Interlink Review: Is This Platform a Safe Investment?

This Interlink review examines the platform’s legitimacy, risks, and potential. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Interlink, accessible at interlinklabs.ai, claims to offer decentralized identity solutions and token-based rewards. However, concerns about ownership transparency, unverified ROI claims, and platform reliability raise questions. Read on to explore whether inter link is safe, covering features, compensation, security, and more, with clear insights and comparisons for investors.z

Table of Contents

Understanding Interlink’s Offerings

Interlink presents itself as a Web3 platform using AI and blockchain for identity verification. It claims to prevent bots through facial recognition and reward users with InterLink Tokens ($ITLG). The company, InterLink Labs Inc., operates from Newport Beach, California, and boasts a strategic investment from Google for Startups. However, multiple concerns, including hidden ownership and unclear financials, raise questions about its reliability.

Ownership and Leadership Transparency

InterLink Labs Inc. is registered at 895 Dove Street, Suite 300, Newport Beach, CA 92660, as confirmed by Dun & Bradstreet. However, the domain’s WHOIS data, registered via NameCheap on October 4, 2024, is hidden by a privacy service in Iceland. This lack of transparency is a concern for investors seeking accountability.

Leadership Profiles

- Vince Caruso: Chief Marketing Officer, also CEO of New to The Street, a media firm promoting Interlink. This overlap suggests a potential conflict of interest.

- “KV”: Co-founder and Chief Technology Officer, with no further details provided, limiting trust in the leadership’s credibility.

Red Flags

- Hidden WHOIS data obscures true ownership.

- Limited executive background information.

- Promotional ties to New to The Street raise bias concerns.

Compensation Plan Breakdown

Interlink’s compensation plan centers on earning $ITLG tokens through:

- Human-Powered Mining: Users verify identity via facial scans to earn daily rewards.

- Referral Program: Promoters share referral links, potentially driving speculative hype.

- Universal Basic Income (UBI): The platform hints at UBI for contributors, but no clear payout structure is provided.

- Mini-App Development: Users can create apps for additional tokens.

The whitepaper allocates 50% of 1 billion tokens to community rewards, targeting early adopters. However, it lacks specifics on token valuation, vesting schedules, or revenue sources to sustain these rewards.

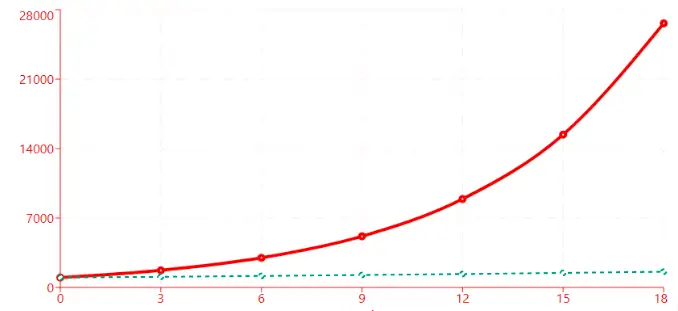

Sustainability Concerns

Let’s analyze the plan’s viability:

- Assumption: 1 million users, 500 million reward tokens, $1/token value.

- Calculation: Each user gets 500 tokens ($500) at 1 million users. At 10 million users, this drops to 50 tokens ($50).

- Required Funding: Supporting $500/user for 10 million users needs $5 billion, unsustainable without massive external capital or token inflation.

Users | Tokens per User | Total Value ($1/Token) | Sustainability |

1M | 500 | $500M | Possible |

10M | 50 | $5B | Unlikely |

Red Flags

- No clear tokenomics or revenue model.

- UBI promises lack financial backing.

- Referral-driven growth resembles pyramid schemes.

Comparing Returns to Other Investments

Interlink’s implied high returns (100-300% annually) are speculative compared to:

- Real Estate ROI: 8-12% annually, stable with tangible assets.

- Bank Deposits: 3-5% APY, low-risk with FDIC protection.

- Crypto Staking: 5-15% APY on platforms like Coinbase, volatile but regulated.

Investment Type | Annual ROI | Risk Level |

Interlink | 100-300%+ | Extreme |

Real Estate | 8-12% | Moderate |

Bank Deposits | 3-5% | Low |

Crypto Staking | 5-15% | High |

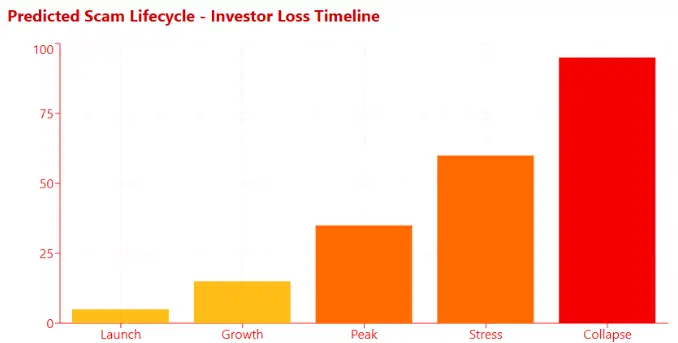

Traffic and Public Perception

Interlink claims 1 million users, but traffic data shows 458,795-655,000 monthly visits, with a high bounce rate (80.23%) and traffic from Nigeria and Pakistan. This suggests low-quality engagement, possibly incentivized. ScamAdviser (16/100) and Gridinsoft (4/100) flag the site as risky, while user reviews average 1/5 stars.

Red Flags

- Unverified user growth claims.

- Low trust scores and negative reviews.

- Paid promotions by New to The Street lack organic support.

Security and Technical Performance

The platform uses a Domain Validated SSL certificate and hosts via DigitalOcean in Singapore. It claims advanced security (zero-knowledge proofs, biometric encryption), but no audits verify this. Gridinsoft warns of potential malware risks.

Red Flags

- Lack of security audits.

- Possible malware concerns.

Payment Methods and Support

Interlink operates crypto-only payments via its wallet, supporting Ethereum and Solana. No fiat options or fee details are disclosed. Customer support is limited to an email (contact@interlinklabs.org), with poor responsiveness reported.

Red Flags

- Crypto-only transactions limit consumer protections.

- Inadequate support channels.

Social Media and Promotions

New to The Street, with 2.65M+ YouTube subscribers, promotes Interlink alongside unrelated ventures like biotech. No official Interlink social profiles exist, indicating a lack of community engagement.

Recommendations for Investors

- Avoid Investment: High risks, low transparency, and unsustainable returns make Interlink a poor choice.

- Verify Claims: Check Google for Startups investment via official sources.

- Explore Alternatives: Opt for regulated investments like real estate or bank deposits.

- Monitor Feedback: Watch for user reviews and regulatory updates.

- Demand Clarity: Request audited tokenomics and security reports.

Interlink Review Conclusion

This Interlink review highlights significant concerns about the platform’s legitimacy. Hidden ownership, vague compensation plans, and unrealistic growth claims suggest high risk. Investors should prioritize safer options like real estate or regulated crypto staking. Always conduct thorough research before investing. For a related analysis, you can also check our Cvcapitals Review.

DYOR Disclaimer: This review is for informational purposes only and not financial advice. Verify all claims using tools like ScamAdviser, SEC filings, and blockchain explorers. Consult a financial advisor and only invest what you can afford to lose.

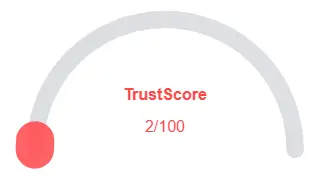

Interlink Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Interlink currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Interlink similar platforms.

Positive Highlights

- Website content accessible

Negative Highlights

- New domain

- New archive

- Whois hidden

- Not in top 1M Tranco list

Frequently Asked Questions About Interlink Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Interlink raises concerns due to limited transparency, unverified ownership, and unclear ROI claims.

Interlink claims to offer token-based rewards and benefits through decentralized identity solutions, but there is no verifiable evidence of consistent returns.

No. Interlink is not licensed or registered with any recognized financial or crypto regulatory authority, increasing the risk for investors.

Risks include potential financial loss, lack of investor protection, limited transparency, and unverified ROI claims.

It is not recommended. The platform’s hidden ownership, unclear operations, and regulatory ambiguity make it a risky investment.

Other Infromation:

Website: interlinklabs.ai

Reviews:

There are no reviews yet. Be the first one to write one.