Infinite X Review: Spot the Scam Before It Steals Your Savings

Are you tired of crypto promises that sound too good to be true? Daily returns from a simple app click? Infinite X Review reveals the harsh truth: this “AI trading” platform is a Ponzi trap. It lures investors with fake executives and wild ROI claims.

But don’t worry real alternatives like bank accounts or legit staking offer safe growth without the risk. In this Scams Radar guide, we’ll break it down simply. You’ll learn red flags, math proofs, and steps to protect your money. Read on to invest smarter.

Table of Contents

Part 1: What Is Infinite X? A Quick Overview

Infinite X markets itself as a cutting-edge AI quantitative trading app. Users deposit USDT, click a button daily, and supposedly earn passive income from smart trades. The site features spot pairs, charts, and an app download link. It claims unlimited innovation in crypto. But dig deeper, and cracks appear. No real products exist. Income ties to recruitment, not trading wins. This setup screams Ponzi, where new money pays old investors.

Launched in early 2025, Infinite X joins a wave of “click-a-button” apps. Similar schemes like Finance AI collapsed fast. Early users might see small payouts. Later ones face locked funds. If you’re eyeing Infinite X, pause. Legit platforms disclose everything upfront.

1.1 Ownership and Team: Who’s Really Behind Infinite X Review Findings?

Transparency builds trust in investments. Infinite X fails here. The site lists no owners, executives, or team bios. This anonymity is a top red flag. Legit firms like Coinbase name leaders with LinkedIn profiles.

1.2 Fake CEO identity

Marketing pushes “Ethan Cate” as CEO. It sounds solid but it’s not. Ethan Cate is fake. Photos come from Roland Kickinger, an Austrian actor and bodybuilder. Scammers even made AI videos of Kickinger as Cate, pitching at fake events. Kickinger has zero ties to Infinite X. This identity theft fools newbies but crumbles under checks.

The company claims “Infinite X Foundation LTD,” a Colorado shell. Easy to form with bogus details. No board members or advisors listed. Source code shows Chinese strings in UI elements. This points to Southeast Asia ops, not U.S. roots. Our research confirms that there is no real leadership. Just smoke and mirrors.

Part 2: Corporate Claims: MSB License Means Little in Infinite X Review

Infinite X waves a FinCEN MSB certificate for legitimacy. It looks official. But here’s the catch: MSB registration is basic paperwork for money handlers. FinCEN focuses on anti-money laundering, not investment safety. It’s not a license to promise returns or run trades.

Think of it like a fishing permit, not approval to sell fish. Shell companies grab these in days. No audits check if payouts match trades. U.S. regulators like the SEC demand more for crypto firms. Infinite X skips that. If a platform hides behind vague compliance, walk away.

Part 3: Compensation Plan Breakdown: Recruitment Over Real Gains

Infinite X’s plan mixes Ponzi payouts with pyramid ranks. No retail products, it’s just memberships. You invest USDT for “daily returns.” Click the app button to “activate trades.” But it’s theater. No real quant strategy links to markets.

3.1 VIP Ranks: How They Work

Nine tiers demand your cash and recruits:

- VIP1: Invest 1,000 USDT; generate 5,000 USDT downline.

- VIP2: 2,000 USDT; two VIP1+; 10,000 USDT downline.

- VIP3: 3,000 USDT; two VIP2+; 25,000 USDT downline.

- VIP4: 5,000 USDT; two VIP3+; 50,000 USDT downline.

- VIP5: 10,000 USDT; two VIP4+; 100,000 USDT downline.

- VIP6: 20,000 USDT; two VIP5+; 250,000 USDT downline.

- VIP7: 30,000 USDT; two VIP6+; 500,000 USDT downline.

- VIP8: 40,000 USDT; two VIP7+; 2,500,000 USDT downline.

- VIP9: 50,000 USDT; two VIP8+; 5,000,000 USDT downline.

Advance by pulling in others. Top earners skim from the base.

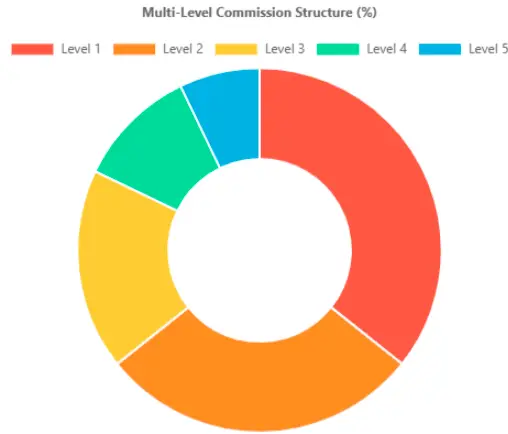

3.2 Bonuses: Hidden Fees Fuel the Fire

- Fee Rebates: 30% (VIP1) to 90% (VIP9) on undisclosed transaction fees. Higher ranks take cuts from juniors.

- Weekly Pools: 5-15% of investments split by rank (e.g., 15% for VIP1-2, 5% for VIP8-9).

- Unilevel Match: Up to 90% on downline bonuses, fading to 5% at level 50.

- Monthly Pool: 5% of fees; 60% to VIP8, 40% to VIP9.

Joining is free, but full play needs minimum USDT. Undisclosed ROIs hover at 1% daily in promos. This isn’t trading, it’s all about a referral game.

Part 4: Math Proof: Why Infinite X Returns Can't Last

Promised 1% daily sounds easy. Compound it, and reality hits. Use this formula: (1 + rate)^days – 1.

For 1% daily over 365 days: (1.01)^365 ≈ 37.78x growth. That’s 3,678% yearly. At 0.5%: 517%. At 2%: 137,641%.

Promised 1% daily sounds easy. Compound it, and reality hits. Use this formula: (1 + rate)^days – 1.

For 1% daily over 365 days: (1.01)^365 ≈ 37.78x growth. That’s 3,678% yearly. At 0.5%: 517%. At 2%: 137,641%.

4.2 How UpCapital Stacks Against Real Options

Daily Rate | Annual ROI | Sustainable? |

0.5% | 517% | No, I need endless new cash. |

1.0% | 3,678% | Impossible without fraud. |

1.5% | 6,628% | Collapse in months. |

2.0% | 137,641% | Pure pyramid math. |

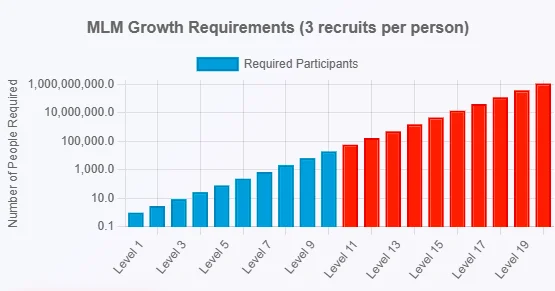

Levels | Total Recruits Needed |

5 | 31 |

10 | 1,023 |

15 | 32,767 |

20 | 1,048,575 |

4.1 Traffic, Perception, and Promotion: What the Web Says

Traffic spikes from social ads, then drops. Tools like SimilarWeb show under 10,000 monthly visits, low for a “global” platform.

Public view? Negative. Which points to it as a ponzi scheme. Trace and confirm flags withdrawal blocks. Malware tips warn of fake profits. Scamadviser scores low trust for hidden WHOIS.

Promoters on X (@InfiniteXen) hype AI wins. But handles like @itx_izayyyy push one-off ads, then vanish. Past shills? The same crowd touted dead schemes like DP Quant AI.

4.2 Security, Payments, and Tech: Basic Cover for a Shaky Core

HTTPS exists, but no 2FA details or audits. Payments: USDT only, irreversible crypto. Support? Telegram bots at first, ghosts later. “KYC fees” block pulls.

Content feels AI-spun: buzzwords, no strategy proof. Chinese code hints at scam factory ties.

4.3 ROI Comparisons: Infinite X vs. Real Options

Option | Annual ROI | Risk |

Infinite X | 500%+ | Total loss |

Bank Savings | 4-5% | Low (FDIC) |

Real Estate | 7-11% | Medium |

ETH Staking | 1.8-5% | High |

Red Flags Checklist

- Fake CEO with stolen photos.

- Recruitment ranks over trades.

- Undisclosed fees/ROIs.

- Meaningless MSB badge.

- Chinese code in U.S. claims.

- Withdrawal hurdles.

- Ties to scam compounds.

The Bigger Picture: Click-a-Button Scams and Crackdowns

These apps stem from Asian factories. 2025 saw U.S. sanctions on Myanmar’s KNA. Thailand cut scam power. Cambodia raids freed thousands. Amnesty reports 53+ compounds. Infinite X fits the mold only expect collapse by year-end.

DYOR Tools: Check Yourself

- WHOIS: icann.org (hidden privacy).

- Scamadviser: Low score.

- VirusTotal: Scan URLs.

- Traceandconfirm: Scam alert.

What to Do Next: Recommendations

Skip Infinite X. Report to FTC or IC3. If invested, screenshot everything, don’t pay “unlock” fees. Recovery scams follow collapses. Try regulated spots like Vanguard for funds, Ally for savings. Build habits, not hype.

Conclusion: Choose Real Growth Over Infinite X Hype

facade, recruitment grind, and impossible math guarantee pain. Opt for proven paths as banks for sleep-easy yields, real estate for steady builds. You’re smarter than the scam. And to find out more about scams like UpCapital.

DYOR always: check leaders, math, and reviews. Invest wisely in 2025 and beyond.

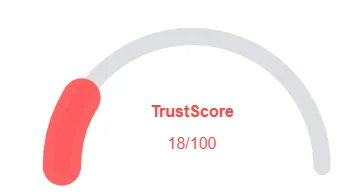

Infinite X Review Trust Score

A website’s trust score is a critical indicator of its reliability. Infinite X currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Infinite X similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About Infinite X Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Infinite X has no proof of actual trading. Its profits rely on recruitment, a clear Ponzi sign.

He doesn’t exist. The photos are stolen from Austrian actor Roland Kickinger, used to create a fake CEO identity.

No. FinCEN MSB registration is only paperwork for money handling. It’s not a license to offer investments.

Even 1% daily compounds to 3,678% yearly. No real market delivers that without collapse.

Stop sending money, document everything, and report to authorities (FTC, IC3). Never pay “unlock” or “tax” fees.

Other Infromation:

Website: N/L

Reviews:

There are no reviews yet. Be the first one to write one.