risks. This guide helps everyday investors decide wisely.

Table of Contents

Part 1: Understanding KGF-Mine: A Quick Overview

KGF-Mine Review: Exploring the Legacy Behind Its Name

The KGF-Mine Review uncovers that the platform’s name originates from the historic Kolar Gold Fields in India, once celebrated for its vast gold reserves and pioneering mining depth. The original Kolar Gold Fields mine began its journey in the late 1800s when the British company John Taylor & Sons established operations. This marked the rise of one of the world’s deepest and most successful gold mining projects, known for its advanced techniques and remarkable production levels that shaped India’s mining history.

At its peak, the Kolar Gold Fields reached depths of over 3,000 meters, making it one of the deepest gold mines in the world. Over a century, it produced nearly 800 tons of gold, using advanced techniques like shaft sinking and cyanide leaching.

Yet, this online site has no real link to that legacy. It claims to offer high-yield investments tied to trading and arbitrage, not actual mining. The mismatch is a key issue. Real KGF mines closed in 2001 due to falling gold prices and high costs. Environmental impact was severe, with soil and water contamination from cyanide waste. Health effects on workers included respiratory issues from dust and poor ventilation. Economic importance faded, leading to unemployment in the area.

1.1 Ownership Profiles and Backgrounds

Details on owners remain hidden. Domain records show registration on October 15, 2025, with privacy protection in Bihar, India. No names, addresses, or company filings appear. The site claims a start date of January 1, 2005, but this conflicts with facts. No team bios or LinkedIn profiles exist. In contrast, legitimate firms list executives with verifiable tracks.

This opacity echoes problems in the KGF mining legacy, where worker conditions were harsh under colonial rule. Miners faced long hours in dark tunnels, with little safety. Today’s platform lacks transparency, much like unregulated ventures. No regulatory licenses or audits show up. It disclaims being a bank or securities firm, stating deposits are private deals at your risk.

Part 2: Complete Compensation Plan Breakdown

The platform offers three plans, all with guaranteed returns, a rare claim in real finance.

- 1-Year Plan: 2.4% daily for 365 days. Minimum deposit: $0. Payouts daily. Total simple return: 876%. With compounding, $1,000 grows to about $5.75 million.

- 100-Day Plan: 3.4% daily for 100 days. Minimum: $10. Daily payouts. Simple return: 340%. Compounded: $1,000 becomes $28,300.

- 30-Day Plan: 150% total after 30 days. Minimum: $10. One lump sum. Equals 50% profit in a month.

An affiliate program lets users earn commissions without investing by sharing links. This focuses on recruitment, not core profits. Payments use cryptocurrencies like USDT on ERC20, TRC20, or BEP20 networks irreversible and hard to trace.

Compare this to real KGF gold production, which relied on labor-intensive methods. Mining techniques involved drilling and blasting, but yields dropped over time. Here, promises seem detached from reality.

1.1 Comparison to Real KGF and Legit Options

Real KGF contributed to India’s gold output, nationalized in 1956. Rehabilitation plans now aim at revival, like industrial parks on abandoned lands. Documentaries cover their timeline, from boom to closure.

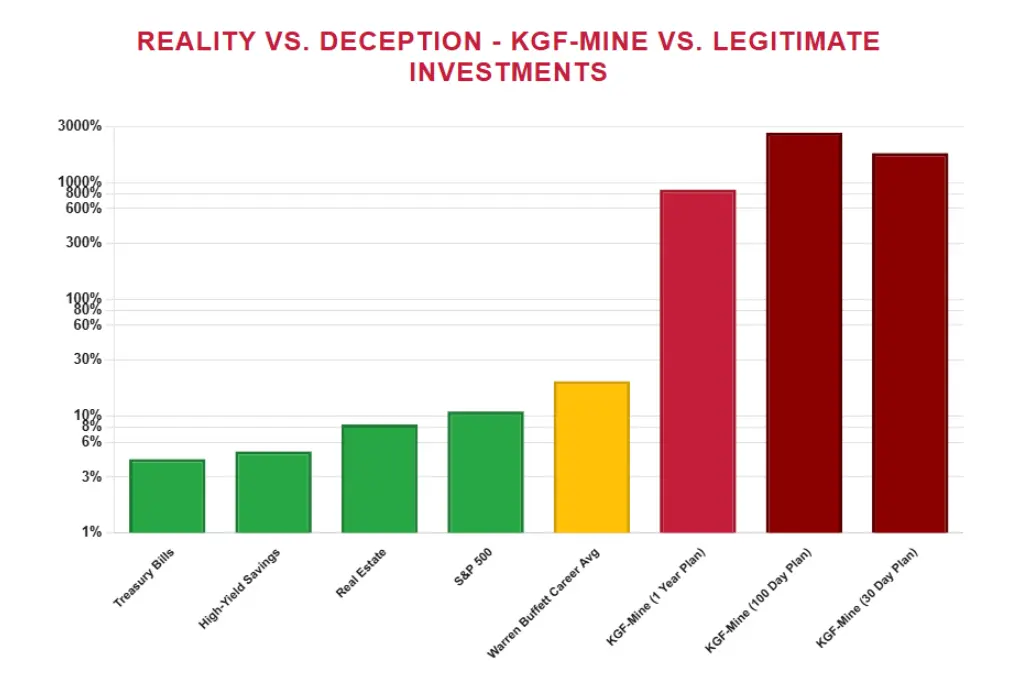

Unlike that, this site offers no proof. Stick to regulated paths: Vanguard funds at 7-10%, ETH staking at 4-6%, REITs at 6-8%.

2.1 Why Promised Returns Are Unsustainable: Math Proofs

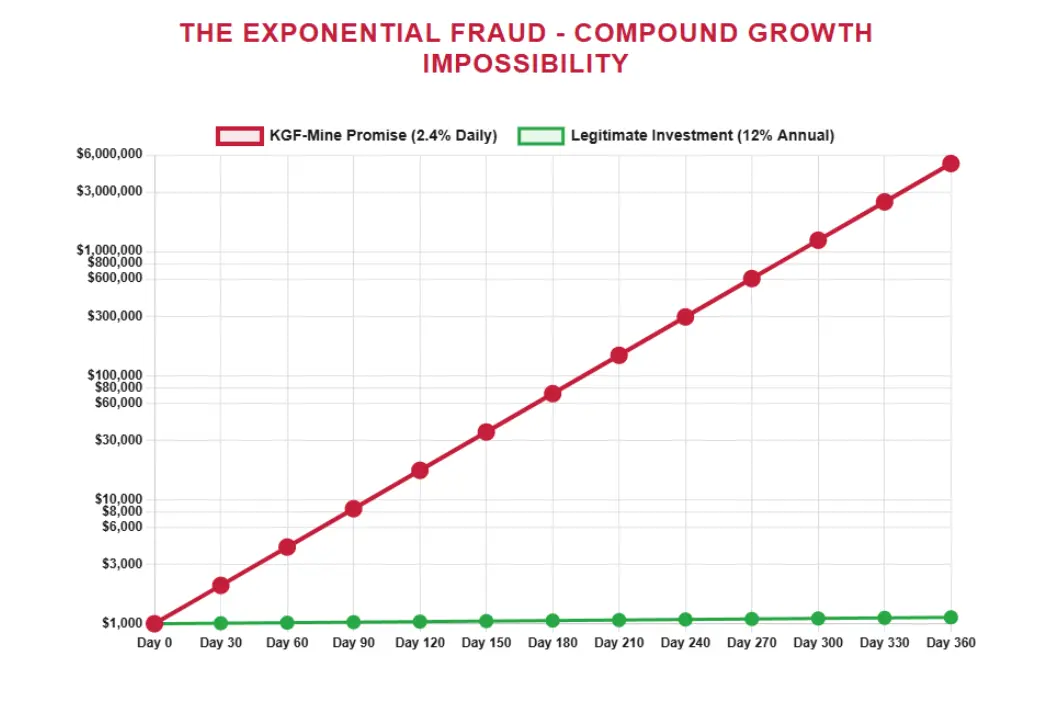

No valid strategy sustains these yields. Let’s calculate.

For the 1-year plan: Final value = Principal × (1 + 0.024)^365. For $1,000, it’s $1,000 × 5,748 ≈ $5,748,000. That’s over 574,700% gain.

100-day: $1,000 × (1 + 0.034)^100 ≈ $28,300, or 2,730% in three months.

30-day: $1,000 becomes $1,500, annualized to massive figures if repeated.

These dwarf real benchmarks. Banks offer 4-5% APY. Real estate cap rates hover at 4.7-5%. Crypto staking yields 3-10%. S&P 500 averages 10% yearly.

Investment Type | Annual Return | Risk Level |

Bank Savings | 4-5% | Low |

Real Estate | 5-8% | Medium |

Crypto Staking | 3-10% | High |

KGF-Mine Plan | 876%+ | Extreme |

A bar graph would show KGF bars towering over others, proving an imbalance. Such growth needs endless new funds, a Ponzi scheme. Real KGF faced sustainability challenges, closing after resources were depleted.

Red Flags and Risks for Investors

Several issues stand out.

- Hidden ownership and false history claims.

- Vague model: No details on trades or assets.

- High returns with guarantees, ignoring market volatility.

- Affiliate push, like pyramid setups.

- No independent reviews; low trust scores on tools.

- Crypto-only payments, no chargebacks.

- Rules suppress negative feedback.

Public perception is poor. No Trustpilot entries. Promoters like Rory Singh on YouTube review similar sites, often questionable. His past covers bitbullmining.com and others with rug-pull risks.

Traffic is low, and content is generic. Security uses basic SSL. Support claims 24/7 but lacks contacts.

Tied to KGF: Real mines caused environmental contamination, affecting local agriculture and water. Worker health was affected by dust and chemicals. This platform risks financial health, with a likely total loss.

DYOR Tools and Future Outlook

Check ScamAdviser (low score), WHOIS (new domain), and VirusTotal. Social searches show promo posts, no official accounts.

Prediction: Early payouts build trust, then delays lead to shutdown in months. Like 99% HYIPs.

Conclusion: Stay Informed and Cautious

This KGF-mine review reveals high risks and little legitimacy. Avoid unless you accept full loss. Research deeply, consult experts. For true KGF fans, exploring its documentary or site visit info is far safer than this venture.

KGF-Mine Review Trust Score

A website’s trust score is an important indicator of its reliability. KGF-Mine currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with KGF-Mine or similar plat0forms.

Positive Highlights

- According to the SSL check the certificate is valid

- DNSFilter considers this website safe

Negative Highlights

- Financial services (or content) identified with a high risk/return

- Characteristics of a HYIP site detected

- This website does not have many visitors

- The website's owner is hiding his identity on WHOIS using a paid service

Frequently Asked Questions About KGF-Mine Review

This section answers key questions about KGF-Mine, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. KGF-Mine hides its owners, offers fake high returns, and lacks regulation clear regulatory scam signs.

It claims crypto trading profits but shows no real proof or verified trading activity.

High risk of total loss due to fake ROI, hidden owners, and crypto-only withdrawals.

No. It only uses the Kolar Gold Fields name; there’s no real mining involved.

Unlike Everstead Review’s structured model, KGF-Mine lacks transparency and sustainability.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.