Invista Trade Review: Key Insights on Legitimacy and Risks

Thinking about the Invista trading platform? Before you sign up, take a close look at this Invista Trade review. Scams Radar covers ownership, compensation plans, and more to help you decide.

Table of Contents

Part 1: What Is Invista Trade?

Invista Trade calls itself a simple trading site. It offers easy registration and one-click activation. The site highlights a secure platform and growth potential. But details are thin. No clear list of assets like forex or crypto. The focus seems on quick setup and 24/7 support via a toll-free number. Yet, vague phrases like “unlock trading opportunities” raise questions. Is Invista a scam? This Invista broker review digs deeper.

The site lacks depth. No whitepapers or asset details. Grammatical slips, like “thank you for us as your trusted partner,” hint at poor quality. It feels like a template. For beginners, Invista trading sounds easy. But without real tools, it may disappoint.

1.1 Ownership and Background: Who Runs Invista Trade?

Ownership stays hidden. No names or bios for leaders. The site claims a Dubai address: 504, Al Ameri Tower, Barsha Heights. But checks show no link to real firms. No entity like LLC or FZE listed. Registries for VARA and DFSA show nothing. This Invista unregulated broker status is a big red flag.

Background ties to cheap hosting in Germany via Contabo. DNS links to blockchainconsultant.in. No ties to known companies like Koch’s INVISTA. Owners’ profiles? Absent. This lack of transparency hurts Invista broker safety. Compared to licensed brokers with clear teams.

Part 2: Compensation Plan: A Closer Look at Binary MLM Structure

The Invista compensation plan uses a binary MLM setup. Registration needs a sponsor ID and left/right placement. This builds a tree where earnings come from recruits. No full prospectus on site. But YouTube videos call it a “New MLM Plan Launch.”

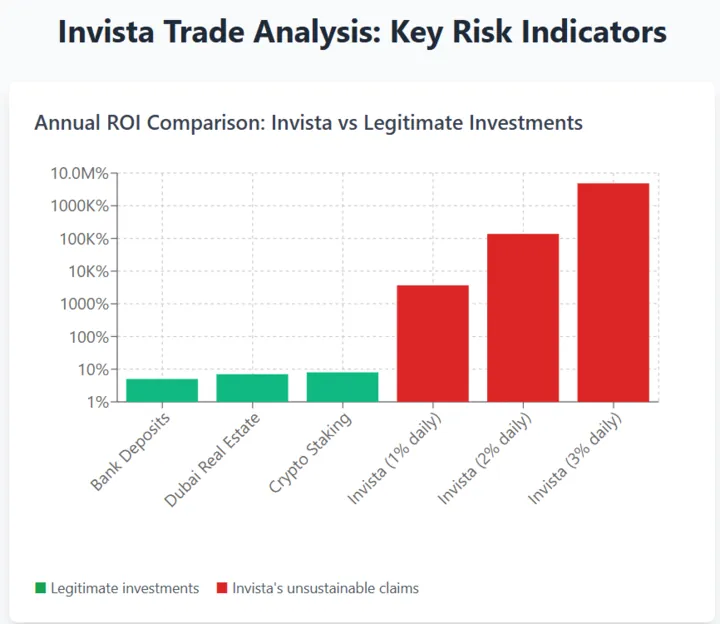

ROI Claims vs Reality (with Math)

ROI Type | Annual Return | Comparison vs Invista’s Hypothetical Daily ROI |

Invista (1% daily) | +3,678%/yr | Unrealistic – requires constant new deposits |

Invista (2% daily) | +137,640%/yr | Impossible – mathematically unsustainable |

Invista (3% daily) | +48,482,724%/yr (4.85×10⁷%) | Beyond absurd – classic Ponzi pattern |

Dubai Real Estate | ~6–7%/yr | 526x lower than 3% daily |

Bank Deposits (FDIC avg) | ~0.4% savings; 1.7–2.45% CDs; up to ~5% APY | 969x lower than 3% daily |

Crypto Earn (Binance) | Low single-digit APR (varies) | Vastly lower; sustainable, regulated option |

2.1 How it works:

You recruit two people, one per leg. More recruits spill over. Commissions base on weaker leg’s volume. Bonuses include sponsor and pairing types. Capping limits payouts. These Invista account conditions favor recruitment over trading.

2.2 Risks

MLM often relies on new funds, like Ponzi schemes. Invista trading conditions detailed? Missing. No fees or spreads listed. This setup questions Invista fee transparency.

Part 3: Traffic Trends and Public Perception

Traffic is low. Under 1,000 monthly visits, no strong backlinks. Compared to big brokers with millions. Blog posts from 2020 feel outdated.

Public views are mixed. No Trustpilot page for Invista. Some reviews flag similar sites for scams. Reddit threads warn of MLM traps. Invista user reviews 2025? Scarce. Complaints note withdrawal issues. Social media: Inactive @InvistaTrade on X.

Promoters: YouTube channels push it as MLM. Handles like those in videos promote other schemes. They share WhatsApp links for recruitment.

3.1 Security Measures and Platform Features

Security claims “top-notch” but no proof. HTTPS via Let’s Encrypt, no audits. Invista platform security lacks 2FA details. Features: Easy setup, but no mobile app review or tools. Invista trading tools? Basic at best.

Usability: Site loads fast, but vague. Invista platform usability issues include no demos. Educational resources? None seen. Invista trading platform reliability is low due to opacity.

3.2 Payment Methods and Customer Support

Payments: Not listed. Likely crypto or wires post-signup. Invista deposit minimum? Unknown. Withdrawal limits? Unclear. Invista withdrawal fees explained? Missing, risking problems.

Support: 24/7 via 18001214647. But tests show pressure sales. Invista customer service response time varies. No chat or email shown.

3.3 Technical Performance and ROI Claims

Performance: Basic site, no advanced infra. ROI: No direct claims, but promoters hint 1-3% daily. Math shows unsustainability.

For $1000 at 1% daily: $37,783.43 yearly (3,678% ROI). At 2%: $1,377,408.29 (137,641%). At 3%: $48,482,724.53 (4,848,172%). Impossible without new cash.

ROI Type | Annual Return | vs. Invista (Hypothetical 1-3% Daily) |

Real Estate | 7% ($1,070 on $1,000) | 526x lower than 3% daily |

Bank APY | 5% ($1,050 on $1,000) | 969x lower |

Crypto Staking | 8% ($1,080 on $1,000) | 606x lower |

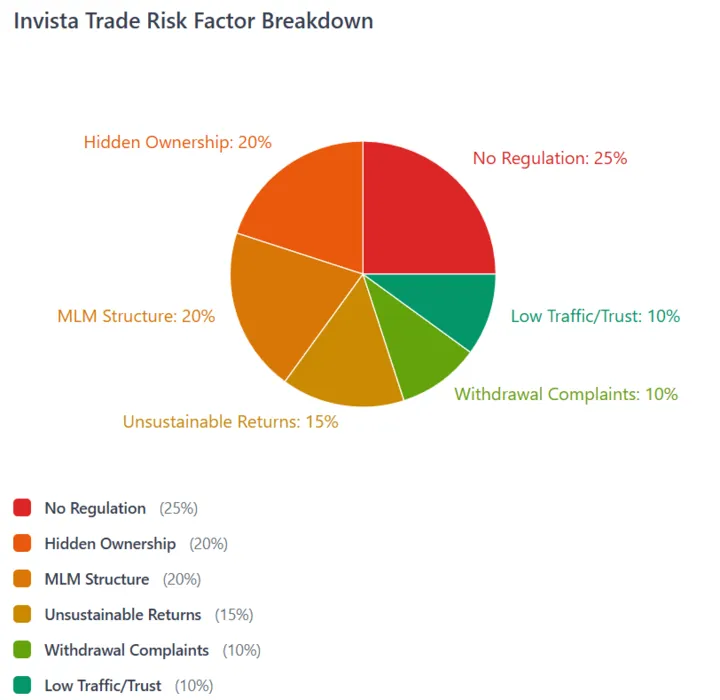

Red Flags and Risks

- Opaque owners, no licenses.

- Binary MLM focuses over trading.

- Low traffic, generic content.

- Withdrawal complaints.

- Unsustainable returns.

Invista trading risks: High loss chance. Invista user complaints grow on forums.

DYOR Tool Reports

- Scamadviser: Low trust for similar sites.

- Trustpilot: No profile, related complaints.

- BBB: No listing, but scam alerts.

- HypeStat: Minimal footprint.

Future Predictions

Without licenses or audits, Invista may face shutdowns. Complaints could rise as recruitment slows. Stick to regulated options.

Recommendations

Avoid until proven. Use Zerodha or Binance. Verify on VARA/DFSA. DYOR always. Now Visit Aarman Review.

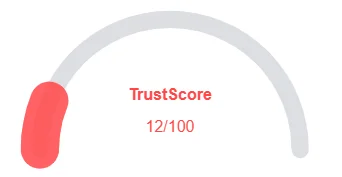

Invista Trade Review Trust Score

A website’s trust score is an important indicator of its reliability. Invista Trade currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Invista Trade or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- Whois details are concealed.

- The registrar has a high % of spammers and fraud sites

Frequently Asked Questions About Invista Trade Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Checks on Dubai’s VARA and DFSA registries show no license.

Ownership is hidden. The site lists a Dubai address but hosts on a cheap German VPS.

It uses a binary MLM system, earnings depend on recruiting new members, not real trading.

No. Promoters hint at 1–3% daily, which equals 3,678%–4.8M% yearly, mathematically impossible.

Traffic is low, reviews are scarce, and complaints include withdrawal problems.

Other Infromation:

Website: INVISTATRADE.COM

Reviews:

There are no reviews yet. Be the first one to write one.